Network effects: Europe’s digital sovereignty in the Mediterranean

Summary

- Undersea internet cables are critical infrastructure as important as gas and oil pipelines, and are becoming a focus of growing geopolitical competition.

- Throughout the EU’s wider neighbourhood, geopolitics influences states’ decisions about who is allowed to build internet infrastructure and where they can do so.

- China and the US differ in their approaches, but both are racing ahead of the EU in their influence over internet infrastructure and the states that depend on it.

- The EU has the ambition and potential to become a sovereign digital power, but it lacks an all-encompassing strategy for the sector, in which individual governments are still the key players.

- The EU should set industry standards, help European telecommunications companies win business abroad, and protect internet infrastructure against hostile powers.

Introduction

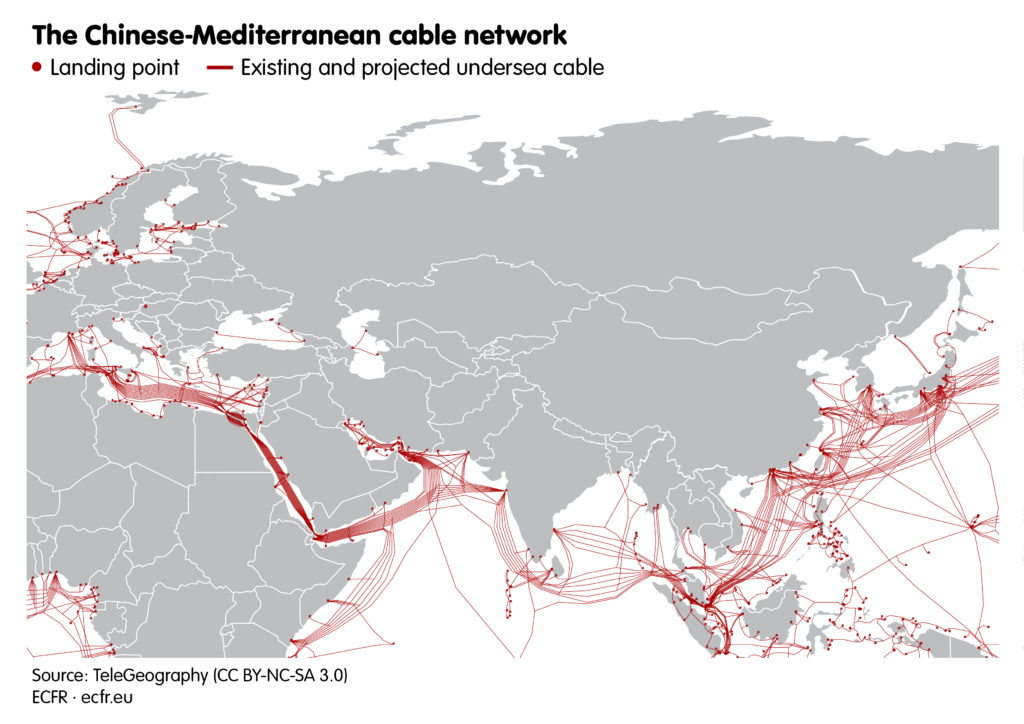

The development of the internet is the defining technological transformation of the era, opening up a new information age in which global communication can happen in an instant. This unprecedented situation is underpinned by infrastructure in the form of physical cables that criss-cross the world, over land and under oceans. Those cables that lie at the bottom of the sea are a cornerstone of this network, and thus of modern life. Indeed, 97 per cent of internet traffic and $10 trillion in daily financial transactions pass through undersea cables, which collectively run for 1.2 million kilometres – more than three times the distance from the earth to the moon.

The infrastructure that makes the internet work is increasingly a focus of geopolitical competition. Who owns undersea cables and what routes they take are increasingly sensitive questions in this. These cables play a critical role in data protection, economic development, and diplomatic relationships between states. Currently, the United States and China are the main players – and rivals – in this market, in terms of both whose companies physically build the infrastructure and which countries are drawing infrastructure issues into wider geopolitical questions.

Unlike these two global powers, the European Union is yet to fully flesh out its own approach to the issue. This could weaken its efforts to become more sovereign in a world of increasing geopolitical competition. Instead of working together in pursuit of shared European interests, EU member states and EU-based companies still largely compete with each other in the roll-out and management of internet infrastructure. At the same time, EU-based companies have well-established relationships in numerous states; they have built and financed the construction of much internet infrastructure around the world; and they operate many existing undersea cables. Europeans should, therefore, capitalise on these strengths by devising and implementing a strategy to identify and support undersea cable projects and incentivise the creation of pan-European consortia, especially in their most immediate neighbourhood: non-EU Mediterranean states and adjacent countries.

This paper examines the relationship between the EU, its member states, countries in the wider Mediterranean region, and the internet infrastructure industry. It draws on interviews with policy experts, business representatives from the sector, and legal specialists. The first half of the paper outlines the main dynamics of this web of relationships, covering the EU’s current position and policy basis, its interactions with China and the US, and the role of individual companies and consortia. The second half of the paper examines the geographical theatres of competition in the EU’s wider Mediterranean neighbourhood: the Middle East, and North Africa and the Sahel. The paper concludes with policy recommendations for how the EU should take a new approach to building and protecting internet infrastructure in the Middle East, North Africa, and the Sahel – and thereby promote its own interests and strengthen the European economy.

The internet infrastructure sector in the wider Mediterranean

Four models predominate in the internet infrastructure market: the first is that of a telecommunications company that delegates construction to an external company, while it operates and maintains the infrastructure. The second is a big tech or telecommunications company that constructs, operates, and maintains the infrastructure. The third involves two or more companies (big tech or telecommunications companies, or both) allocating the infrastructure to a specialised group and operating and maintaining it as part of a consortium. The fourth is that of two or more big tech or telecommunications companies constructing, operating, and maintaining the infrastructure in consortia.

The current market in the wider Mediterranean is influenced by two main global political actors: the US and China. Generally, the US works to create the best conditions around the world for American companies to operate in the sector. The Chinese government actively engages with its companies to advance its interests; individuals linked with the Chinese government are often on the boards of these firms. Meanwhile, some regional players – telecommunications companies based in the Gulf, above all – also have a significant interest in the wider Mediterranean region. And European companies are also active in the region; these firms often have a global reach but their activities are also strongly shaped the decisions of EU member states.

Broadly speaking, three main types of company are active in the internet infrastructure sector.

- Telecommunications companies provide voice- or data-transmission services. Some of these firms also participate in the construction and operationalisation of undersea cables via subsidiaries such as Orange Marine, Telecom Italia Sparkle, and Huawei Marine.

- Big tech companies provide internet-based services. They include Amazon, Apple, Google, Facebook, and Microsoft. All these firms, aside from Apple, have recently invested in the construction of undersea cables.

- Companies that specialise in the installation and repair of undersea cables work in the internet infrastructure sector on behalf of telecommunications firms and other operators. One such company is Alcatel Submarine Networks.

The EU, internet infrastructure, and digital sovereignty

Since 2019, the European Commission has explicitly stated its aim to be a “geopolitical Commission”. In line with this, the concept of ‘digital sovereignty’ has become increasingly important as the Commission deals with the new challenges facing Europe. The EU is currently devising a broad European digital agenda whose external aspects include the idea that the EU should become a unified actor in the realm of technology, particularly as concerns computing power, data control, and securing connectivity. Achieving this will involve creating legal, regulatory, and financial instruments that can help the EU actively promote European values and principles in this domain. Without its own digital capacities and autonomy, Europe will not be able to fully contend with other actors in the tech space, and will find itself caught up in rising US-China competition for technological supremacy.

Undersea cables are critical infrastructure because they are essential for other parts of the economy. Broadly speaking, the greater the number of undersea cables and routes available, the better the lines of communication in the countries they connect – and the better the protection against interruptions that could lead to a digital network collapse.

However, the power to grant licences to build digital infrastructure lies solely with member states. The EU is not able to grant licences or agree on a common policy for the sector, despite the potential benefits to EU member states of developing a harmonised strategy. Italy, France, and Spain share a strong interest in the wider Mediterranean area for geographical and political reasons, but their domestic companies are each pursuing their own initiatives to connect Europe to Africa and the Middle East. These initiatives currently lack coordination, and often involve direct cooperation with companies from competitor powers such as China, including in consortia. It is not unusual for companies from different countries to form consortia to build and manage undersea cables; this is equally true of EU and non-EU countries in the wider Mediterranean neighbourhood, and of China and the US. But the overall lack of coordination hinders the EU’s pursuit of digital ‘strategic sovereignty’.

All states in the region have at least some nominal authority to grant and manage licences to companies operating in the digital sector in general, and the undersea cables sector in particular. Some governments decide to grant licences only to a state-owned company (monopoly). Other governments grant licences to both private and state-owned companies (partial liberalisation). There are also governments that grant licences only to private companies (full liberalisation). That said, all states (regardless of whether they are in the EU) have the power to prevent potentially hostile companies from entering the market or acquiring stakes in domestic companies. And tech companies that are active in the region – especially Chinese firms, but also numerous European ones – are often under state control or are at least partially owned by the state. States frequently grant licences on the condition that they, or companies from their country, participate in the consortium building the infrastructure.

From an operational point of view, the geopolitics of undersea cables resembles that of oil and natural-gas pipelines: the core issue is the vital importance of the entry points of the infrastructure, and of the areas and countries it passes through. Transit and landing states must both agree on the passage of cables through their territorial waters and in exclusive economic zones (EEZs), marine areas that are not under the territorial control of a state but where a government can grant licences for activities such as fishing and oil extraction. Despite their more limited jurisdiction in EEZs, states frequently use legal pretexts to slow or obstruct undersea cables’ construction if they are opposed to some aspect of the consortium or states that stand behind it.

Of course, there are potential advantages to international cooperation, so long as partners do not pose security concerns. European companies engaging in initiatives with states and firms outside the bloc can improve Europe’s internet infrastructure. They can do so by creating greater connectivity and generating further business opportunities in the wider neighbourhood. This activity can provide benefits to partner countries too, as increased broadband adoption contributes to GDP growth in countries with low connectivity.

However, European policymakers increasingly realise that states that dominate the sector – principally China and the US – have the power to foster the region’s digitalisation, impose regulatory standards, facilitate favourable conditions for their operators in digital markets, and promote partnerships among the countries of the region.[1] And, geopolitically speaking, if the EU fails to build up its influence in the Mediterranean region, other global players will fill this space. They will do so by creating technological dependencies that are likely to prove detrimental to EU interests, such as standards determined by China.

There are also security risks associated with undersea cables. Companies and states can often access data transmitted by the digital cables they manage. Therefore, another growing concern for Europe is likely to be in ensuring that friendly powers (and private companies based in friendly states) build and maintain as much infrastructure as possible; physically protecting this sort of infrastructure is likely to become more important to the EU and all organisations involved in the sector.

The EU does have policies on some aspects of undersea digital infrastructure. But these policies are scattered across different policy locations held by different parts of the EU. Given the changing context, EU policymakers should make concerted efforts to draw together these issues and devise a strategy on building, managing, and protecting undersea cables.

The geopolitics of the undersea cables sector

The EU will need to improve its policy on – and capacity to address – these challenges in a context in which there is already a close relationship between geopolitics and the operation of the undersea cables industry.

Governments around the world currently use their prerogative to grant licences to strengthen their geopolitical alliances, favouring companies based in friendly countries for diplomatic reasons. In the EU, three companies are particularly active in the internet infrastructure sector in the wider Mediterranean region: Telecom Italia Sparkle, Orange, and Telxius. They are based in Italy, France, and Spain respectively – all countries that are key landing points for internet infrastructure. These firms cooperate with one another by, for example, creating consortia to build and operate new infrastructure. But competition between such European companies remains the dominant framework: member states’ strong diplomatic relations with countries in the region often helps these firms secure contracts. For example, the positive relationships between France and countries in the Sahel have helped Orange secure licences in that region. Italian diplomatic efforts to maintain positive ties with Libya and Israel helped Sparkle launch infrastructure projects in those countries.[2]

There is a similar relationship with those multinational consortia that states allow to operate undersea cables. For example, the Africa-1 cable is due by 2023 to connect Europe to Pakistan and east Africa via Egypt. This internet infrastructure is operated by a consortium of companies based in Saudi Arabia, Egypt, and the United Arab Emirates against the backdrop of their cooperation to limit Iranian influence in their neighbourhood.

Similarly, political power can influence the routes of undersea cables and landing points’ locations. If a telecommunications company wishes to enter a new market, it needs to build cables and associated infrastructure to enable its activities. It has two options for doing so. The first is to acquire a stake in a consortium that already exists and that operates undersea cable infrastructure; the second is to sign an agreement with a government or governments to build a new undersea cable. Positive relations with the relevant national government (or governments) are essentially a prerequisite for receiving a licence and obtaining national security approvals, in both scenarios. A recent example of state intervention on a new route is the US government’s decision to stop Google and Facebook from constructing an undersea cable connecting the US to Hong Kong – a decision motivated by a Chinese broadband provider’s participation in the project.

States can also gain bilateral political benefits from constructing internet infrastructure in other countries. As noted, effective connectivity helps support economies, which can in turn incentivise governments to maintain their diplomatic relationships when their countries are linked through undersea cables. The well-established network of infrastructure running between Italy and Libya (comprising oil and gas pipelines, and undersea internet cables) is important to their strong political relationship.

The EU’s current approach

The EU’s approach to shaping the digital infrastructure market could enable it to build bridges to neighbouring countries by funding projects and setting operational standards through its regulatory power – just as it previously did with, for example, electricity grids. Alongside this, the EU aims to protect European companies from unfair competition and support their expansion outside the bloc by setting rules and interoperability standards. As in the energy sector, the EU could work with states in its neighbourhood to set similar legislative standards on privacy and ownership. In doing so, it has the potential – still largely untapped – to facilitate European companies’ investments in the region and curtail the efforts of hostile powers.

The EU is slowly moving towards setting a political strategy for the sector. It has started to promote itself as a key political actor by providing financial support to digital infrastructure projects through a funding mechanism: the Connecting Europe Facility 2 (CEF2), which it has just adopted. This allocates €3 billion to internet infrastructure over the next six years. Its launch confirms that the EU is aware of the digital realm’s political importance, especially in relation to regulatory policy and frameworks, as well as third countries and the diversification of connection routes. However, business sources complain that this level of funding is too low to match the EU’s ambitions.[3]

There are other approaches that the EU could test in the coming years. For example, in terms of financing, the European Commission is the lead investor in the BELLA consortium, which financed an undersea cable connecting Portugal to Brazil through EllaLink, with the cable constructed by Alcatel Submarine Networks. The EU could adopt a similar framework for the Mediterranean region, potentially financing new internet infrastructure there.

If the EU were to begin playing a greater role in this domain, its efforts would have shared benefits for member states and advance the role of Europe as a global player in the innovation sector, as part of its promotion of its digital sovereignty. Stronger EU involvement will, however, only come about if it works with the power that states retain in this area.

Europe is not alone in this market, of course. Indeed, it is somewhat behind China and the US, which are both highly competitive in the sector and whose influence is growing in the Middle East and Africa. Over the last few years, companies such as Huawei, Google, and Facebook have increased their presence in the market for undersea cables linking European and non-European Mediterranean states to parts of the world. European companies have adapted to the new situation by joining competing consortia with American or Chinese groups. In this regard, Orange signed a treaty with the PEACE Cable International Network to locate the cable’s terminal in Marseille, while Sparkle and Google are reported to be working together to build an undersea cable connecting Italy to India through Israel. However, the EU should develop a deeper understanding of how China and the US operate in this sector.

China

Nearly a decade ago, China set up its Belt and Road Initiative (BRI) to invest in countries across much of Asia, Africa, and Europe. The initiative includes a specific ambition to build a “Digital Silk Road”. And the Chinese government’s strategy papers on the BRI cite the importance of undersea cables and Huawei’s role in constructing cables. Such projects are likely to help China obtain foreign technology and “enable politically motivated censorship”, according to the US Department of Defense. Beijing participates in the construction and management of internet infrastructure both directly and indirectly, while influencing Chinese companies’ strategies in the sector. It directly engages with other governments on the issue, ensuring that the development of digital infrastructure is included in the wide-ranging memoranda and economic agreements it signs with them.

China’s digital rise in the wider Mediterranean region is taking place in three main ways. Firstly, China is ‘pivoting’ to the region, which its BRI strategy identifies as a crucial geopolitical battleground in a new form of tech war. Beijing considers digital infrastructure to be no longer just a question of business, but a critical part of Chinese foreign policy. Secondly, Chinese companies are expanding their operations to new parts of the world, such as by constructing cables in the Mediterranean Sea. Thirdly, Chinese companies in the sector are increasingly working under a single political framework designed to help Beijing increase its reach and presence in the region.

This approach is reflected in major policy statements such as Xi Jinping’s speech to the Second BRI Forum on ‘all-round connectivity’, in which he called for a “focus on infrastructure connectivity”. In the speech, Xi set out a comprehensive approach to the digital realm in which there is a central role for infrastructure connectivity, smart manufacturing and the digital economy, and innovation-driven development. The Chinese government’s position paper “The Belt and Road Initiative Progress, Contributions and Prospects” also sets out Beijing’s intentions, pointing to collaboration on Chinese-led projects such as the BRI Digital Economic International Cooperation Initiative, part of the Belt and Road Strategy – which also involves Egypt, Laos, Saudi Arabia, Serbia, Thailand, Turkey, and the UAE.

Beijing’s strategy has driven Chinese companies to invest in internet infrastructure in the wider Mediterranean region. Major investors include state-owned Chinese telecommunications firms such as China Mobile, China Telecom, and China Unicom. Chinese entities including the Hengtong Group and its subsidiaries, Huawei Marine and Hengtong Marine, are currently leading the construction of the PEACE cable, a Digital Silk Road project that starts in Gwadar and Karachi in Pakistan and is planned to land in Marseille in France. According to the US Senate Foreign Relations Committee, the PEACE cable connection “could be useful to the PRC government even if the cable is not commercially successful” because it provides the Hengtong Group with an entry point into the international market of undersea cables.

Last year, the US raised its concerns about the cyber security risks associated with such Chinese initiatives – in relation to data tapping and intelligence gathering. The danger is that Hengtong and other Chinese companies could cooperate with Beijing’s intelligence and security services.

These US concerns stem from the dynamics between ownership of the cables, cables’ capacity, operators, and cloud providers or data centre operators. (A data centre is a physical facility that organisations use to house their critical applications and data.) In the usual configuration of the digital infrastructure market, the owners and operators of the cables sell operational capacity to businesses as data centre operators and cloud providers – a system similar to that of many railway sectors around the world, with infrastructure managers on one side and the rail operators on the other. However, Hengtong Group is both the owner and the operator of the infrastructure. This is made possible through a constellation of ad hoc consortia created by the Hengtong Group itself. The most important consortium is Hengtong LightHash, which is a network and data centre operator but also the cable network capacity manager. This setup leads to concerns because the consortium could, according to the US Senate Committee on Foreign Relations, potentially “manage and redirect the data flow travelling through the cable”.

Indeed, the geopolitical implications of China’s investment in undersea cables come not only from ambitious infrastructure projects such as the PEACE cable but also in the ties that the Hengtong Group has with the Chinese political and military ecosystem. Hengtong’s founder and chair, Cui Genliang, is a former officer in the Chinese Army and has been a member of the National People’s Congress since 2013. There is potential for political influence in this security-sensitive sector. And Hengtong’s activity is only growing. In 2019, Hengtong’s international business unit and Telecom Egypt signed an agreement to open a landing point in Egypt, securing for China a crucial strategic player in the PEACE cable project. Elsewhere, the Libyan International Telecom Company and Huawei Marine agreed in 2013 to construct the Silphium cable system, which connects Derna in Libya with Chania in Greece and constitutes Libya’s third international digital cable.

Overall, Chinese digital infrastructure activity in the Mediterranean should be a particular geopolitical concern for Europe. The EU has not made full use of its regulatory power in the realm of digital infrastructure. And Beijing does not play according to the same rules as the EU. As Chinese companies increasingly establish their own relationships with state governments and local consortia, the Chinese approach is likely to prevail.

Another point of tension between Brussels and Beijing relates to accusations of dumping. The European Commission launched an investigation into the import of components for undersea cables, which some European companies believe to be artificially low. The issue is particularly important for China’s strategy, as it distorts the market. If left alone, European and other companies will opt for the cheaper option, giving Chinese firms – and, by extension, Beijing – a competitive advantage. This has geopolitical implications, as lower prices could allow China to expand its presence in the Mediterranean.

The EU may find it difficult to establish a comprehensive regulatory framework with regard to China, as it could encounter opposition from member states such as Greece – which have traditionally been keen on Chinese companies’ participation in their market. So far, the European Commission has attempted – through DG Connect and the European External Action Service – to engage with Chinese companies and outline a common framework under which they can operate. Examples of such efforts include a dialogue between the European Commission and China, chaired by the executive vice-president for A Europe Fit for the Digital Age and the vice-premier of China. As this effort has not proven very effective, the EU will likely need to change its strategy.

The United States

China is the greater potential challenger to Europe in this space. However, the US is also a major geopolitical player in the market of digital infrastructure in the wider Mediterranean region. It pursues a dual strategy on undersea cables.

The first strand of this strategy is geopolitical: the US wishes to ensure that its companies will retain and increase their market share in the face of security concerns connected to Digital Silk Road initiatives.[4] The second is geo-economic, involving American interests in securing the wider Mediterranean region as a crucial marketplace for digital infrastructure, especially in view of the recent expansion of US tech giants such as Google and Facebook in the undersea cables market in the region. Given the technological supremacy of US companies in the sector, the main American interest remains to create open market competition so that these firms operate in favourable conditions.

The EU occupies a crucial role as an intermediate player between the US and China in the sector. The transatlantic relationship – now slowly recovering from the damage of the Trump years – remains core to both sides. This is especially true given that the containment of Chinese authoritarian initiatives and unfair Chinese competition in this and other markets are shared priorities for both the US and the EU, as well as for their private companies active in the sector.

The EU is discussing a more comprehensive and coordinated approach with the US. This could lead to measures that provide American companies with greater access to the European market in the digital infrastructure sector by building a regulatory framework that encompasses the full spectrum of geopolitical interests of the players involved. While it would not be without its own potential obstacles and controversies, such an approach could help protect EU-based companies from the potential dumping risks related to Chinese initiatives and provide opportunities for European companies to cooperate closely with US tech giants.

Digital technology is a crucial area in which transatlantic cooperation has fallen short over the last few years. With the Biden administration now in place, and on the basis of an understanding of Chinese influence in the digital infrastructure sector, the EU and US should renew their efforts to build a transatlantic tech agenda to advance democratic interests together.

Internet infrastructure in the wider Mediterranean neighbourhood

One can identify two main regions in the digital infrastructure sector in the wider Mediterranean: the Middle East; and North Africa and the Sahel.

The first is characterised by a series of cable corridors that stretch across the Mediterranean, mainly via Egypt, to the Gulf and the Arabian Peninsula. The Arabian Peninsula is particularly important because several undersea cables running from Asia land there, and because the digital markets of some economies there are well developed. In particular, the UAE and Saudi Arabia are reliable partners for digital infrastructure projects (in contrast to countries such as Iran, Iraq, and Syria, which suffer from political instability and poor infrastructural development). Meanwhile, Egypt is especially important to the internet infrastructure sector as its geographical position makes it a key link between Europe and the Gulf. However, Egypt is also a potential bottleneck that, should its infrastructure fail, could cause problems across the network. Nevertheless, the Abraham Accords between Israel and Arab countries such as the UAE could lead to new strategic agreements in this sector, particularly if Saudi Arabia joins the agreement as well: Israel and Saudi Arabia could easily connect through the northern end of the Red Sea.

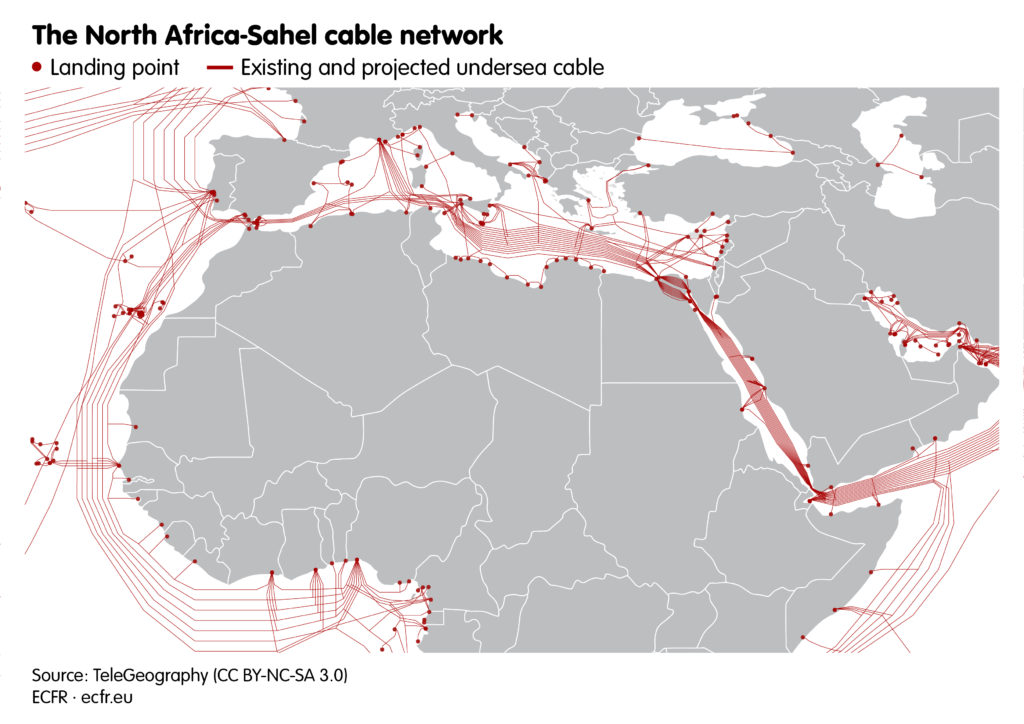

With regard to connections between Europe and Africa: North Africa and the Sahel are central to the expansion of digital markets throughout Africa, where some countries are well-connected and others much less so. With regard to the routes marine cables take, there are two possibilities: through Egypt, under the Red Sea and through waters near the Horn of Africa; or through the Strait of Gibraltar and continuing around towards west Africa.

The Middle East

The links between undersea cables and politics in the Middle East are significant. Three key issues deserve closer examination.

The first is the way in which Gulf countries’ political influence influences who is able to participate in consortia. The second is the link between the establishment of diplomatic relations (or lack thereof) and where undersea cables can be laid, with the Abraham Accords currently being of particular importance. The third relates to political tensions about EEZs in the eastern Mediterranean, which affect the routes that new undersea cables can take between the Middle East and Asia.

The Gulf and consortia

Companies based in Gulf countries are the leading regional players in the construction and maintenance of internet infrastructure in the Middle East. There is a clear geopolitical influence in the sector: Middle Eastern states that have positive relations with Gulf countries, such as Egypt and Jordan, allow Gulf companies to play a prominent role in their internet infrastructure markets. The main foreign telecommunications companies that operate in Egypt are those based in places that have positive relations with the country: Etisalat, which is headquartered in the UAE; the UK-based Vodafone; and Orange, in which the French government has a stake. In addition, the FALCON cable provides a network connecting Sri Lanka, India, Gulf countries, Yemen, Egypt, and Sudan.

Gulf states’ role as the technological gateway to the Middle East has helped them strengthen their relationships with China and the US. At least one Gulf-based company operates in the markets of Egypt and Jordan, which have positive relations with all Gulf states except Qatar, and are connected to Gulf states through cables. Meanwhile, multinational companies look to land their undersea cables in the UAE when transiting between Asia and Europe because of its innovative market environment and the wider network of cables that provide access to the wider Middle East and Africa markets. This is because the UAE is located just kilometres away from the main undersea cable route between Asia and Europe. Some experts argue that Gulf companies provide access to the regional market for international telecommunications companies.[5]

Within this framework, Gulf companies have launched a number of initiatives to cooperate with Chinese groups that will require the construction of new internet infrastructure. Examples of this include Saudi Telecom Company’s partnership with Ali Baba and the UAE’s partnership with Huawei in its 5G roll-out. Similarly, Gulf companies have worked with US groups on cables designed to travel from India to Israel – which will reportedly involve Oman Telecom and Google, and will transit through Saudi Arabia.

The EU does not currently have specific plans to develop political cooperation with Gulf states in the internet infrastructure sector. Although EU-based telecommunications companies operate with Gulf groups, there is a lack of a political framework with these states for agreeing on joint projects in the region. Such a framework could be mutually beneficial for all parties involved, and could give the EU a stronger geopolitical voice in the sector.

Abraham Accords

The signing of the Abraham Accords last year was a significant development for the digital market in the Middle East, for several reasons.

Firstly, the agreement creates another viable route for undersea cables connecting Asia to Europe, which can now transit through Israel. Although it still does not officially engage in diplomacy with Israel, Saudi Arabia has a close relationship with the UAE that could allow companies to construct undersea cables that pass through Israel and ultimately connect to Saudi territory. This new route provides an alternative to Egypt, whose geographical position allows it to charge high prices to companies that make use of its territory. Currently, all undersea cables transiting between Europe and Asia pass through Egypt. The political consequence of such a change is that Egypt will lose part of its strategic relevance, while Gulf countries will further increase their status as a regional hub.

Secondly, the agreement creates a formal diplomatic relationship between the UAE and Israel, whose economies are among the region’s most innovative. A broader consequence of this might be that the two countries establish a relationship of mutual trust in this sector, which could lead to Emirati and Israeli companies joining the same consortia.

Thirdly, if internet infrastructure is established between Israel and Gulf states, the mutual benefit of operating this infrastructure could strengthen their resolve to maintain good diplomatic relations. Such positive relationships could have political consequences, including closer collaboration on issues of common interest, such as their shared goal of reducing Iranian influence in the region.

The EU could benefit from the new potential route in several ways. The first is that, by diversifying its connectivity routes, the EU could protect its broadband capacity from the risk of damage to infrastructure in Egypt or elsewhere. The second is that EU-based companies can avoid the Egypt bottleneck and gain financial benefits at the same time. The third is that an EU-based company could enter consortia that include both Israeli and Gulf companies, which might generate new economic opportunities. Finally, if developments associated with the Abraham Accords strengthen regional cooperation among states that did not previously recognise each other diplomatically, they could improve regional stability – which is a strategic imperative for the EU.

Exclusive economic zones

One major factor in the Middle East is the current tension around EEZs in the eastern Mediterranean. Turkey’s and Libya’s December 2019 agreement delineating maritime boundaries across the Mediterranean could prove problematic for a company that wants to lay new undersea cables. This is because of potential legal disputes that could arise in a contested area. Currently, the construction of undersea cables in EEZs is broadly regulated by the United Nations Convention on the Law of the Sea – particularly Article 79, which states that companies can install and maintain undersea cables without consent or permit requirements. However, not all countries observe their obligations and some regularly attempt to obstruct new undersea cables for political reasons, using legal pretexts such as protecting the marine environment, preserving energy exploration contracts, and guaranteeing fishing rights.

Companies can handle such disputes in two ways. The first is by offering compensation to states – although this can quickly inflate construction costs. The second is to take the case to the International Tribunal for the Law of the Sea – but this also means higher costs for companies because of delays to construction. Legal experts argue that companies tend to head off such risks by developing strong relations with governments and only choosing uncontested routes through which to transit.[6] This should provide yet another reason for the EU to mediate between eastern Mediterranean states that are currently disputing the delimitation of EEZs. Success in this endeavour would provide the EU with yet greater diversification of undersea cable routes that connect its member states to the rest of the world.

North Africa and the Sahel

While the dynamics of the internet infrastructure sector in the Middle East follow a pattern of competing alliances of states, those in North Africa and the Sahel are mostly characterised by fragmentation among states. This fragmentation is caused by competition in the technological and political domain. The failure of states in North Africa and the Sahel to work together on projects to build and maintain internet infrastructure is partly responsible for the enormous variation in how much of their populations can access the internet. A lack of internal connections, and of connection to other states through undersea cables, affects the performance of the internet in countries in the region. The share of people who use the internet ranges from 84.2 per cent in Libya to just 6.9 per cent in Eritrea, compared to the global average of 64.2 per cent. This region is also characterised by political fragmentation in the sense of North African and Sahel countries competing with each other – but with much less of a recognisable pattern of alliances such as that in the Middle East.

Several issues are worth closer examination in this region: the process of granting licences; the weakness of current political cooperation; and issues of infrastructure security.

Licences

In North Africa and the Sahel, domestic markets range from state monopolies – such as in Eritrea and Libya, where the state owns the companies that control undersea cables, and they are the only internet provider available – to partial liberalisation, such as in Algeria and Morocco. In countries where the government allows some degree of competition, the most prominent company is Orange. This company operates directly or indirectly in six of the 13 countries in North Africa and the Sahel that are examined in this paper and that exhibit partial liberalisation: Egypt, Mali, Morocco, Niger, Senegal, and Tunisia. Other relevant players include Gulf telecommunications companies, which operate in five countries in the region: Algeria, Tunisia, Egypt, Morocco, and Sudan.

As in the Gulf and the Middle East, there is a clear link between the states’ relationships with foreign governments and their decisions to grant licences. For example, Orange has a prominent position in the region mainly because of Paris’s long-standing relationship with most governments in North Africa and the Sahel. Meanwhile, Gulf companies are also present thanks to their governments’ positive relations with several African states. In recent years, Chinese companies such as Huawei and US companies such as Facebook, Google, and Microsoft have also increased their investment in the region. One such example of this is the PEACE cable, connecting Egypt and Djibouti to Somalia, Kenya, and South Africa. Facebook is working with several local telecommunications companies to build a cable around Africa. Google is constructing the Equiano undersea cable along the west coast of Africa.

Political cooperation

Business experts confirm that states in North Africa and the Sahel rarely cooperate on joint internet infrastructure projects that could provide mutual benefits for countries.[7] On the contrary, they avoid building overland infrastructure that would link coastal states (where undersea cables land) to non-coastal states.[8] For example, there is no land or sea connection between Morocco, Mauritania, and Senegal. This is in contrast to the Middle East – where, as noted, states that have some degree of friendly relationships are connected to each other via internet infrastructure. There is no infrastructure comparable to the FALCON cable in North Africa and the Sahel, where some states simply have no connections at all. Experts observe that coastal states – perhaps unsurprisingly – prefer to have a landing point in their own territory instead of relying on one of a neighbouring country. The lack of political cooperation between states results in the Sahel and North Africa lacking an efficient network that connects the countries in the region.

This infrastructure deficit has four key consequences for the region. Firstly, the poor quality of connections in landlocked countries such as Chad reduces internet access for the population. Secondly, companies tend to invest less in regions that lack networks running between countries, for reasons of cost-effectiveness. This, in turn, further reduces the overall quality of internet access. Thirdly, African users’ data often travel to other regions of the world, such as Europe, instead of roaming within the continent – thereby slowing internet speeds. For example, there is no overland connection between Morocco and Algeria, but both countries are connected to France. In Morocco, a cable called Atlas Offshore links Asilah on the country’s Atlantic coast to Marseille. Meanwhile, the Med Cable Network links the main Algerian cities to Marseille. This means that a Moroccan user relies on a connection travelling through France to access a website whose server is based in Algeria. Finally, this infrastructure deficit reduces the potential political benefits that countries might otherwise gain by cooperating with each other.

Against this background, in January 2021 there entered into force the African Continental Free Trade Area, to which all African countries belong. This historic agreement will likely have consequences for the development of internet infrastructure: as countries’ economies begin to converge, this will increase the incentives to invest in such infrastructure. However, there is still much work to do in this area, as African countries’ trade with one another only accounts for 16.7 per cent of their total trade – much less than the equivalent for countries in parts of the world such as Europe, where the figure is 68.1 per cent.

In recent years, the EU has focused primarily on increasing its general outreach to Africa. The sixth EU-Africa Business Forum held in Côte d’Ivoire in November 2017 was a milestone for implementing commonly agreed solutions on digital connectivity between the EU and Africa. One of these priorities was to support “the deployment of affordable broadband connectivity and assure a direct link with the EU via cross-border backbone infrastructure”. Further activity in this area includes the creation of the EU-AU Digital Economy Task Force, whose objectives became concrete policy recommendations at the Digital Assembly, an event in Europe for stakeholders to discuss the European Digital Single Market strategy. The policy recommendation for this area of intervention has been included in the African Union’s Digital Transformation Strategy for Africa within the broader framework of the Sharm El Sheik Declaration, which is the key document on the European strategy in the undersea cable sector in Africa. The EU-AU Digital Economy Task Force also has implications for European companies looking to expand into Africa – its core concept is to support digital transformation in Africa and connect it with development cooperation.

Security

Finally, North Africa and the Sahel face particular challenges in terms of the security aspect of internet infrastructure (although this is also a concern in the Middle East). Some states do not have full control over their territory, making it even more challenging to protect digital infrastructure. In North Africa and the Sahel, there is an exceptionally high risk that non-state armed groups will target this infrastructure and disrupt countries’ internet connections.

There are two main aspects to this problem: the protection of the physical infrastructure and the protection of users’ data. The first relates to the threat that individuals, insurgent groups, or even states will damage undersea cables and landing points. One such hostile action was that of a group of scuba divers who were captured by the Egyptian Navy in 2013 as they cut a cable called SE-WE-ME-4. The second relates to the risk of data tapping by rival powers, which may be able to access internet traffic transiting through undersea cables or landing points. In this respect, several NATO reports have expressed concern about the Russian military, which may have carried out data tapping operations in the Atlantic – although there appears to be no firm evidence of such activity.

If armed groups start targeting it, this infrastructure might require protection by multinational forces involving European military powers such as France and local organisations such as the G5 Sahel. In particular, landing points from the sea are the most likely targets given the relative ease with which one can access them.[9] The EU’s lack of security forces means that it has few options to act directly on this. But it could encourage member states such as France and others to work with the countries in the region to protect vulnerable infrastructure. The task could involve the European military ships that are deployed to the Red Sea, the Mediterranean, and the west coast of Africa to protect international trade.

Recommendations

The EU is actively working to define a stronger and broader policy on the development of internet infrastructure and its geopolitical implications. But the bloc needs to take further steps to maximise its influence and defend and promote its interests in this sector.

Devise new EU goals and guidelines on consortia, licences, and new digital infrastructure

The EU does not have the power to set policy on consortia and the allocation of licences because this is the prerogative of its member states. Nevertheless, it can set joint goals and define guidelines on these crucial issues.

The EU has the power to establish benchmarks in areas such as broadband capacity and the diversification of connection routes. To do this, the European Commission can make recommendations to states about the allocation of licences and consortia formation with non-European companies. The European Commission could also warn member states against projects that include companies that may pose a threat to EU interests, such as by creating channels for foreign governments to exert pressure on member states.

More generally, the EU and its member states should agree on a common approach to dealing with other global powers in the sector. One of the EU’s goals should be for US companies to operate according to its rules on data protection and taxation.

On China, the strategy should be very different. Beijing’s internet infrastructure construction efforts must be understood within the framework of its broader foreign policy, which is as a competitor with, and potential threat to, Europe. The EU and political leaders in member states should, therefore, set stricter limits on what European companies can and cannot do when cooperating with Chinese firms that have links with the Chinese government.

Support pan-European consortia in EU-driven projects

Such moves by the EU could drive broader cooperation among EU telecommunications companies across the wider Mediterranean region. Crucially, however, such an elevated EU ambition will require a much larger budget than the €3 billion for 2021-2027 currently allocated to the CEF2. The EU should, therefore, increase this allocation.

It is also in the EU’s interest to create synergies with relevant regional players in the Mediterranean region. In particular, the bloc can engage in fruitful cooperation with Gulf states and the Gulf Cooperation Council to increase the sector’s EU presence across this part of its neighbourhood. Such a strategy should address three key points: ensuring internet infrastructure is high on the EU-Gulf political agenda; harmonising current regulations between the EU and countries in the wider Mediterranean region; and establishing a supra-regional forum to facilitate cooperation among EU and Gulf companies and states. This could potentially increase the EU’s importance to these states, which currently cooperate mainly with the US and China in the internet infrastructure sector.

Encourage a diplomatic resolution to EEZ disputes in the eastern Mediterranean

Current tensions about the delimitation of the EEZs in the eastern Mediterranean hamper the EU’s ability to diversify undersea cable routes. The EU should, therefore, seek to mediate the ongoing crisis about EEZ demarcation in the eastern Mediterranean, given the region’s importance to maintaining strategic undersea cable routes between Europe and Asia. As part of this, the EU could provide policy recommendations to member states for not obstructing the construction and maintenance of undersea cables in their EEZs.

Protect the security of internet infrastructure and users’ data

Security issues could become a growing source of concern for the EU in maintaining functioning digital infrastructure. Without military forces directly available to it, the only way the EU can help protect internet infrastructure is to work with its member states, NATO, and countries in the wider Mediterranean region. The EU should make the protection of digital infrastructure a geopolitical priority and encourage EU member states that also belong to NATO to deploy a military presence in places where cooperation and with its partners across the wider Mediterranean region.

In terms of data security, a NATO military presence could also help prevent data tapping by hostile forces, thereby also benefiting states that host the relevant infrastructure. The EU could also work to harmonise its regulatory framework with those of states in its neighbourhood by setting standards and norms on users’ protection. This can be done by including such measures in the EU’s and member states’ agreements with partner countries.

Improve internet infrastructure in Africa

Africa’s economy would benefit significantly from a boost in digital connectivity, which would create new job opportunities and reliable infrastructure. The EU could work with the AU to provide political and technical support in the establishment of new infrastructure that connects countries to one another. The EU and the AU can do this together by setting goals in the realm of digitalisation and financing strategic projects. The EU should back its companies in creating synergies and business partnerships to invest in the region. The bloc could also work with the AU to harmonise the market and thereby facilitate investment in the region, which would be beneficial for European companies and would speed up internet infrastructure development in Africa.

The EU could look to advance a partnership with the AU to improve economic relationships between states in Africa through cooperation on internet infrastructure. The creation of a regional network that fully connects all states would help boost e-commerce and other internet-related economic activities, supporting wider inter-African economic integration. Such an initiative would also open up new possibilities for EU-based companies to invest in the construction of new infrastructure.

Europe can increase its connectivity within its neighbourhood and become a strategically sovereign player in a sector of increasing international importance. It is in the EU’s interests to pursue effective initiatives with other states to boost internet infrastructure both to create business opportunities for European companies in the wider Mediterranean region and to strengthen its own political and economic sovereignty there. The EU’s potential as a regulatory power is particularly significant but woefully unfulfilled. Geopolitical shifts present an opportunity for the EU to become a stronger player in this sector, but they also create other imperatives for it to act. If the EU does not begin to marshal all its strengths in the world of internet infrastructure, it will be obliged to play by rules set by others.

Acknowledgments

The research benefitted from interviews with leading experts on the business, economic, political, and security aspects of digital infrastructure. In this respect, we would like to thank Ali M Al-Khouri, Rebecca Arcesati, Alessandro Aresu, Kent Bressie, Tara Davenport, Jinghua Lyu, Janka Oertel, Marco Santarelli, Fred Soons, and Nicole Starosielski.

This paper is part of ECFR’s Mediterranean Cables Geopolitics Tracker (MECAGET) project, supported in part by a contribution from Telecom Italia Sparkle S.p.A.

About the authors

Matteo Colombo is a visiting fellow at the European Council on Foreign Relations and an associate research fellow at the Italian Institute for International Political Studies.

Federico Solfrini is a PhD candidate in international relations at the University of St Andrews and a former research associate at the European Council on Foreign Relations.

Arturo Varvelli is the head of the Rome office and a senior policy fellow at the European Council on Foreign Relations.

[1] Authors’ interviews with industry experts, October-December 2020.

[2] Authors’ interviews with industry experts, October-December 2020.

[3] Authors’ interviews with industry experts, October-December 2020.

[4] Authors’ interviews with industry experts, October-December 2020.

[5] Authors’ interviews with industry experts, October-December 2020.

[6] Authors’ interviews with legal experts, October-December 2020.

[7] Authors’ interviews with business experts, October-December 2020.

[8] Authors’ interviews with legal experts, October-December 2020.

[9] Authors’ interviews with security experts, October-December 2020.

The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of their individual authors.