Gateway to growth: How the European Green Deal can strengthen Africa’s and Europe’s economies

Summary

- In much of Africa, growth is being driven by “green energy innovation ecosystems”, which combine telecoms, digital platforms, solar power, and the internet of things.

- European companies and states risk losing out on business opportunities and political influence if they fail to integrate their services and infrastructure into these emerging ecosystems.

- China and other economic and geopolitical rivals will become African states’ main partner if Europeans stand aside from this key growth trajectory.

- The EU can: assist on offering world-class data regulation and supporting the construction of data centres; support the construction of other infrastructure, such as for 5G; and help roll out off-grid solar power generation and electric vehicle manufacturing.

- Europeans should work in joint ventures with African firms as this model is proven to create value added that China’s investments often fail to produce.

- The EU should merge its nascent Global Gateway international connectivity programme with the European Green Deal. The objectives of both require similar levels of investment in African infrastructure and they can unlock the investment potential of European public-private partnerships.

Introduction

Economic and commercial relationships with Africa are set to play an ever-greater role in determining countries’ and blocs’ place in the global economic order. By 2025, Africa will have over 100 cities with more than one million inhabitants – more than three times the number in the European Union. By 2030, 42 per cent of the world’s young people will live in Africa, making the continent home to the largest supply of affordable labour on the planet in the coming decades. And, with an extremely extensive supply of inexpensive and available land, Africa is already attracting international businesses looking for affordable manufacturing sites.

Moreover, Africa is the fastest-growing end market for a widening range of products. This means it is increasingly not just a place that makes things to export, but is also home to important consumer markets that are underserved and set to rapidly expand. This trend will accelerate with the full implementation of the African Continental Free Trade Area, which launched in January 2021.

Much of this growth is being powered by the green energy innovation ecosystems that are emerging in sub-Saharan Africa; they are already defining the future trajectory of economic growth on the continent. These innovation ecosystems thrive by combining cutting-edge digital technologies and telecommunications with renewable energy technologies. They respond to Africa’s unique market needs – which include significant consumer demand for better digital connectivity – and they make use of the considerable green energy potential of the continent. These ecosystems are, by definition, a cross-industry phenomenon in which growth in one sector supports growth in another. Solar energy, electric vehicles, and telecommunications and information and communications technology (ICT) are all intimately interconnected. They synergise with one another to create a virtuous cycle of market expansion for each sector.

Africa has seen growth in these sectors thanks to their interconnectedness. For example, the expansion of digital financing platforms operating over mobile networks has enabled consumers to purchase off-grid solar power systems. The components needed for these systems are supplied by local solar panel manufacturing sectors. Access to affordable power has enabled the development of new commercial markets for other goods and services.

However, it is far from assured that Europe will play a primary role in the new commercial architecture emerging in Africa. Indeed, Europe’s global economic competitiveness is at risk. Now and in the coming years, international actors will be racing to establish new manufacturing value chains – a process that is shaping Africa’s economy and boosting those actors’ positions in the global economic order. Indeed, in the last decade, China overtook the EU to become Africa’s top trading partner, and India became the continent’s second-largest such partner. Turkey’s rate of growth in African trade surpassed the EU’s by a factor of five, while the Gulf Arab states similarly expanded their trade and investment relationships with Africa. Even prior to the outbreak of covid-19, European, Gulf Arab, and Asian states showed a growing interest in nearshoring – shortening supply chains to bring them closer to intended end markets. This interest has only increased in the time since.

European companies in Africa are forced to compete with Chinese counterparts that have the advantage of formidable state backing. But, when it comes to successful investment partnerships in Africa, bigger does not always mean better. Chinese investments across the continent have not brought about a China-style economic boom in any African country. Europe could fill this gap by investing in the creation of large-scale, value-added production in sub-Saharan Africa. To do so, Europe needs to deploy its resources in a coordinated, strategic manner. The EU urgently needs to combine the foreign policy aspect of its European Green Deal with its nascent Global Gateway programme, which is its answer to China’s Belt and Road Initiative (BRI).

Form should follow function. And the function needed is a unity of action among Europeans. Though this is a perennial challenge, European policymakers should acknowledge that a Europe that fails to be a whole greater than the sum of its parts will inevitably be eclipsed by China and other competitors. Sub-Saharan Africa’s economy is changing rapidly. Europeans have an opportunity to be part of this, and to help promote economic growth while strengthening geopolitical ties with governments and businesses across the continent. But, to achieve this, they will need to provide investment and other support that makes a real difference to Africa’s growth trajectory.

Africa’s and Europe’s economic relationship

New and enhanced global economic engagement with Africa in the last decade led to unprecedentedly high growth rates in several sub-Saharan African countries. Dubbed Africa’s “lion economies”, these nations consistently experienced economic growth rates of more than 6 per cent. But, while Europe has hesitated, other powers have stepped in to assume technological and commercial leadership roles – and have strengthened their political ties with African countries in the process. For example, almost half of the Chinese companies operating in Africa during the past decade have introduced a new product or service to the local market, while more than one-third have introduced a new technology.

Such expansion has been to Europe’s detriment. Far from being ‘the more, the merrier’, the value-added production created in Africa by such powers has displaced Europe from various markets, reduced European revenues, and made it more likely that Europe will fall further behind. So far, the EU and its member states have failed to address this challenge, resulting in a decline in Europe’s political influence on the continent.

This has coincided with growing interest across the world in how to shorten key supply chains. In the years immediately before the pandemic, global supply chains were already becoming shorter as companies and countries placed greater emphasis on resilience over immediate cost-efficiency. For both European and non-European companies, this profound structural transformation meant bringing sourcing and manufacturing closer to European end markets. The commercial imperative to maintain a low cost base while nearshoring has led to the establishment of new production facilities in Africa. Since the onset of the pandemic, this trend has accelerated as part of the competition among international actors. Undeterred by the severe economic impact of covid-19, countries such as China, Japan, South Korea, Turkey, Qatar, and the United Arab Emirates have expanded their economic involvement in sub-Saharan Africa faster than Europe has. In line with this, each of these countries has improved its position in Africa’s expanding end markets.

Turkey’s economic activism in Africa

Turkey’s development of commercial architecture in the central Maghreb and west Africa is an illustrative example of a significant state actor’s increasing involvement in the African economy. By establishing steel and textile manufacturing in Algeria, Turkey has become that country’s largest foreign employer, undercutting the political influence of France and Italy. Turkey and its close partner, Qatar – which also opened a steel plant in Algeria – now dominate the country’s steel industry. Within the same time frame, Turkey opened Africa’s largest textile production plant – also in Algeria. And, following this success, Turkey has established a steel plant and a furniture factory in Senegal, to serve the rapidly growing consumer markets there and in other parts of west Africa. Turkey’s Senegalese furniture factory can benefit from other Turkish plants in both Senegal and Algeria, which service its need for fabric, coil, and other metal inputs for cost-effective, vertically integrated manufacturing. Poland is the world’s second-largest furniture exporter, while Germany, Italy, and the Czech Republic are in third, fourth, and ninth place respectively – and Turkey is in tenth place. However, these EU member states can expect to lose global market share to Turkey because of the way in which it has secured an advantageous position in the sub-Saharan African market.

Sub-Saharan Africa’s green energy innovation ecosystems

There are clear reasons for this interest in sub-Saharan Africa. One increasingly important factor has been the unprecedented growth in consumer markets that states and citizens in the region spurred through the early adoption of mobile banking and related digital finance services. These sectors have been a major driver of African consumer purchases: in 2019, mobile technologies and services in sub-Saharan Africa generated $155 billion of economic value added, or 9 per cent of the region’s GDP. The sector is projected to grow by 18.7 per cent by 2024, to $184 billion.

This astounding consumer market growth is being driven by local green energy innovation ecosystems. Profitable, digital, and low-carbon, these ecosystems are now bringing about growth in other sectors, such as solar power systems and electric vehicles – products whose development is closely intertwined. For example, the rise in mobile banking in Africa using cellular networks is creating market demand for solar power adoption and electric vehicle use. As African countries roll out higher capacity cellular networks such as 4G and 5G – in partnership with European, Chinese, or other firms – their infrastructure requires more power generation. And the networks’ expansion creates new incentives for businesses to generate and use more solar power. The integration of digital platforms and mobile banking has enabled the large-scale adoption of solar power by African consumers, spurring an expansion of solar panel production in sub-Saharan Africa.

The scale and pace of this change will continue to be considerable. In 2020 approximately 600 million people in sub-Saharan Africa – 48 per cent of the entire continent’s population – had no access to electricity. Yet the International Energy Agency (IEA) has projected that, by 2030, renewable energy sources will power over 60 per cent of the region’s “new electricity access” (a term referring to electricity for people who previously did not have electricity available to them). Almost half of this new supply will be provided by off-grid photovoltaic (PV) solarsystems (and by mini-grid PV systems, which are local and small-scale). In turn, the IEA states that the further adoption of off-grid and mini-grid systems will be facilitated by the use of “new business models using digital and mobile technologies”, such as those noted above, as people use apps to acquire and manage such systems.

To take another example, sub-Saharan Africa has experienced a rise in digital car-sharing and ride-hailing services. These services operate over mobile networks and allow customers to access electric vehicles, thereby pushing up demand for energy, electric cars, network capacity, and data storage capacity. In this way, Africa’s innovation ecosystems increasingly rely on the internet of things.

European firms are playing some role in these industries, but are yet to achieve their full potential. They risk leaving companies from other states, such as China, with much more significant sway over these sectors’ future development – and potentially in political relationships with governments in the region.

ICT

In 2019 there were 447 million unique mobile device subscribers in sub-Saharan Africa – 45 per cent of people in the region. While 50 per cent of subscribers in the region use smartphones, the GSM Association (GSMA) anticipates the smartphone adoption rate will reach 65 per cent, or 678 million users, by 2025.

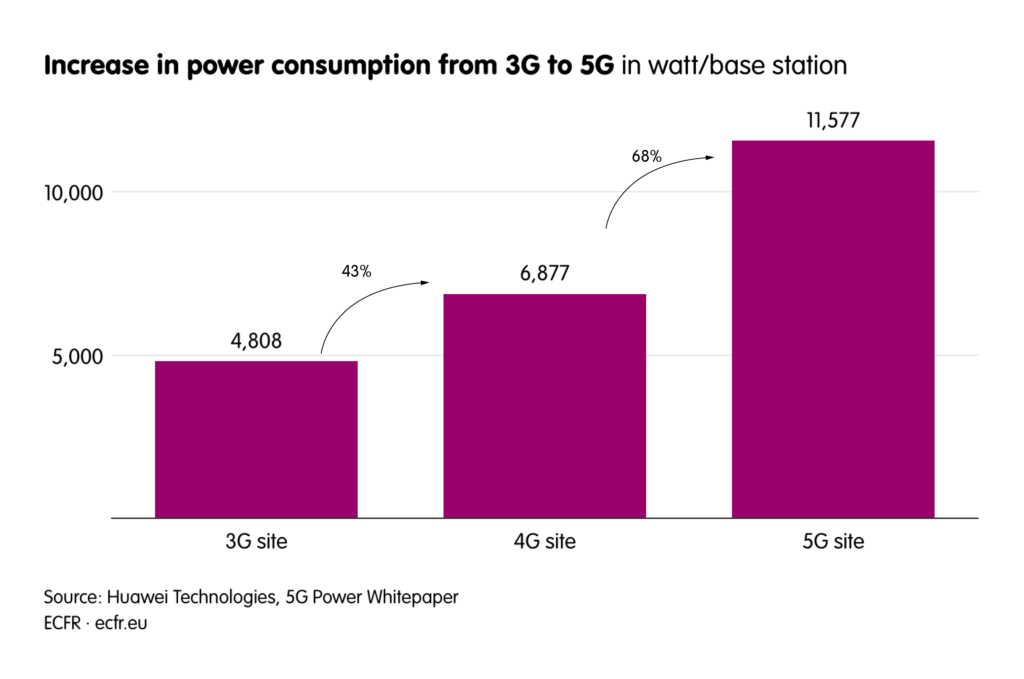

Europe’s market position in Africa’s next generation, green energy innovation ecosystems will be influenced by the level of European firms’ participation in sub-Saharan Africa’s transition to full 4G and 5G coverage. If Europeans are not involved in Africa’s 4G and 5G rollouts, it will be harder for their companies to be part of other sectors in Africa’s innovation ecosystems. Therefore, both European and African businesses have an interest in increasing African solar power generation to meet the additional energy demand these networks require. While the typical maximum power consumption of a 3G site is 4,808W, this goes up to 6,877W for 4G and 11,577W for 5G. Accordingly, upgrading 3G coverage in sub-Saharan Africa to 4G would lead to an additional 43 per cent in power consumption at such sites. The upgrade from 4G to 5G would involve a further 68 per cent rise in power consumption. This is a clear and significant investment need that European, Chinese, or other firms could address.

The scale of such investment is set to be substantial. A 2019 International Monetary Fund report projected that establishing full 4G connectivity in sub-Saharan Africa by 2025 would require $14 billion in capital and operational costs – the latter including energy consumption. The report also estimated that, assuming the whole of Africa has full-scale 4G by 2025, it would cost $57 billion to upgrade this to 5G by 2040. Although 4G accounted for only 15 per cent of subscriptions in 2020 and 5G less than 1 per cent, current forecasts suggest that, by 2026, “4G will become more pervasive”, reaching 28 per cent, and that 5G will reach 70m subscriptions (equal to 7 per cent of total subscriptions). GSMA projects capital expenditure investment in infrastructure of between $7.2 billion and $7.5 billion each year from 2020 to 2025. The association estimates that 5G will account for most of this capital expenditure from 2025 onwards.

Even though 5G usage is expected to reach only 7 per cent of subscribers by 2026, the race to install 5G networks is about securing a market share in Africa’s emerging cross-industry ecosystems. 5G broadband cellular networks offer data speeds up to 100 times faster than 4G and can support up to 1m connected devices per square kilometre, compared to 100,000 for 4G. This makes the technology the gatekeeper of the internet of things – meaning that whoever builds 5G networks will have an advantage over their competitors in the development of Africa’s next-generation, cross-industry applications.

European companies’ role

The early 5G rollouts undertaken in 2020 and 2021 demonstrate that network vendors already participating in Africa’s cross-industry ecosystems have a competitive advantage in the market. The first 5G networks in sub-Saharan Africa were launched in South Africa in 2020 by Vodacom and MTN. Vodacom, which is majority-owned by the British-based Vodafone, used Nokia 5G technology while MTN used Huawei technology. In March 2021, Kenya became the second African country to launch 5G for public use; this was developed by Safaricom using Nokia network technology as well as Huawei network technology. Kenya’s use of Huawei in its 5G rollout – in the face of intense opposition from the United States – was rooted in the Chinese firm’s central role in Safaricom’s M-PESA mobile banking service and derivative services such as M-KOPA’s solar power adoption programme, which it enables. In 2015 M-PESA started using Huawei Mobile Money. This cemented Huawei’s relationship with Safaricom and Vodafone, which effectively holds a 40 per cent share in the Kenyan telecoms company.

Such digital financing services provide access to wider opportunities, particularly the upgrade of a country’s entire telecoms network to 5G. Chinese telecoms companies have moved vigorously to gain this first-mover advantage in other sub-Saharan markets. For example, Huawei began deploying its digital financing platform in Ethiopia in May 2021 to power an Ethiopian version of M-PESA called Telebirr, provided by Ethio Telecom.

In west Africa, China’s Kunlun Tech has developed a similar mobile banking services platform in Nigeria called OPay, using its Chinese-Norwegian web browser subsidiary Opera. Orange, which originally launched its first mobile money transfer service in 2008, began the rollout of completely mobile banking services in June 2020 across the regions of sub-Saharan Africa the company serves.

This is particularly important for many sub-Saharan African nations. Those that do not produce surplus oil and natural gas simply cannot afford the additional imported fuel costs required by the expansion and upgrade of network coverage. Moreover, environmentally, sub-Saharan Africa cannot tolerate additional power generation from fossil fuels, particularly high-polluting but lower-cost diesel fuel. When Ericsson established basic network coverage for rural parts of Benin in 2015, the company installed low-power consumption base stations to enable them to run on solar power. This avoided both the high fuel costs and emissions production associated with diesel generators.

Against this backdrop, the development agencies of the EU and its member states need to view 4G and 5G expansion as important to increasing European participation in Africa’s cross-industry ecosystems. Europe’s contribution to the growth of African economies will be closely influenced by the role its firms play in the rollout of telecoms infrastructure and service provision. This will enable Europeans to have a greater influence in the development not only of these particular sectors but also of those that that ICT supports, such as mobile services and renewable energy generation.

This is a key area in which European firms from different sectors can engage in joint activity with their African partners. Europe’s current position in Africa is also limited by the lack of coordination between European network vendors Ericsson and Nokia and French telecoms giant Orange, which has 130 million subscribers in Africa – meaning that one in every ten Africans is an Orange customer. Ericsson and Nokia are the only European vendors present in Africa, but they are not making a significant investment in infrastructure there. While Orange is surging ahead, Nokia and Ericsson are not following suit. Meanwhile, Orange is only working with non-European companies.

Through its Africa and Middle East division, Orange serves more countries in Africa than it does in Europe. In 2020 the division earned €5.8 billion in revenue. To maintain its market position, Orange invests €1 billion annually in Africa and the Middle East in the construction of cables and network upgrades. This includes the construction of the first pan-west African network and the extension of the 7,000km Portugal-Ghana-Nigeria MainOne submarine cable to Senegal and Côte d’Ivoire. This will support digital innovation in numerous sectors. Orange views this capital expenditure as necessary for maintaining its market share in Africa. On MainOne, Orange Africa and Middle East CEO Alioune Ndiaye explained that: “[a]s barriers to access continue to fall with improved networks and more affordable equipment, Orange, as part of its multi-service strategy, is seeking to position itself as an important partner in the continent’s digital transformation.”

Orange is the leader of a consortium developing the 17,000km Africa Coast to Europe (ACE) subsea fibreoptic cable, with the company financing $250m of the $700m project. The cable connects France, Portugal, and Spain’s Canary Islands with 16 African countries, spanning Africa’s west coast from Mauritania to South Africa. But the consortium has no European members other than Orange. The company is also a central player in the ambitious 37,000km 2Africa undersea cable project connecting Europe, the Middle East, and 16 African countries. It is working on that $1 billion project with China Mobile International, US-based Meta, South Africa’s MTN GlobalConnect, Telecom Egypt, British telecoms giant Vodafone, and the Mauritius-based WIOCC. The project’s purpose is to support the expansion of 4G, 5G, and fixed broadband access to hundreds of millions of African consumers and businesses. Orange has been explicit in stating it does not have enough European partners with sufficient commitment to African 5G network development. As a consequence, it is increasingly working with Huawei to meet its growth demands in sub-Saharan Africa. At the 2021 Mobile World Conference, Orange CEO Stéphane Richard pointed out that, while his company is using Ericsson and Nokia technology for its European 5G services, it is forced to work with Huawei in Africa. He said that Huawei “invested in Africa while the European vendors have been hesitating”.

During 2020 and early 2021, Ericsson launched network operations in Benin that standardised 4G operations and laid the groundwork for 5G in the country. The company also introduced 4G coverage in Kenya and south-west Ethiopia, a 5G service in Madagascar, and an automation hub in Nigeria to pave the way for a 5G rollout and enabling greater access to the internet of things. In the same time period, Nokia launched a 5G network in Togo, west Africa’s first 5G network, and the first 5G network in Kenya (along with Huawei, as discussed above). In July 2021, Nokia announced that it would be deploying a new network in Angola’s capital, Luanda, to support the upgrade from 2G to 4G services, which in future could be further upgraded to 5G. The network will be operated by Africell, which obtained a $100m loan from the US International Development Finance Corporation (DFC) – facilitating Nokia’s selection over Huawei. However, these interventions remain small by comparison to others, and there is little sign that they will be scaled up enough to strengthen European influence on emerging innovation ecosystems.

Africell’s rapid rise to become the market leader in the Gambia and Sierra Leone, and a major player in Uganda and the Democratic Republic of Congo, resulted in part from the company’s entry into mobile banking. The DFC’s support for Africell is an example of a government agency helping a telecoms company engage holistically with Africa’s cross-industry innovation ecosystems – another important factor for Europeans to consider, and to further integrate into their approach to engaging with sub-Saharan Africa’s emerging innovation economy.

Mobile banking and solar power

The spread of ICT that can sustain mobile networks with greater capacity and geographical coverage has helped drive the development of other industries, including mobile banking. Increased local solar power generation has, in turn, been facilitated by the greater mobile network access and consequent ability of online financial services to create consumer markets by extending credit to those previously without access. Examples from across the continent demonstrate this dynamic situation.

Solinc is a joint African-European manufacturing enterprise based in Kenya. Yet, much of its success can be attributed to the emergence of local digital mobile financing platforms. Originally known as Ubbink East Africa, Solinc was formed in 2011 as a joint venture between Dutch manufacturer Ubbink and Kenyan battery maker Chloride Exide. Using an initial investment of $3m, the company built a manufacturing plant that could produce 30,000 solar panels a year. By 2016, Solinc had increased its annual production capacity by more than 400 per cent to keep up with growing domestic demand. It has since begun selling in other east African markets and intends to further double its annual production capacity. By 2021, the company had sold over 775,000 solar panels, amounting to 47MW of off-grid solar power generation capacity – equal to more than half of Kenya’s 2019 installed PV capacity of 95MW.

This expansion was supported by Solinc’s partnership with Kenyan mobile financing businesses such as M-KOPA. Featuring in MIT Technology Review’s 50 Smartest Companies in 2017,M-KOPA pioneered the development of an online pay-as-you-go (PAYG) model that combined digital micropayments with internet of things connectivity. (“Kopa”, incidentally, is the Kiswahili word for “loaning”.) The firm has used its sophisticated mobile platform to provide $400m in financing. This has, in turn, enabled 1 million African mobile subscribers to purchase off-grid solar power and some of the technologies that use such power, including energy-efficient lights, televisions, refrigerators, and smartphones. This has had environmental benefits: M-KOPA estimates that its PAYG solar services have prevented 2m tonnes of CO2 from entering the atmosphere. According to the company, M-KOPA has generated $86m in income for the countries in which it operates and created $467m in cost savings for households.

M-KOPA users make their financial transactions through the aforementioned M-PESA, which is also an example of African-European cooperation. (“Pesa” is the Kiswahili word for “money”.) M-PESA is a mobile banking service formed by a joint venture between Vodafone and Safaricom. The company enables users to deposit, withdraw, and transfer money, as well as to pay for goods and services using PIN-secured text messages, on their mobile devices. M-PESA had 22.6 million active customers in 2019 and has expanded into central and southern Africa, Ethiopia, and Egypt. This has provided access to financial services to people who previously lacked it.

Just as Solinc has allowed ordinary Kenyans to use off-grid solar power solutions, businesses in Kenya are also taking advantage of the increased supply of solar power generation created by the country’s green energy innovation ecosystem. Some firms have built their own solar power plants using locally manufactured solar panels. For example, the Kenya Tea Development Agency (KDTA) announced in March 2021 that it would install solar power plants at 29 of its factories to reduce power costs. (Kenya is the world’s third-largest tea producer.) KTDA is not alone in making this transition to solar energy – Kenyan steel manufacturer Blue Nile Rolling Mills is installing a 1.5MW plant.

In west Africa, two other indigenous solar panel manufacturing companies have emerged that could take off as Kenya’s Solinc did, benefiting from foreign partnerships and the integration of mobile banking and digital platforms.Strategic Power Solutions (SPS), a subsidiary of the Ghanaian conglomerate Strategic Security Solutions International, built a manufacturing plant in 2016 with an initial annual capacity to produce 30MW of solar modules. In 2019 American engineering firm AEG International entered into a partnership with SPS to create solar energy systems to power schools, clinics, and other facilities, combining SPS solar modules with AEG equipment. As a result, SPS is expanding its capacity by a total of 500 per cent across west Africa. AEG’s successful partnership with SPS was facilitated by a grant from the US Trade and Development Agency.

West Africa’s other solar panel manufacturer, Faso Energy, began production in 2020. Based in Burkina Faso and financed by private investors, Faso Energy’s €5m plant was built through a partnership between the country’s government and Spain’s Mondragon Corporation, which supplied a semi-automatic PV production line for the facility. With an annual production capacity of upwards of 120MW of solar panels, Faso Energy provides a strategic partnership opportunity for European firms and, potentially, the European Green Deal. (As discussed below, there are ways for the EU to better align its European Green Deal and other major programmes to support such investments in Africa.)

Not all European activity currently combines the full range of elements that make up local green energy innovation ecosystems. For example, French multinational utility company ENGIE has entered the field by buying three African PAYG solar companies. In this way, it has become a player in off-grid solutions for sub-Saharan Africa, providing solar power to 4 million people. It has also followed M-KOPA’s sales model. However, ENGIE does not appear to be supporting local solar panel manufacturing. In 2018 it acquired American firm Fenix International, which sells off-grid energy products in Benin, Côte d’Ivoire, Zambia, and Mozambique. In 2019 ENGIE acquired German firm Mobisol, which is a competitor to M-KOPA in Kenya and also operates in Rwanda and Tanzania. African mini-grid construction start-up PowerCorner, incubated at ENGIE starting in 2015, operates mini-grids in Zambia and Tanzania, and is constructing new mini-grids in Uganda, Benin, and Nigeria.

Other companies are also entering the African market without partnering with African firms. American start-up ZOLA Electric (formerly Off Grid Electric) provides PAYG solar services in west African countries Nigeria, Ghana, and Côte d’Ivoire, while also operating in Tanzania and Rwanda, in east Africa. ZOLA Electric conducts operations in Côte d’Ivoire as a joint venture with French electric utility giant EDF and has received investment capital from French energy major TOTALEnergies and pioneering American electric vehicle manufacturer Tesla.

Wider ramifications

If African and European partners can together harness the synergy between solar energy and consumer mobile banking enabled by enhanced network coverage, they can also empower enterprises that promote wider social and economic development. This is evident with Swedish water purification start-up Wayout International, which is supported by Ericsson and Norwegian telecoms firm Telenor. Wayout International makes micro-purification modules that can produce drinking water for up to 300 households each day, reducing both CO2 emissions and the need for plastic bottles. The system is affordable for communities because customers use the service on a PAYG subscription through a mobile app. Telenor has no direct operations in Africa, but its internet of things subsidiary Telenor Connexion is providing network solutions, including SIM cards and full cellular internet of things connectivity management services. Ericsson’s internet of things accelerator is providing funding for, and expertise on how to securely operate, the system on standardised worldwide mobile network infrastructure. The system’s pilot project has been successfully operating in Uganda, producing 70,000 litres of pure drinking water every month and selling at competitive prices to 22,000 customers. The system is now set to expand to nine other sub-Saharan African countries.

These examples demonstrate the impact of European involvement in PAYG services powered by solar energy. This can stimulate the local manufacture of solar cells, panels, and modules in sub-Saharan Africa, and can address pressing social and health needs. If the EU and its member states want to exercise a leadership role in the development of African solar power manufacturing value chains (and other industries), they need to incentivise European companies to invest in the scalability of sub-Saharan African solar panel manufacturing and purchase locally produced solar panels.

Data centres

Around half of mobile money accounts worldwide belong to consumers based in sub-Saharan Africa. And the region is on track to see the fastest growth in mobile money anywhere in the world through to 2025. An estimated 700 new data centres are needed to meet the continent’s growing demand for data storage and thereby support other digital activity. This will likely require 1,000MW of additional installed power generation capacity. Recently opened private data centres in Nigeria and Kenya consume 10MW and 18.9MW respectively. Heavy data centre investments will be required in South Africa, Kenya, Nigeria, and Ghana – and, to some extent, in other countries with expanding ecosystems, such as Côte d’Ivoire and Uganda. The new trend of establishing co-location campuses – very large data centres – will also increase demand for power, with one Kenya-based co-location campus project slated to consume 42.5MW. This considerable rise in energy demand lends added urgency to the adoption of solar power, providing further opportunities for European firms to partner with African enterprises.

The region’s digital advance also creates severe vulnerabilities, as sub-Saharan Africa lacks comprehensive internet data and privacy regulation. Earlier this year, the OECD found that only 28 African countries had enacted comprehensive personal data protection legislation, and just 11 had adopted significant laws on cyber-crime. The operation and ownership of data storage centres in sub-Saharan Africa is crucial to the region’s digital sovereignty and security.

By investing in data storage in African countries, European firms can help improve these states’ digital security and sovereignty – giving them a competitive advantage over Chinese firms. One of the greatest concerns for African governments and businesses should be their vulnerability to the abuse of their digital platforms and data by the Chinese government. Europeans can help in this area by operating in compliance with the framework of the EU Cybersecurity Strategy and its directive on the security of network and information systems. Europe could then use its involvement in African data storage to gain entry into expanding African markets linked to the internet of things.

The case of Senegal’s €70m national data centre provides a cautionary tale in this regard. In June 2021, Senegal’s president, Macky Sall, inaugurated the data centre, declaring that “[w]e have to rapidly repatriate all national data hosted out of the country.” Sall ordered his government “to migrate all state data and platforms to the data centre”. However, this “national” data centre was built by Huawei and financed by a Chinese loan – calling into question the efficacy of Senegal’s exercise of secure and sovereign control over its data. Once the data centre becomes operational in early 2022, Chinese technology will dominate practically of all of Senegal’s cyber infrastructure.

Electric vehicles

As the lion economies of Africa began to roar in the mid-2010s, global automakers began turning their attention towards sub-Saharan Africa. This led Bloomberg News in 2015 to describe sub-Saharan Africa as the “last frontier for car makers on the hunt for growth.” Since then, there has emerged an even firmer global industry consensus on the prospects of the region’s car market. “The question on Africa isn’t, ‘is it a market of the future?’” – Nissan's managing director for Africa operations explained in a 2019 interview – “it’s a case of when.”

As car use increases on the continent, African governments and multinational carmakers are eyeing the possibility of leapfrogging internal combustion engine vehicles and advancing directly to electric vehicle production. For African governments, electric vehicle adoption is already an urgent economic and environmental imperative. In most African countries, the import of new and used cars is the second-highest contributor to their current account deficits, surpassed only by the cost of petroleum and petroleum products. Increased local or regional production of affordable vehicles in Africa would be an important economic boon for the continent. Moreover, urban regions of Africa are facing an environmental and health catastrophe due to the prevalence of highly polluting, end-of-life internal combustion engine vehicles. These substandard used cars – 80 per cent of which are unable even to pass the less stringent 2005 Euro 4 emissions standard – spew a tremendous amount of toxic carbon emissions into the air of Africa’s major cities, a problem worsened by their extremely low fuel efficiency.

Volkswagen’s Africa division estimates the potential new car market in sub-Saharan Africa to be 3-4m vehicle sales a year. The new car market in the region could reach or exceed sales of 15m vehicles a year by 2035, especially if companies make affordable models locally. Senior executives in the Africa divisions of Volkswagen and Hyundai have expressed their enthusiasm about the emerging electric vehicle markets in the region. If there is rapid growth in the number of electric vehicles in sub-Saharan Africa, there will be a proportional rise in demand for solar energy and ICT and internet of things solutions.

A former chair of Volkswagen’s Africa division, Thomas Schäfer, confirmed that the company wants to develop a pan-African end market. He explained the company’s larger vision for this: “the big game will be to connect … Kenya, Rwanda, Nigeria, South Africa and create an African market. Because then you [are] talking a billion people, and then you can walk away from exporting to America; exporting to Germany ... What’s the point? You’ve got the market right here.” In terms of introducing electric vehicles into that end market, the company considers its e-Golf pilot “a blueprint for electric mobility in Africa”. This level of ambition from major carmakers indicates the potentially great implications for green energy innovation ecosystems more widely in Africa.

However, Europeans are currently failing to work with local firms in the same way as their rivals from China and South Korea are (to name just two countries). The EU and EU-based companies have not engaged with local African manufacturers in joint ventures. Therefore, Europeans risk missing out on a vital form of engagement.

For example, with the help of the China Hi-Tech Group Corporation, a leading special-purpose vehicle-maker, Uganda’s government created the state-owned Kiira Motors Corporation (KMC) to produce buses for mass transit. KMC will soon go into full production of a fully electric, 90-passenger mass transit bus intended to reduce pollution across the country. Elsewhere, South Korean automaker Hyundai has assumed pole position in the race for electric vehicle production in sub-Saharan Africa by creating electric vehicle assembly lines in the region’s two most populous countries, Nigeria and Ethiopia. In 2019 Hyundai opened an assembly plant with the capacity to produce 10,000 cars annually in the Ethiopian capital, Addis Ababa. The company aims to export vehicles to the markets of Kenya, Somalia, Djibouti, Eritrea, and Sudan. Working through a joint venture partnership with Ethiopia’s Marathon Motor Engineering, Hyundai assembled its first IONIQ Electric model in Ethiopia in July 2020, and is now positioned to market this all-electric vehicle in the greater east African region.

Europeans should look more carefully at how to partner with local firms in the development of this industry and, crucially, at how its growth will affect related sectors.

Kenya

Africa’s PAYG pioneer, Kenya, has significant potential to leapfrog to electric vehicles. In the first half of 2021, new car sales in Kenya increased by 35 per cent. Kenya’s transport sector accounts for 39 per cent of the country’s CO2 emissions. And the Kenyan government is moving to facilitate the adoption of low-carbon mobility. The national electric utility company announced in March 2021 that it would invest in electric vehicle charging infrastructure to create urban and roadside retail charging services.

Kenya’s innovation ecosystem has provided its most effective electric vehicle adoption initiatives, such as Nopea Ride, an all-electric ride-hailing start-up. This is a Kenyan-Finnish joint venture that launched as a pilot in 2018 in Nairobi with three Nissan Leafs, and that by January 2021 had a fleet of 30 vehicles. Its Finnish parent company, EkoRent Oy, provided Nopea Ride with the ride-hailing app to operate on Kenya’s mobile networks. The service is currently in the process of expanding to 100 electric vehicles by January 2022. With a €357,000 grant from the Energy and Environment Partnership Trust Fund (EEP Africa), Nopea Ride is creating a solar charging hub in Nairobi. EEP Africa provided the grant to enable the Kenyan-Finnish joint venture “to determine the precise technology and strategy for a larger scale rollout across East Africa”. From a European perspective, it is important to note that EEP Africa is funded by the Austria Development Agency and the Nordic Development Fund – an institution supported by Denmark, Finland, Iceland, Norway, and Sweden.

Nopea Ride is an example of the enormous opportunities Europeans have to initiate and scale up electric vehicle adoption in Africa through coordinated partnerships between European automakers, energy companies, and ICT firms. Due to the synergies between PAYG off-grid solar pioneers Solinc and M-KOPA and electric vehicle taxi services such as Nopea Ride, Kenya’s innovation ecosystem already has the basic infrastructure it needs to make an integrated transition to solar power and carbon-free mobility built on value-added manufacturing production. Kenya’s four primary automotive assembly facilities have a combined capacity to produce around 46,000 vehicles annually, and have already assembled a variety of models – including those designed by Volkswagen, Peugeot, Volvo, and Scania. Collectively, the four assembly plants have received $145m in investment. Any one of them could assemble electric vehicles with a relatively modest investment from an appropriate foreign partner.

Rwanda

Volkswagen has selected Rwanda for its electric mobility project, as a part of which it will launch its e-Golf model as the first Volkswagen electric car in Africa. Rwanda has one of the most active innovation ecosystems in sub-Saharan Africa. Volkswagen’s $20m assembly plant in Kigali – which can produce 5,000 units annually – is focused on producing the company’s B-Segment Polo model, but can also produce the Passat and others. The components the plant uses are shipped from Volkswagen facilities in South Africa via Kenya in response to demand, enabling the company to transfer small consignments to accommodate slight increases in demand, and thereby incrementally expanding its market share.

Volkswagen can operate with the same nimbleness in the production of electric vehicles. The firm is conducting its African electric vehicle rollout in partnership with German conglomerate Siemens, which is providing the electric vehicle charging infrastructure. And it is precisely the mobile-enabled car-sharing and ride-hailing sector that Volkswagen envisages as developing the local market for these vehicles. To this end, the firm is working with Rwandan start-up company, Awesomity Lab, which developed the IT mobility software, Move App, to offer these services. This integrated, cross-industry approach is introducing electric vehicles into a sub-Saharan African market and capitalising on the opportunities of the digital realm while being supported by a serious growth in solar power. As Volkswagen’s Schäfer said, “the success of our innovative and pioneering mobility solutions business has shown us that Rwanda has the potential to leapfrog the internal combustion engines into electric cars.”

Volkswagen’s partnership with Siemens should encourage European automakers to engage with European firms outside the automotive sector. Indeed, Siemens views the project as a step towards expanding its involvement in the emerging innovation ecosystems of east Africa’s other lion economies. Furthermore, and as with other examples noted above, cooperation between Volkswagen, Siemens, and the Rwandan authorities in the electric mobility project also benefited from the important role played by a European development agency – in this case, German agency GIZ. It facilitated public-private partnerships and advised on the development benefits of the project.

Ghana

Electric vehicle production is moving ahead in Kenya and Rwanda, but Europeans should acknowledge the potential of Ghana’s green energy innovation ecosystem in this area. They should consider how they can partner with Ghanaian firms to become more closely involved in the country’s emerging industry. Ghana could soon prove to be importantto the adoption of electric vehicles. The country has a domestic solar panel manufacturing sector that could support charging infrastructure. Moreover, the country has 1,575MW in surplus power production capacity, which could enable it to serve as a launchpad for electric vehicle manufacturing.

In 2020 Ghana’s car industry was valued at $4 billion and projected to reach $11 billion by 2026. In March 2020, Volkswagen opened a 5,000-unit assembly plant in the country, fulfilling a memorandum of understanding the company signed with Ghana during Chancellor Angela Merkel’s tour of west Africa in 2018 – which also saw it sign a similar memorandum of understanding with Nigeria. In contrast to Nigeria, where progress has faltered, the Ghanaian government acted quickly to adopt its Ghana Automotive Development Policy (GADP), which imposed restrictions on used cars and offered tax incentives to global carmakers. This initiative is linked to other parts of the green energy innovation ecosystem: Volkswagen is contemplating introducing integrated mobility services similar to Rwanda’s Move App, raising the possibility of Volkswagen attempting an electric vehicle rollout in Ghana.

But Volkswagen is not alone in eyeing Ghana as its west African manufacturing hub. Also prompted by the GADP, Suzuki and Toyota opened a joint vehicle assembly facility in the country. By establishing its Ghana plant, Toyota matched Volkswagen in the east and west African automotive markets; each company now has assembly facilities in Ghana, Nigeria, Rwanda, and Kenya. Nissan has also set its sights on the west African market, constructing an assembly plant in Ghana that is due to open in 2022, and that – with a capacity to produce 50,000-60,000 vehicles annually – will overshadow both Volkswagen and Toyota. And, in April 2021, Ghana’s minister for trade and industry, Alan John Kyerematen, announced that Hyundai would establish an assembly facility in Ghana. Any one of these global automakers could begin assembling zero tailpipe emissions vehicles in the country, which would make Ghana west Africa’s main hub for electric vehicle assembly.

Europe’s role

Green energy innovation ecosystems and Europe’s global priorities in Africa

The emergence of markets and industries with digital financial platforms has created successful new development models across sub-Saharan Africa. The expansion of such platforms and mobile networks has increased the generation of, and access to, solar power – which also supports sub-Saharan Africa’s energy transition and efforts to counter climate change. The evidence suggests that European investment in joint-venture, value-added production in the region will succeed if it takes place in cooperation with local innovation ecosystems. To make this a reality, the EU and EU members of the G7 will need to align their strategies with this priority.

In recognition of the geopolitical importance of the transition to a decarbonised economy beyond Europe’s borders, the EU is making climate a fully fledged part of its foreign policy. Currently, there are multiple initiatives that can usefully contribute to this, ranging from the European Green Deal to the Global Gateway and Build Back Better World (B3W).

At the heart of this more outward-facing stance is the European Green Deal, which aims to mobilise a total of €1 trillion to decarbonise the European economy and facilitate similar transitions abroad. It combines public financing with policies the EU hopes will unlock private sector investment, without which it will be impossible to mobilise €1 trillion.

In addition, European policymakers have also devised their alternative to the BRI, through which China is investing $1 trillion in major projects in more than 100 countries. The BRI is reshaping the architecture of global trade and commerce. As well as building new infrastructure through the BRI, Beijing is using it to strengthen political ties with governments. In response, in December 2021, the European Commission launched a global connectivity strategy called the Global Gateway.

Finally, Europeans participate in the B3W initiative, which was launched by the G7 in June 2021 with the same aims as the Global Gateway. The EU members of the G7 are Germany, France, and Italy, and, as a transatlantic initiative, the B3W also includes the US (which leads it) and the UK.

The EU’s climate and connectivity agendas are at different stages of development. Its climate policy is more advanced than its approach to global connectivity. More broadly, the EU plays a relatively dominant role in European climate action, while European responses to the BRI are developing via two parallel initiatives: one led by the EU; the other driven by the G7. However, overall, the EU is now assembling the strategies and policies it needs to support the green transition in sub-Saharan Africa – and it is giving them some financial heft.

Reframing European climate policy to support Africa’s economic development

To succeed in this challenge, Europeans need to establish a clear priority for their climate policy. Their first step should be to consider the current image of European climate action in Africa – and, consequently, to work to reframe what they are offering.

In its inception, the European Green Deal was inwardly focused rather than led by foreign policy. A source of intense debate among the 27 EU member states, the deal represents a hard-won compromise between national domestic considerations across the bloc. By necessity, it initially focused on agreeing to a path towards climate neutrality within the EU, with the foreign policy element emerging later and as a lower priority.

Early assessments of the geopolitical impact of an EU-only climate strategy recognised that it would fail if the rest of the world did not pursue the same standards. For this reason, under the rubric of the European Green Deal policymakers began developing measures to prevent “carbon leakage”: the outsourcing, for economic gain, of polluting production beyond the EU’s borders (and legislative reach). To respond to that challenge, the carbon border adjustment mechanism (CBAM) leveraged the EU’s greatest geopolitical asset – the size of its single market – to encourage exporters to Europe to reduce their carbon footprint. The CBAM essentially acts as a tax on any exports to the EU that are more carbon-intensive than those that new European Green Deal-driven regulations allow within the union.

Arguably the best-known foreign policy measure on the EU’s climate agenda, the CBAM has risen to prominence in Africa-Europe relations, and threatened to act as an unfair tax on Africa’s economic development trajectory.

Of course, the European Green Deal aims to achieve much more than the CBAM, but, where a clear vision for the future should be, there is a vacuum – into which the CBAM rushed. To address the problem, European policymakers should explicitly recognise the potential of Africa’s green energy innovation ecosystems and thread it through their decision-making. This would replace the vacuum with a positive agenda. The EU currently mixes potentially punitive measures such as the CBAM with funding for adaptation to climate change and mitigation of greenhouse-gas emissions. Together, these approaches lack strategiccohesion.

To create the strategic underpinning for a positive agenda, the EU should start by acknowledging that the greatest contribution it can make to sub-Saharan Africa – and that, in turn, the region can make to global climate objectives – is to ensure that the next stage of Africa’s economic development is green. This would account for the fact that Africa’s historical contribution to global cumulative carbon emissions is a mere 3 per cent, and that precipitous changes to European climate policy risk harming its economic growth – which is already struggling under the shocks of the health crisis, supply chain disruptions, and inflationary pressure caused by the pandemic. European policymakers should show that they understand that sub-Saharan Africa faces enormous hurdles to achieving growth while decarbonising. Accordingly, they should position Europe’s climate foreign policy as the pre-eminent tool for achieving these objectives. This would simultaneously address the perception that European climate policies would harm Africa’s economic development and that European policymakers are blind to Africa’s needs.

The Global Gateway and Build Back Better World

Coordination aside, the EU will need to work out how best to ensure these investments support the strategic objective described above. To succeed in this, and to reframe its climate policy, the EU should embrace joint-venture cooperation with innovation ecosystems and value-added production in Africa.

A key reason for this is not simply greater efficiency and effectiveness on the European side (although that may be part of it) but also the nature and importance of Africa’s green energy innovation ecosystems themselves. These ecosystems are already driving growth in the new components of global connectivity, moving beyond a narrow – BRI-style – focus on ports and roads. Having understood this, European policymakers should set out a holistic vision of connectivity that includes telecommunications networks, mobile finance, and infrastructure that generates, stores, and transports green energy – precisely the components of Africa’s green energy innovation ecosystems. The Global Gateway could help build infrastructure for green energy production, advanced information and communications networks, electric vehicle production, and other sectors in these ecosystems.

This process of reframing the foreign policy aspects of the European Green Deal in Africa would dovetail with the Global Gateway and the B3W. Ultimately, all three initiatives would direct investment towards similar sectors. The risk is that multiple initiatives lead to a dissipation of efforts and give rise to bureaucratic turf wars between EU institutions. But, to really support this shift and make the most of the EU’s combined financial and organisational power, the bloc should cease to distinguish between its objectives on climate and its response to the BRI. The EU should combine the European Green Deal and the Global Gateway into a single overarching policy. If it does not do this, it will find itself investing across two (or three, including the B3W) programmes that all ultimately aim to support similar sectors. The time to bring them together is now, as both the Global Gateway and the B3W are currently little more than formal aspirations lacking in concrete policy.

On the B3W, the EU could work with Germany, France, and Italy to promote a greater understanding of the importance of supporting Africa’s green energy innovation ecosystems. As well as aligning resources with strategy, this would send the strongest possible message to the EU’s African partners about the congruity and seriousness of European policy and action, and would provide the best possible basis for genuine future partnership. A crucial advantage of merging the Global Gateway with the European Green Deal is that, in terms of promoting business connectivity, commercial corridors only emerge when they are anchored in a manufacturing value chain that includes local value-added production. This is another weakness of the BRI; as noted above, for individual African states’ economies, the boon from BRI investments has been limited.

Therefore, the EU has an opportunity to offer more enduring and more attractive partnerships. There are already successful European examples of this combination on a smaller scale – for example, French support for the automotive sector in Morocco. At heart, decarbonising the economy – Africa’s, Europe’s, the world’s – is simultaneously an infrastructure and a manufacturing challenge. This paper has shown that local value-added production anchored in improved infrastructure is already key to sub-Saharan Africa’s burgeoning green energy innovation ecosystems. In this respect, Europeans have an opportunity to gain a first-mover advantage – if they act now.

Moreover, such investment can also help level the playing field for European companies in Africa that have to compete with rivals backed by the Chinese state. But Europe also needs to accelerate the transition away from the one-sided dynamic of the old donor-recipient relationship, which has hampered engagement efforts in the past. These initiatives can also help reset Africa-Europe relations, by supporting joint-venture investments that create value-added production in partnership with the firms at the centre of Africa’s green energy innovation ecosystems. They can do so in a way that assists the economies of both Africa and Europe, in the face of intensifying international competition.

Recommendations

There is no shortage of ways in which the EU can better engage with this key agenda. For example, although the European Green Deal’s inward focus predominates, its “EU as a Global Leader” chapter contains many of the provisions needed for investment-driven engagement with green energy innovation ecosystems. Similarly, the EU’s “Towards a Comprehensive Strategy with Africa” may predate the European Green Deal, but it provides a sufficiently broad framework for the more specific programmes and financing to flourish. Three of the strategy’s “five partnerships” are relevant: the green transition and energy access; digital transformation; and sustainable growth and jobs. In addition, the Global Gateway promises to focus on infrastructure investments and make use of the European Fund for Sustainable Development Plus – the financial arm of the EU’s External Investment Plan, which was approved in March 2021 to mobilise financing in Africa to the tune of €29.18 billion.

As it is difficult to secure extra EU public funds for such purposes, European policymakers should promote public-private partnerships in Africa as an important source of funding. Public-private partnerships have at times been dismissed in European civil society circles as government subsidies to the private sector that contravene free-market principles. But they are key to leveraging Europe’s full potential. Indeed, the European private sector’s investment in, and partnership with, African businesses will be a force multiplier for Europe. Public funds provided by EU member states and the EU will not be of the scale needed to transform Africa’s economies. European private sector actors can fill this gap. The EU should play a coordinating role to enable them to work together.

European policymakers should consider the following points in these key areas of activity.

Foster Europe-wide cooperation on investment in Africa

Effective public-private partnership requires sufficient scale. European actors in the private sector will need to cooperate with one another if they are to match – but not imitate – the scale of China’s footprint in Africa. This is complicated because industries in different member states compete with one another, as do companies within and between member states. But the ability to collaborate is what differentiates mega-projects serviced by an array of Chinese private and state-owned enterprises from individual, competing European vendors providing piecemeal contributions. A past example is the Democratic Republic of Congo’s INGA III mega-dam project: China made a whole-of-project offer, while European players lacked a common financing mechanism and investment guarantor.

Promote solar power

The investment programmes of the European Green Deal (or its successor after merging with the Global Gateway) should aim to incentivise coordinated cooperation between European energy and ICT companies, pushing them to invest in local solar panel manufacturing in Africa. This would promote the adoption of solar power in the form of industrial-scale solar plants, and would help national power grids to decarbonise.

African and international ICT companies seeking to expand 4G and 5G coverage to support the growing use of smartphones and the internet of things also have an interest in African solar power generation, as it can help meet the additional energy demand their networks require. Under the auspices of the European Green Deal, the EU could incentivise European companies to purchase locally produced solar panels and invest in the scalability of sub-Saharan African solar panel manufacturing.

Participate in telecommunications upgrades

Europe’s market position in Africa’s next generation of green energy innovation ecosystems will depend on the level of European participation in sub-Saharan Africa’s transition to full 4G and 5G coverage. Orange has a leading role to play in the development of these ecosystems. But it will need greater European commitment to African 5G network development, including from cross-industry partners from the energy and automotive sectors, among others. Without such partnerships, Orange will increasingly work with firms from China and other countries outside the EU.

Promote electric vehicles

The European Green Deal’s July 2021 Fit for 55 package aims to help the EU to achieve a 55 per cent reduction in carbon emissions by 2030. It calls for the EU to ensure that, by 2035, all new cars sold in the bloc have zero tailpipe emissions. With African innovation ecosystems helping spur the adoption of electric vehicles, and with local production of such vehicles starting to grow, the European Green Deal can become the investment and programming engine to drive sub-Saharan Africa’s transition to low-carbon mobility. Volkswagen’s integrated, cross-industry approach in Rwanda demonstrates how firms can introduce electric vehicles into sub-Saharan African markets. The European Green Deal is especially well suited to promote European firms as leading partners in sub-Saharan Africa’s shift to the production of electric vehicles and widescale adoption of these vehicles. GIZ’s successful intervention should serve as a model for EU-level engagement with European firms across national boundaries.

Provide support on data centres

The European Commission should link its “EU Cybersecurity Strategy” and its directive on the security of network and information systems to support the development of ICT in Africa. The European Commission can provide advice and direct support to improve security and sovereign control over data. These issues become particularly acute with sub-Saharan Africa’s pressing economic need to develop data storage centres. Combined with new European investment, the stronger protections that such rules provide African citizens should prove to be a more attractive offer than the Chinese alternative.

By developing a diversity of supply chains for key products, and by building stronger economic and political relationships with businesses and governments in sub-Saharan Africa, Europeans would achieve greater resilience in the emerging geopolitical competition with China. This would also reduce the benefits China could gain in its pursuit of similar goals.

A reformed European Green Deal can accelerate green energy development in sub-Saharan Africa. EU policymakers should consider merging the European Green Deal with the Global Gateway, and establishing new coordination mechanisms to drive investment. This revised approach can support investment in the expansion and upgrade of cellular networks, solar panel manufacturing, local electric vehicle production, and other new products and services driven by green energy innovation.

This paper has shown that some EU member states’ institutional interventions have excelled at enabling effective African-European partnerships. They have fostered cross-industry initiatives that use telecoms to develop new products and services. These initiatives should serve as models for EU-level engagement with European firms across national boundaries. Accompanied by a message that Europeans will lead the world in supporting sub-Saharan African economies as they move towards a greener future, the EU can help achieve the vital goals of decarbonising the global economy while holding its own geopolitically vis-à-vis major powers such as China.

About the author

Michaël Tanchum is an associate senior policy fellow in the Africa programme at the European Council on Foreign Relations. He is a professor at the University of Navarra and a senior fellow at the Austrian Institute for European and Security Policy. He also is a non-resident fellow in the economics and energy programme at the Middle East Institute in Washington.

Acknowledgments

The author would like to thank Elan Fox, Daniel ‘Mac’ Lang, Rafaella Vargas Reyes, María del Pilar Cazali Castañón, Paula Suárez de Castro, Alaia Flamarique Jorrín, Clara Sallán Artasona, and Gabriela Pajuelo Chavéz for their research assistance.

The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of their individual authors.