Digital stability: How technology can empower future generations in the Middle East

Summary

- The growth of the digital economy in the Middle East and North Africa could become one of the key solutions to the region’s youth unemployment crisis.

- Governments in the region have taken steps to create an environment in which technology startups can thrive.

- However, they need to overcome challenges such as flaws in their education systems, bureaucratic inefficiency, and a lack of funding for new businesses.

- Digitisation not only creates new opportunities for employment and political participation but also enables digital authoritarianism in the region.

- Europeans must help construct the region’s digital infrastructure, to prevent China from popularising its internet governance model there.

- The European Union should support the digitisation drive in the Middle East and North Africa through regulation, capacity-building, and funding.

Introduction

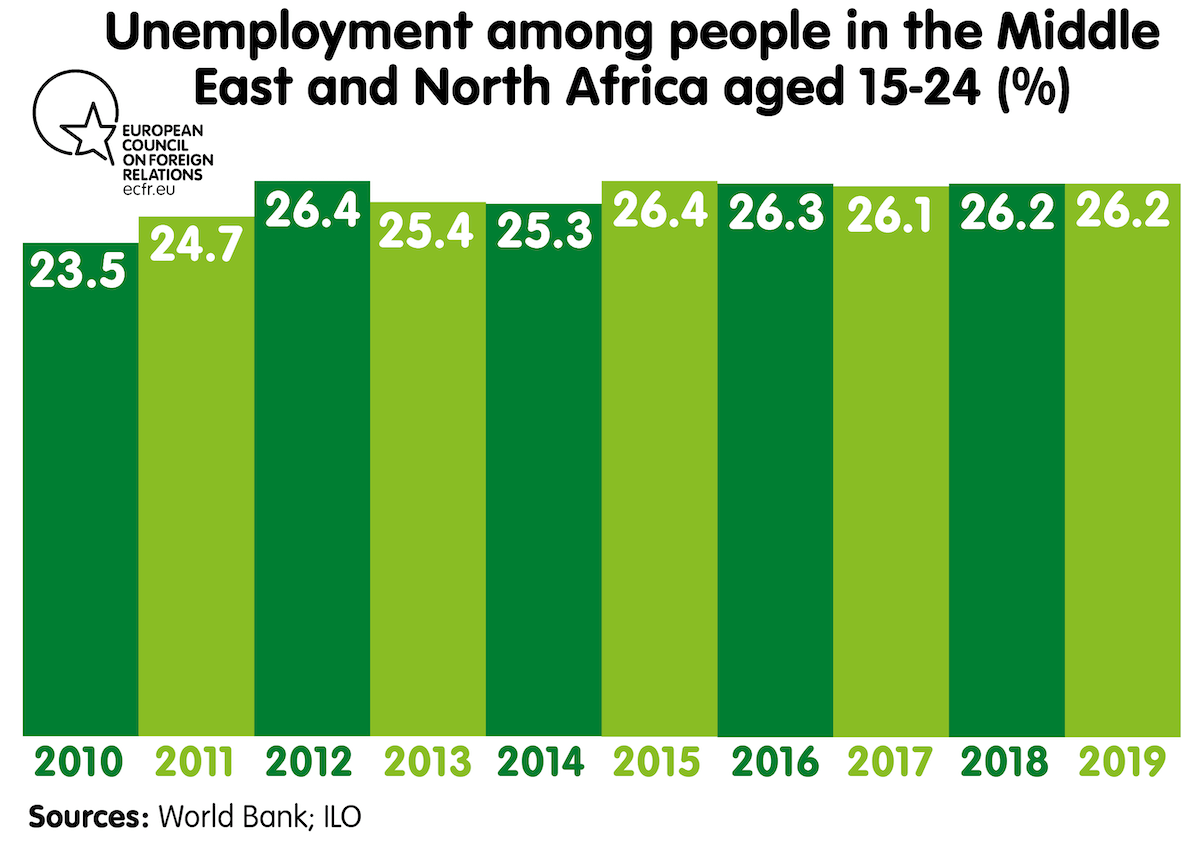

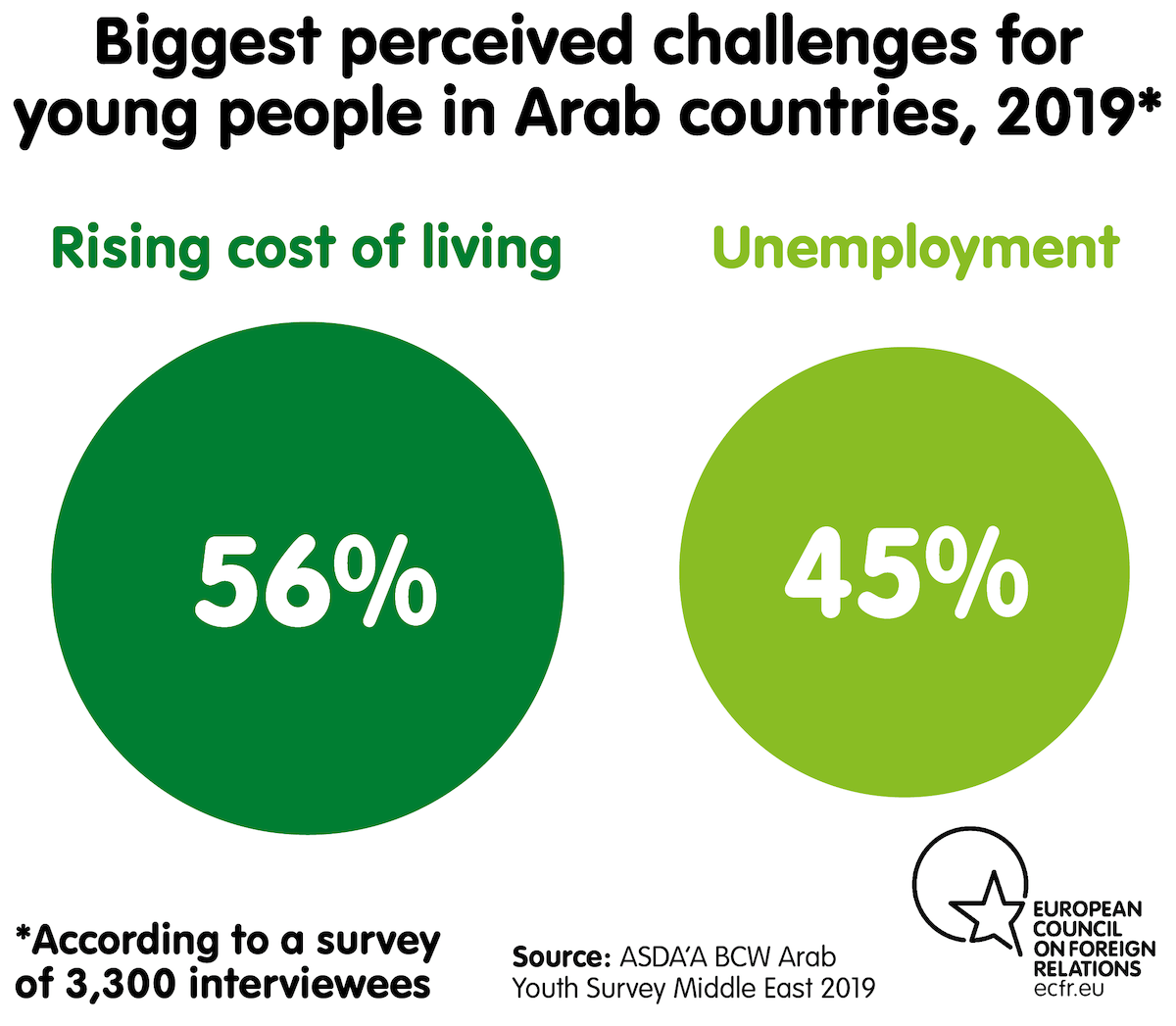

Countries in the Arab world have long failed to create enough jobs for their growing working-age populations. Accordingly, with roughly 300m people under the age of 24, the Middle East and North Africa continue to suffer from a youth unemployment crisis. The socio-economic problems resulting from this have contributed to the violent conflicts and civil strife that continue to shake the region.

Many Arab countries have long depended on hydrocarbons, but increasing access to the internet could provide the foundation of a new economic future. As governments across the region roll out economic diversification strategies, its technology sector – and its tech-savvy, often unemployed young people – has the potential to transform the economy.

A digital transformation of this kind could empower current and future generations, providing them with much-needed job opportunities and new forms of civic participation. Indeed, the World Bank has called on governments in the Middle East and North Africa to launch a “moonshot” – a reference to the United States’ space-flight programme in the 1960s and 1970s – that will “liberate the digital futures of their millions of tech-savvy youth”.

And there have already been successes in the Arab world’s technology sector, albeit on a relatively small scale. Ride-hailing app Careem and online marketplace Souq – which Uber and Amazon recently bought for $3.1bn and $580m respectively – have put the Middle Eastern technology industry on the map for global investors. The introduction of 5G across the region promises to open a new digital frontier.

Nevertheless, digitisation – the use of digital technologies to transform business practices and everyday activities – faces numerous challenges. Although both the use of smartphones and internet penetration rates have increased drastically in the past decade – reaching more than 65 percent of the region’s population, according to some estimates – this has not yet translated into digital jobs. And, despite all the hype, 5G may not turn out to be the positive game-changer many observers hope.

Digitisation is a double-edged sword. While they can improve transparency and accountability, new technologies can also provide authoritarian regimes with new means to monitor citizens and crack down on dissent. Moreover, digitisation is entangled with geopolitics. As the US-China trade war and Russian interference in the 2016 US election illustrate, the battle for technological supremacy is a deeply political affair, particularly in relation to 5G. The Arab world is emerging as a key battleground in both respects.

This paper analyses the ways in which countries in the region have stepped up their digitisation efforts in recent years, focusing on the United Arab Emirates and Jordan. The UAE, the main hub of the digital economy in the Arab world, aims to become a global centre of technological innovation. Jordan, one of the region’s early movers in technology startups, has also allocated significant resources to boosting economic growth through digitisation and created the Arab world’s first digital economy ministry. Both countries are strategic allies of Europe and the US, with Jordan forming an important part of the European Union’s Neighbourhood Policy.

European states have a strong interest in stabilising the Middle East and North Africa, particularly in preventing the emergence of terrorist groups and conflicts close to their borders. Contributing to the region’s economic success – through measures such as stabilisation funding, aid, and youth employment initiatives – is a key component of this effort. Given that supporting the Arab world’s digital economy is an important and under-explored element of the process, the EU should give greater thought to how it can support digitisation in the Middle East and North Africa, as well as further integrate this into its development policies. The EU should use its position as a global leader in regulation to help countries in the Arab world build policy frameworks that will strengthen the digital economy. The bloc should also increase its funding for capacity-building programmes in the region, aiming to provide young people with the latest digital skills. And the EU should also reassess the role of European tech companies that have supplied cyber-surveillance tools to Arab governments.

Automation and job creation

The World Bank estimates that the Middle East and North Africa need to create 300m jobs by 2050 if it is to meet the employment needs of its young people. By allowing the public sector to become the main source of employment, governments in many countries in the region have weakened the private sector. For example, in 2018, two-thirds of Saudi workers were employed by the government. In Jordan, more than half were.

Under pressure to find alternative sources of employment for their growing populations, these governments are now focusing on entrepreneurship and innovation to diversify the economy, promote growth, and cut unemployment. They increasingly see digitisation as a promising means to achieve this.

The upward trend in internet penetration rates – which vary by country – is driven by the declining cost of smartphones and mobile internet access. However, so far, government efforts to promote a culture of entrepreneurship have created too few jobs. As World Bank economists Rabah Arezki and Hafez Ghanem write, “although the internet and hand-held devices are ubiquitous throughout the region, they are currently used for accessing social media, rather than for launching new enterprises.”

Equally, many of the digitisation strategies put in place by Arab governments are only likely to cut youth unemployment in the medium to long term – and, even then, will require improvements in infrastructure for startups and the removal of barriers to entry into regional markets.[1] Nevertheless, one recent study estimated that an “enhanced digital job market has the potential to create 1.3m additional jobs in the GCC [Gulf Cooperation Council] by 2025, including 700,000 in Saudi Arabia alone.” The study also argued that some of the roughly 3.9m economically inactive women and young men in GCC countries could benefit from digital self-employment.

There is no consensus on the impact of increased internet access on job creation. A World Bank study published in 2018 argues that the development of broadband access would have a positive effect on job creation in the short term, noting that its long-term effects are “complex”. The development of broadband creates “direct jobs to build the infrastructure”, “indirect and induced jobs from this activity”, and “additional jobs … because of broadband network externalities and spillovers”.

However, there is little academic work on the impact of digitisation on the global economy, including on job creation in the Middle East and North Africa. Various digitisation experts interviewed by ECFR have voiced scepticism about the digital sector’s potential to become a major employer there.

To convert increasing internet access into economic growth and jobs, the World Bank launched in 2019 the Mashreq 2.0 initiative, which approaches digital transformation “as a unique opportunity … to help address the Region’s most imminent challenges”. The initiative focuses on Jordan, Lebanon, and Iraq. It supports these countries with loans and the Skilling Up Mashreq Initiative, which aims to provide 500,000 women and young men in the countries with digital skills by 2021. The World Bank will also dispense advice on areas such as infrastructure, innovation, and reform of the broadband sector.

Such digitisation efforts are already having a positive effect on the jobs market in the region, especially in relation to the employment provided by ride-hailing apps such as Uber and Careem. As a report by the Internet Society argues, “while the total number of jobs created by startups is still small, there is huge potential for these firms to create more – and high quality – jobs and drive an entrepreneurship culture where recent graduates are more likely to create their own jobs than to emigrate.”

A shift towards the “cloud” – moving data from an on-site platform to a remote virtual database accessible through the internet – can also promote digital transformation and job creation in the region. For example, a study by Microsoft and the International Data Corporation predicts that the cloud and the Microsoft ecosystem will create more than 500,000 jobs in the Middle East between 2017 and 2022. Another International Data Corporation study, published in 2018, estimated that the growing use of cloud services and the Microsoft ecosystem would create more than 55,000 jobs in the UAE between 2017 and 2022. A top Amazon Web Services executive said in September 2019 that many of the 30,000 workers the firm plans to hire will be based in the Middle East.

With the nature of employment changing in the Middle East and North Africa (as elsewhere), there are widespread concerns that digitisation could result in a net loss of jobs. A 2018 report by the World Government Summit and McKinsey found that existing technology could automate 45 percent of current work activities, saving around $367 billion in wages in Bahrain, Egypt, Kuwait, Oman, Saudi Arabia, and the UAE.

However, the same report estimates that, in the medium to long term, “the associated labour productivity increases can also be an engine for growth and new job creation like in previous innovation cycles” and that most of these jobs would be “outside the technology sector itself”. This could include work that requires “strong human-machine interaction”.

Beyond the numbers, digitisation is also changing the way people work qualitatively. For instance, advanced communication technologies allow people to work remotely, thereby lowering logistics costs.

Such conclusions are echoed by a recent report published by LinkedIn, which ranked “software engineer” as the most popular emerging role in the Middle East and North Africa between 2013 and 2017. LinkedIn also listed “data analyst” and “data scientist” as emerging job roles in the region between 2018 and 2022. In a similar vein, information technology was the second most popular sector on Middle East and North Africa jobs website Bayt in 2018 (after oil and gas).

There are varying estimates of the extent to which digital transformation can boost economies in the Middle East and North Africa. According to a report by GSMA (an association that represents mobile telecoms operators), mobile technologies and services created almost $165 billion in value in the Middle East and North Africa in 2017. The report projects that the region will see the “fastest subscriber growth rate of any region except sub-Saharan Africa”. In 2016 McKinsey estimated that a unified digital market in the Middle East, with 160m potential mobile users by 2025, could increase GDP by around $95 billion per year. In addition, a 10 percent rise in broadband access would increase GDP growth by as much as 1.4 percent and improve trade integration between Jordan, Lebanon, and Iraq.

Advances in artificial intelligence (AI) technology will also increase the Middle East’s GDP – by as much as $320 billion between 2018 and 2030, according to one study. Such technology is widely expected to facilitate the manufacture of a range of products, including autonomous vehicles, robots used in healthcare, and automated video surveillance. And GCC states aim to be at the forefront of these developments. The UAE projects that AI will increase GDP by 14 percent between 2018 and 2030, ensuring that 25 percent of all transportation in Dubai is driverless by the end of this period. Saudi Arabia, which has made digital transformation part of its Vision 2030 economic restructuring plan, projects that AI will account for 12.4 percent of GDP by that year.

Some experts believe that 5G, which promises data-transfer speeds that are at least 20 times faster than 4G, will be at the centre of such developments, ushering in a fourth industrial revolution in the region. According to one 2018 estimate, 5G technology in GCC countries – the most advanced markets in the region – could increase the revenue they generate by as much as $273 billion over ten years.

This technology will affect not only citizens’ media consumption but sectors such as manufacturing. For instance, the creation of smart factories would allow various systems on a production line to communicate with one another, and adapt in real time, with little human intervention. Other planned applications of 5G range from entertainment to drone technology to remote surgery and robotics.

Taken together, 5G data transfers, large-scale data processing enabled by AI, and the large amount of data collected by devices connected through the internet of things will enhance companies’ decision-making processes. (The internet of things allows devices such as cars or speakers to connect to collect and exchange data.) A policy that allows for large-scale transfers of non-personal information would aid countries’ efforts to boost innovation. However, as discussed below, big data processing raises human rights issues, as it can allow authoritarian governments to closely monitor citizens.

And, despite the touted impact of 5G, several ECFR interlocutors cautioned against the idea that the technology would have a transformative effect. One venture capitalist in the region argues that vendors are overhyping 5G, adding that he failed to see how it would significantly affect consumers in the short term.[2] This view was echoed by the Jordanian digital economy minister, Mothanna Gharaibeh – who, although he welcomed such technology, doubted that it would be a game-changer, because “so much” could already be done with 4G.[3]

Digitisation has facilitated rapid growth in the number of startups in the Arab world. Last year saw a record number of 564 startup investment deals, amounting to $704m in funding, in the region. This equated to a 12 percent increase in funding in just one year (excluding the acquisitions of Careem and Souq).

In 2019 the UAE continued to receive more funding for digital startups than any other country in the region. But, for the first time, Egypt – whose population has soared to more than 100m – struck a larger number of startup deals than any other country in the Arab world. Egypt captured 25 percent of all such deals, due to both private and public support for the sector.

Saudi Arabia has also experienced rapid growth in its startup economy. According to industry platform MAGNiTT, the country came in third place in both funding and number of deals in 2019. With its large population and significant government support for technological development, Saudi Arabia is likely to see its digital economy grow quickly in the coming years.

Lebanon witnessed a slight decrease in its annual number of startup deals, coming in fourth place. This decline seems partly due to heightened civil unrest in the last quarter of 2019. Meanwhile, Jordan remained in fifth place. Both Lebanon and Jordan have been early adopters and promoters of entrepreneurship in the Arab world.

Yet the concept of startups is not new in the region. Email service provider Maktoob, the first to offer free Arabic support for emails, was launched in 1999 and acquired by Yahoo in 2009. However, it was the acquisitions of Souq and Careem that thrust the Middle Eastern startup scene into the spotlight. The latter remains the biggest private technology deal in the history of the Middle East and North Africa.

By comparison, both Iran and Israel have thriving startup scenes. Israel has attracted investors from the US, Europe, China, and the Gulf. While US sanctions have dealt a blow to Iran’s ambitions to attract foreign investment in the tech sector, this is one of the few Iranian industries that has continued to grow in recent years.

American technology firms such as Microsoft and Amazon Web Services have also increased their presence in the Arab world in the last few years by setting up data centres and cloud storage facilities. The enhancement of local digital infrastructure will be critical to regional governments’ efforts to meet their digital transformation goals.

The promise of financial technology

Given that many of its inhabitants do not have access to traditional banking services, the Middle East and North Africa could greatly benefit from the growth of the fintech (financial technology) sector. Fintech projects can promote financial inclusion and serve the region’s large expatriate population. Although cash remains citizens’ preferred payment method, the number of fintech companies in the region is projected to continue its rapid growth in the coming years. This could significantly reduce transaction costs in the financial sector.

While the UAE is the largest fintech hub in the region, Bahrain merits particular attention in this sector. The government in Manama has introduced a set of regulations aimed at turning the small Gulf nation into a regional fintech centre. As a result, there are currently more than 90 fintech startups in Bahrain.

In June 2017 the Central Bank of Bahrain established a regulatory “sandbox”, a framework that aims to provide a “light-touch regulatory environment to test and incubate new FinTech and innovative solutions”.[4] The sandbox, which benefits both startups and regulators, is open to companies across the world, including fintech startups and traditional financial institutions.[5] Bahrain has also introduced new bankruptcy and data protection laws, which aim to make the country more attractive to investors.

States such as Egypt and Saudi Arabia have also launched private and public initiatives to strengthen their nascent fintech sectors. But, for fintech to make a profound impact on the region, governments will need to make legislative changes that allow newcomers to enter the market more easily and thereby disrupt the established banking system.

Economic and technical barriers to digitisation

If they are to grow the digital economy and make effective use of the region’s many computer-literate young people, Arab governments will need to address several shortcomings of their digitisation strategies. As part of this, they should streamline the regulatory process for new digital businesses, improve the digital infrastructure that startups rely on, and increase public and private investment in digital literacy training.

Many entrepreneurs in the region emphasise the difficulty of obtaining funding for their digital startups, particularly at an early stage. This remains the case despite the increased access to venture capital they have had in recent years as the startup scene has matured.

Startups in the Arab world face challenges in hiring and retaining talented staff. This problem is particularly acute in non-GCC countries, where many highly skilled employees emigrate to Europe, the US, and the GCC in search of better salary and benefits packages.[6]

Many tech startups in the Arab world have developed their innovations into successful business models in the local market – as seen with, for example, food delivery app Talabat. Nevertheless, some industry insiders have criticised what they see as a lack of innovation in the region. As one interlocutor active in the digital sector in the UAE put it, the Middle East has been a “consumer of innovation”, not a creator.[7]

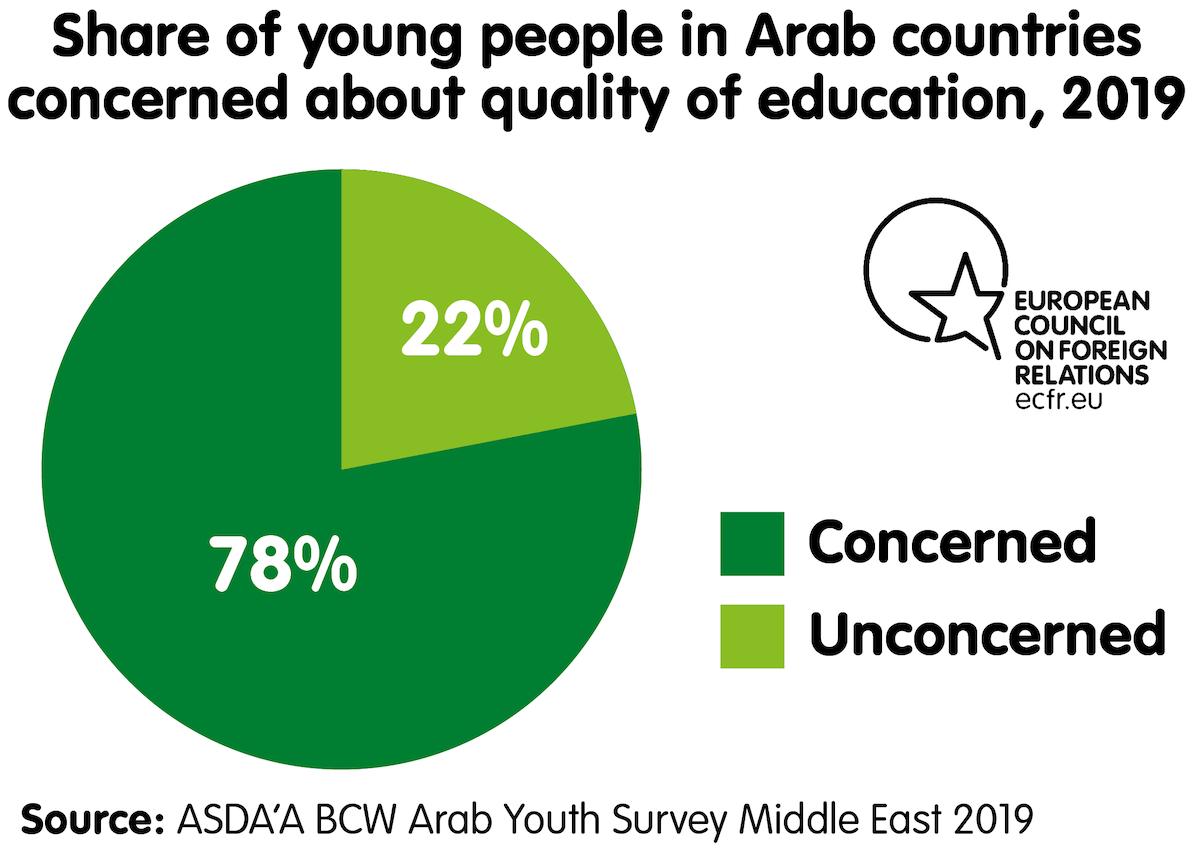

A successful digital transformation strategy will require greater investment in human capital. Yet, at present, the education system in Arab countries does not adequately prepare students to participate in the digital economy, with public schools often focusing on rote learning rather than critical thinking or up-to-date technology skills. Some states in the region, such as the UAE, have tried to teach students information-technology skills from an early age. However, the rapid pace of new developments in information and communications technology (ICT) presents a challenge for the education sector even in these cases.

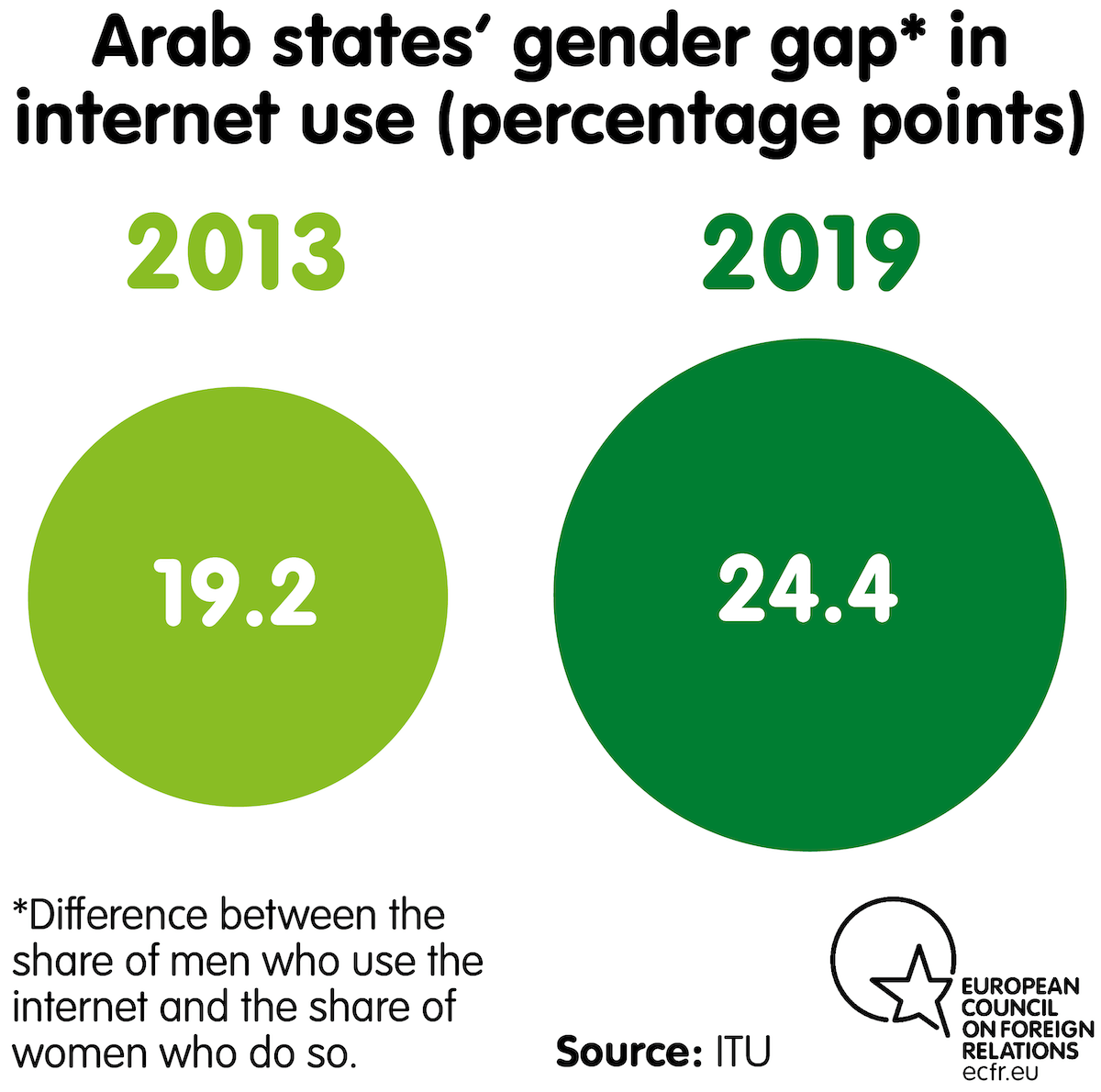

Adding to this problem is the fact that few women in the region pursue careers in science, technology, engineering, or mathematics – and that there is a growing gender gap in internet access in many countries. Moreover, while many Arab governments have made internet access more affordable, they have continued to restrict online content – through censorship and the underdevelopment of infrastructure – in ways that reduce the potential benefits of digitisation.[8]

The Middle East and North Africa’s relative lack of infrastructure – as reflected in its insufficient number of internet exchange points (IXPs) – is also a factor. These points increase the speed of the internet, thereby supporting 5G and the internet of things. As such, the shortage of IXPs both forces much internet traffic originating in the Arab world to travel through other regions and makes it easier for authoritarian governments to turn off the internet.

Other infrastructure shortcomings, such as those that interrupt the electricity supply, also remain a problem across the region, complicating companies’ digital operations and last-mile logistics (the delivery of goods or services to their final destination). Limited access to voice over internet protocol services in many Arab countries – such as the ongoing ban on Skype and WhatsApp calls in the UAE, and temporary bans on such services in Morocco in 2016 – also raises firms’ transaction costs.

Lastly, many digitisation experts and participants in the digital economy ECFR interviewed saw regulation and its implementation as a key problem for established businesses and entrepreneurs who aim to set up new companies. Even when amenable laws are in place – as they are in, for instance, Jordan – the ways in which the authorities implement and interpret them can increase transaction costs.[9]

These challenges are compounded by public services’ lack of personnel with the knowledge to design and implement regulations capable of boosting the digital economy. Relatedly, the absence of a unified regional policy framework for regulation makes it hard for companies to operate in multiple jurisdictions at once, deterring local and foreign investors.[10]

The benefits of regional regulatory standards can be seen in, for instance, the Nordic Mobile Telephone network, whose establishment in the 1980s allowed Nokia (then Mobira) and Ericsson to sell to a unified market in Sweden, Norway, Denmark, Finland and, subsequently, Iceland. While other European countries set national regulations (as did the US and Japan), the Nordic standard paved the way for the mobile communications technology in use today.

The political impact of digitisation

As well as creating new economic opportunities for young people, digital transformation in the Arab world could have a positive political impact – by enhancing the free flow of information and creating the kind of secure direct communication channels that facilitate civic mobilisation. Growing internet access in the region can even help citizens hold their governments to account. Various online platforms have also served as hubs and meeting points for persecuted minority communities.

Similarly, by acting as public forums, digital communications tools have empowered young people and facilitated political participation. Such tools played a pivotal role in the Arab uprisings that swept the region at the beginning of the last decade, and in more recent protests such as those in Lebanon. For example, in 2011, videos and blog posts documenting Egyptian security forces’ brutal treatment of protesters helped galvanise the demonstrations that eventually led to the downfall of President Hosni Mubarak.

Beyond enabling digital communication, growing internet access has also brought about the emergence of news platforms that provide critical reporting in countries that are at war or ruled by authoritarians (or both). In Syria, a rise in internet access is linked to the spread of citizen journalism and the emergence of countless online news sites that document the crimes of the Assad regime, providing a public space in which citizens can discuss alternative political systems for the country.

The threat of digital authoritarianism

Nevertheless, governments in the Arab world broadly see the internet as a tool of surveillance rather than development, as digital rights expert Hanane Boujemi contends.[11] Some of these governments increasingly harness technology such as spyware and automated surveillance systems to monitor citizens and crack down on dissent at home and abroad. Indeed, the prospect that these governments will fully control domestic data flows has prompted Freedom House to warn of a shift towards digital authoritarianism in the region.

Authoritarian leaders’ desire to maintain control of the internet also reduces digitisation’s potential to create an entrepreneurial environment and spur economic growth.[12] China plays an important role in this. Chinese President Xi Jinping has put forward China’s governance model, including its management of the internet, as “a new option for other countries and nations that want to speed up their development while preserving their independence”. Much of this no doubt draws on Beijing’s experience of heavily controlling domestic internet usage. Researcher Tin Hinane El Kadi writes that, in North Africa, a key issue with “China’s dominance of the global communication market lies in its ability to shape the future of cyberspace governance in ways that normalize censorship and restrict freedoms.”

Arab governments have shown an interest in recreating China’s state-controlled digital environment in their own countries. Beijing hosts sessions on censorship and surveillance with media officials from states such as Egypt, Jordan, Saudi Arabia, and the UAE. In November 2017, China held a seminar on “Cyberspace Management for Officials of Countries along the Belt and Road Initiative”. According to Freedom House, these meetings have been followed by the introduction of cyber-security laws resembling those in China. In 2018, for instance, Egypt passed a controversial cyber-crime law that drew on China’s internet governance strategy. Soon after, the Egyptian authorities blocked hundreds of websites, many of them dedicated to the news.

For some Arab governments, China provides a valuable example of how to push for economic innovation while maintaining control over citizens. But it is not just China that helps create a hostile digital environment. As digital privacy expert Samuel Woodhams argues, “due to the lack of meaningful international human rights-compliant regulatory frameworks, the opaque global sale of surveillance technology has been able to flourish, resulting in significant and recurrent human rights abuses”.[13]

Firms based in the US, Israel, and various European countries – including Italy, Germany, France, and the United Kingdom – have exported surveillance technology to the Middle East and North Africa. For instance, Italian company Area began building an internet surveillance system in Syria that, according to Bloomberg, would have given the Assad regime “the power to intercept, scan and catalogue virtually every e-mail that flows through the country”. (Area abandoned the project in November 2011 under international pressure.)

Similarly, Gulf states have allegedly used software connected to the Israel-based NSO Group to spy on dissidents and critics in the Gulf, including the late Saudi journalist Jamal Khashoggi. WhatsApp has accused NSO Group of facilitating “hacking sprees” against government officials, diplomats, political dissidents, and journalists in 20 countries, including the UAE and Bahrain.

The geopolitics of digitisation

Digital transformation often intertwines with geopolitics, as the dispute over Huawei and 5G technology between China and the US shows. The Shenzhen-based company is credited with pioneering the technology behind 5G, promising fast installation times at a lower price than its European and US competitors. But companies such as Huawei and ZTE also play a vital part in China’s push to become a technology superpower. Whereas most of China’s tech companies are privately owned, they benefit from significant state support (through instruments such as loans from state-owned banks), which allows them to set relatively low prices in old and new markets.

Chinese tech supremacy in the Arab world is particularly evident in Huawei’s central role in the expansion of ICT infrastructure. As part of this effort, the firm has signed various 5G installation deals with operators across the GCC. The company’s footprint is growing as China steps up its economic involvement in the region through the expansion of the Belt and Road Initiative.[14] The project has a large digital element, with big data helping create what Xi calls a new “Digital Silk Road” for the twenty-first century.

The increasing dominance of China’s tech firms has created security concerns in Western countries, some of which warn that Beijing will use these companies’ equipment for espionage or other forms of data collection. American and EU officials have pointed to China’s National Intelligence Law from 2017, article 7 of which mandates that organisations and citizens must assist state intelligence services in their work.

In February, US National Security Advisor Robert O’Brien said the US had evidence that Huawei could secretly “access sensitive and personal information” on 5G networks. Huawei has rejected these charges. But the US has publicly pressured European countries to avoid using Chinese firms’ 5G equipment, threatening to end intelligence-sharing with them if they refuse to do so. In December, the US welcomed the European Council’s conclusion that “components critical for national security should be sourced from trustworthy parties only”.

The Trump administration has threatened to cut off intelligence-sharing with any country that uses Huawei’s 5G equipment. In January, the British government classified Huawei as a “high-risk vendor” but allowed the company to participate in the construction of the UK’s 5G network, while excluding the firm from the network’s sensitive “core” parts and limiting its share of the local 5G market to 35 percent. The US reportedly expressed its disappointment with the move, but the countries have so far averted a more serious dispute over the issue. The French government, meanwhile, has stated that it would not exclude Huawei equipment from France’s 5G network.

American officials have also reportedly warned the GCC and Jordan against what they see as the risks of using Huawei’s 5G mobile infrastructure. But Washington’s Arab allies also appear not to share its concerns about Huawei and other Chinese companies, believing that they can manage the security risk. Bahrain’s telecommunications minister told Reuters in March 2019 that Huawei met the country’s security standards.

The UAE’s push for innovation in a controlled environment

Like other GCC countries, the UAE is attempting to diversify its economy away from energy. As part of this effort, the emirate of Dubai has become the key hub for the digital economy in the region, and is aspiring to become a leader in wider digital transformation – as reflected in the fact that Careem and Souq are based there (even if some in the UAE argued that Careem could not be counted as a homegrown success, because it was not led by Emiratis).

Economic diversification is an urgent issue for GCC governments. The International Monetary Fund (IMF) warned in February 2020 that the Gulf “could exhaust its financial wealth in the next 15 years” as oil demand grew more slowly and, eventually, began to decline. (This projection was based on an oil price of $55 per barrel.)

The Emirati government launched in 2017 the UAE Strategy for the Fourth Industrial Revolution, which aims to spur innovation to strengthen the national economy and improve the wellbeing of citizens. The strategy focuses on several areas – including innovative education, the medical sector, and economic security – “by adopting digital economy and blockchain technologies”. Blockchain, which is mainly known for enabling cryptocurrencies such as Bitcoin, is a technology used to store digital transactions in a decentralised manner.

In 2017 the Dubai International Financial Centre set up the FinTech Hive, a regional initiative that provides funding, co-working spaces, and regulatory support to firms. In August 2019, five fintech startups completed a joint programme with Emirates NBD, using the bank’s regulatory sandbox.

People who work in the digital space in the UAE have identified various challenges for technology startups in Dubai. These include the high cost of living and of renting offices. In addition, as Fadi Ghandour, chairman of Wamda Group, notes: despite progress in setting up “hard” infrastructure, there is still a need for “soft” infrastructure – the legal and regulatory framework that helps entrepreneurs set up and run a business, covering issues such as insolvency and access to bank accounts.

The Emirati government has tackled some of these challenges: it has made an effort to improve the business environment, including through significant investments to boost entrepreneurship, five-year visas for entrepreneurs, and permits for foreigners to fully own UAE-based businesses. In September 2019, Dubai also launched a “virtual company licence”, which allows entrepreneurs, investors, and freelancers to conduct business in Dubai without residency. The Emirati authorities have made longer-term visas particularly available to those in technology-related roles, according to the Dubai Chamber of Commerce and Industry.

In November 2019, the UAE also passed a new insolvency law that applies to individuals. The law decriminalises financial obligations and allows for the repayment of debt through a court-approved plan.

This digitisation drive extends to the public sector. Both Dubai and Abu Dhabi have used digital technology to launch smart city initiatives – which, in the former case, allows citizens to access several kinds of public services via smartphone. The Dubai government even plans to eliminate all paperwork by 2021.

A key element of the UAE’s digitisation efforts is the rollout of 5G technology with the assistance of companies such as Huawei, Ericsson, and Nokia. These service providers plan to extend the 5G network across the UAE’s densely populated areas in the next two years.

Meanwhile, the UAE’s Fourth Industrial Revolution Strategy calls for the creation of a national talent pool of scientists and entrepreneurs. And, in 2017, Sheikh Mohammed bin Rashid Al Maktoum, Emirati prime minister and the ruler of Dubai, launched the “One Million Arab Coders” initiative, which provides free programmes that train citizens to code (in the hope that they will use this skill in the labour market). In February, the UAE hosted its third hackathon, using data to develop innovative ways to enhance citizens’ wellbeing.

In the lead-up to Dubai’s Expo 2020, consultancy firm Accenture will provide 2,020 hours of coding tutorials in Emirati primary schools. In addition, the world’s first graduate university focused on AI will open in Abu Dhabi’s Masdar City in 2020. Through the Mohammed Bin Rashid Space Centre, the UAE has also worked on the Emirates Mars Mission in collaboration with the University of Colorado, Arizona State University, and the University of California, Berkeley. (The programme’s exploration probe is set to enter Mars’s orbit by 2021.)

Dubai also hosts the Centre for the Fourth Industrial Revolution UAE, a project it launched in partnership with the World Economic Forum. The facility focuses on precision medicine, AI and machine learning, and blockchain.

Strengthened ties with China

The UAE continues to be a major political, economic, and military ally of Western countries, particularly the US, France, and the UK. However, in 2019, the Emirati government significantly strengthened its relationship with Beijing, which sees the UAE as providing crucial links to Africa and Europe within the Belt and Road Initiative. From an Emirati perspective, improved ties with China form part of a strategy to reduce reliance on the US, with a focus on economic matters. Despite this shift, the UAE is unlikely to draw so close to China as to jeopardise its relationship with the US.[15]

Nevertheless, the flurry of agreements that China and the UAE have signed in the last year have deepened cooperation between Chinese and Emirati companies, including in the technology realm. For example, in July 2019, the UAE and China signed 16 memorandums of understanding, including a scientific and technological one that focused on AI.

Meanwhile, Emirati officials and companies have downplayed American concerns about Huawei. The chief technology officer of Emirati telecommunications company du told Reuters that it partnered with Huawei (and Nokia) in rolling out the 5G network, adding that “we have not seen any evidence that there are security holes specifically in 5G”.

Human rights concerns

The UAE has allegedly used products supplied by NSO Group – including “lawful intercept” spyware Pegasus – Munich-based FinFisher, and Italy’s Hacking Team to monitor human rights activists, journalists, and political rivals. The Citizen Lab, a Toronto-based research organisation that focuses on digital threats, concluded that Emirati human rights activist Ahmed Mansoor was targeted with spyware connected to the NSO Group. The UAE reportedly used the firm’s software to monitor communications between members of the Qatari royal family. And the country reportedly used hacking tool Karma as part of clandestine surveillance project Raven, hiring former US intelligence officers to carry out surveillance on human rights activists, journalists, and political rivals.

More broadly, the Emirati government’s large-scale use of AI-supported facial recognition software as part of its Oyoon (Eyes) project raises concerns about personal privacy. In 2018 Dubai’s large-scale biometric surveillance programme assisted in the arrest of 319 suspects, according to a local police official. Dubai police officers claim that AI enables surveillance cameras to analyse live video without human intervention. The UAE’s minister of state for AI argued in May 2019 that the country did not use such technology “for the sake of surveillance. We’re going to do it if there is a way for us to become the safest city on earth.”

Therefore, a controlled environment such as the UAE’s can make it difficult for the government to reap all the economic and civic benefits of digitisation. The same is true for digital entrepreneurship.

Jordan’s troubled economy

Job creation presents an urgent challenge for Jordan, with unemployment at around 37 percent among Jordanians aged 15-24 in 2019. Nevertheless, the country is widely seen as having a significant pool of talent in the digital and engineering sectors. In this context, the Hashemite kingdom – which has limited hydrocarbon resources and officially hosts more than 745,000 refugees, most of them from Syria and Iraq – has been one of the Arab world’s early movers in creating a digital and startup economy. The Oasis500 business accelerator, which King Abdullah II established in 2010 to support tech and creative startups, was the first of its kind in the Arab world.

In 2016 Jordan published a comprehensive digital economy strategy, Reach 2025, and committed to the World Economic Forum’s Internet for All Initiative a year later. Reach 2025 is designed to create “a digital economy that empowers people, sectors and businesses to raise productivity and ensure growth and prosperity”. The government has also made an effort to establish Jordan as a fintech centre, with a specific focus on backing startups and providing economic opportunities for young people. This led to the creation of a regulatory sandbox to test new fintech ideas. The University of Jordan’s Innovation and Entrepreneurship Centre has also started to hold hackathons to spur innovation.

However, the digital economy currently accounts for only around 3 percent of Jordanian GDP.[16] Reach 2025 aims to create 130,000-150,000 additional digital economy jobs over ten years. According to projections, most of these jobs will be in existing companies, but some will be in startups. The strategy aims to increase annual GDP growth by 3-4 percent by 2025. Jordan is also in discussions with service providers Zain, Orange, and Umniah to prepare for the introduction of 5G into the local market.

In the World Bank’s analysis of network readiness, Jordan receives a high score on its political and regulatory environment – due to its open telecommunications market and independent regulator, the Telecommunications Regulatory Commission – as well as government usage of technology. But the country lags behind some of its neighbours on fixed broadband infrastructure and individual internet usage. As a study by the German Society for International Cooperation argues, “because Jordan is not a highly industrialised country, ICT adoption is unlikely to contribute to unemployment, because technology will not replace jobs. On the contrary, Jordan’s economy is predominantly service-based and as such, ICT is likely to increase job opportunities.”

Acute challenges

Jordan has supported the digital transformation process by setting up a range of business incubators and accelerators. And it has also benefited from what the World Bank describes as a coherent digital strategy. Yet several obstacles remain.

Most of Jordan’s digital economic activity is concentrated in the capital, Amman – despite government initiatives designed to reach out to other governorates. Another challenge relates to the volatile regulatory environment caused by frequent changes in government.[17] Issues relating to the country’s insolvency law and slow business registration processes have deterred would-be entrepreneurs from setting up companies in the country, as has limited access to finance at an early stage.[18] More broadly, foreign direct investment in Jordan fell by 52.6 percent to $958.5m between 2017 and 2018 (following widespread protests in mid-2018), and experienced another decline in the first quarter of 2019, due to a drop in investments in the energy sector – but the IMF projects that it will grow again between 2019 and 2024.

Another challenge lies in the size of Jordan’s population. As the country has around 10m inhabitants, Jordanian companies have only a small domestic consumer market in which they can grow. Jordan’s startups have been forced to expand into neighbouring countries such as Iraq, with which it has increasing economic ties. Many Jordanian startups have moved their head offices to Dubai, while keeping their technology support units in Jordan.[19] Equally, as Gharaibeh points out, the Jordanian government hopes to persuade European companies to set up their back offices in Jordan and invest in the country.

However, for now, a lack of employment opportunities in the domestic technology sector has pushed many Jordanian experts to look for work abroad. While Jordan has not experienced brain drain on a very large scale, the departure of key technology leaders has had a qualitative effect on innovation.[20]

A related issue is the education sector’s capacity to produce graduates with the appropriate skills. The authors of Reach 2025 acknowledge that there are still “barriers to overcome with regard to higher education modernization, in particular curriculum relevance to the industry, and modes of cooperation between university and industry.” As part of this effort, Jordan signed in April 2019 a memorandum of understanding with Huawei to establish three ICT academies in Jordan. Each academy will train 3,000 students and public employees. Gharaibeh also aims to expand the World Bank’s “upskilling” programme over the next five years, to provide Jordanians with the training they need to compete in the digital economy.

Another challenge is, as noted by one international donor, resistance to digitisation from bureaucrats who fear that this would mean greater scrutiny and accountability. The same source added that, with the Jordanian state continuing to monitor online communication and media, there has been “little progress towards guaranteeing data protection”.

Relations with the US and the EU

Due to its dependence on US support, Jordan has been relatively careful about using Chinese technology.[21] This is why the country is unlikely to follow the UAE in significantly strengthening its relationship with China. Nevertheless, Gharaibeh describes concerns about Huawei’s data security as being mainly an American issue.[22]

Jordan also has a close relationship with the EU, which extends to support for the country’s digital transformation process. For instance, the EU funds Luminus Shamal Start, a business accelerator in northern Jordan that aims to support entrepreneurs in this marginalised part of the country, with a focus on the manufacturing sector.

Meanwhile, Amman is pushing the EU to shoulder more of the cost of hosting Syrian refugees in Jordan, arguing that this would free up resources needed to push for digital transformation.[23] A European Commission source claimed in November that Jordan still needed to put forward its funding priorities for 2020 (in the past, such priorities have not included the digital sector). This could mean that Jordan will gain access to new funding to support its digitisation drive at some point in the year.

The EU’s digitisation strategy

In 2019 digital and technological sovereignty became a priority for the European Commission for the first time. As one EU official points out, “digital is not avoidable whether one likes it or not. It’s either you’re in or you’re dead.”[24]

The European Commission’s president, Ursula von der Leyen, has put Margrethe Vestager, executive vice-president of the body, in charge of the EU’s digital portfolio. Vestager has a mandate to turn the bloc into a “big player” in the global tech sector. Von der Leyen has charged Thierry Breton, commissioner for internal market and services, with “investing in the next frontier of technologies, such as blockchain, high-performance computing, algorithms, and data-sharing and data usage tools” and “defining standards for 5G networks and new-generation technologies”.

The EU’s new strategy for data and AI, which Vestager presented on 19 February 2020, has three main objectives in establishing Europe as a “trusted digital leader”: technology that works for people; a fair and competitive economy; and an open, democratic, and sustainable society. The EU wants to export “its way of managing the digital transformation so it works to the benefit of all, in line with our European values”. The bloc aims to create a single market for data in which non-personal information flows freely between EU countries, to harness the power of big data. This could increase the productivity of factories and the efficiency of agriculture.

Digital issues have also become increasingly important to the EU’s trade deals, such as those with Japan and Mercosur. As part of these agreements, the EU seeks to promote its “model of a safe and open global internet”. A key element of the international dimension of the EU’s plans is its Global Digital Cooperation Strategy, which it is set to launch in 2021. The strategy “will put forward a new approach to digital transformation that projects European values onto the international stage”. According to official documents, the strategy will support the EU’s work in Africa and elsewhere in line with the United Nations’ Sustainable Development Goals.

The EU engages with Algeria, Egypt, Jordan, Lebanon, Libya, Morocco, Palestine, and Tunisia on digital issues through the European Neighbourhood Policy and the Union for the Mediterranean (which also includes Mauritania). The Union for the Mediterranean has set up a digital economy and internet access expert working group to identify ways to deepen cooperation between the parties. This year, the organisation plans to release several digital strategy documents, including those on an instrument for foreign subsidies and on standardisation.

The new digital strategy follows the launch in 2015 of the EU’s digital single market strategy, which is designed to increase opportunities for people and businesses, and to promote economic growth by supporting technology training and high-performance computing. As part of this, the EU adopted in 2016 the General Data Protection Regulation (GDPR), which gives its citizens greater control over their data. As it applies to non-European organisations that provide services and goods within the EU, the regulation furthers Europe’s efforts to become a global leader in digital regulation.

There has been only limited progress on strengthening the EU’s export control regime for cyber-surveillance technology. Yet there have been discussions between the European Parliament, the European Commission, and European Council about including more cyber-surveillance products in the EU’s export control regime for dual-use technology.

Currently, the EU updates its export control list based on information gathered under international agreements, such as the Wassenaar Arrangement on dual-use goods and technology. The latest update to the list, published in December 2019, includes references to cyber-surveillance technology such as “intrusion software”. Suppliers cannot export dual-use goods if they know they may be employed “in connection with a violation of human rights, democratic principles or freedom of speech”.

The European Parliament, the European Commission, and civil society groups are pushing for the establishment of an autonomous EU export control list that would go beyond existing international agreements. The European Parliament also wants to attach stricter conditions, including privacy rights, to national export control decisions.

However, there are significant differences between the European Parliament, the Commission, and the Council on the issues. For instance, the Czech Republic, Cyprus, Estonia, Finland, Ireland, Italy, Poland, and Sweden stated in 2018 that establishing an autonomous EU list undermined the competitiveness of European industry and deviated from existing international control regimes.

In February 2019, the European Parliament used a resolution on women’s rights campaigners in Saudi Arabia to call for an arms embargo on the country. The resolution highlighted some of the ways in which dual-use technology can be used for repression.

Digital transformation as foreign policy tool

The EU prioritises digital technology in its international development policy – as reflected in its work to create a Global Digital Cooperation Strategy and that with the Union for the Mediterranean. However, as specific support for digitisation is a relatively new part of the EU’s foreign policy, the bloc has only funded a small number of digital projects so far.

The EU launched Digital4Development in 2017 as a collaboration between the Commission’s Directorate-General Connect (which is responsible for digital matters) and Directorate-General Devco (which oversees international cooperation and development). The new approach aims to integrate digital technologies and services into the EU’s wider development policies, focusing on issues such as skills, entrepreneurship, and broadband connectivity in government, education, agriculture, and other areas. The EU sees the Digital4Development framework as crucial to achieving the Sustainable Development Goals by 2030.

In April 2019, the Commission hosted the Digi4Med conference in Brussels, describing the event as “the first step towards developing a connectivity and data strategy for the Southern Mediterranean countries”. The conference identified several types of cooperation within the southern Mediterranean region: regulatory harmonisation, the transfer of best practice, capacity-building, and infrastructure investment.

The European Commission plans to give the European Bank for Reconstruction and Development and European Investment Bank €4m in technical assistance, and €74m for a digital transformation and a broadband investment programme, in 2020. It hopes this will lead to €350m in guarantees for banks in the southern Mediterranean region. According to one source at the Commission, this programme is designed to reduce the financial risks for these banks, prompting them to lend more money to domestic firms.

The EU has used the Technical Assistance and Information Exchange (TAIEX) to support countries such as Algeria, Egypt, Jordan, Lebanon, Libya, Morocco, Palestine, Syria, and Tunisia. The instrument’s ICT work has focused on, for instance, electronic communication and broadband infrastructure. Such assistance sometimes takes the form of workshops hosted by European experts or study visits to EU member states by representatives of beneficiary countries.

Various EU member states have also provided targeted support to digitisation and training efforts that help people find employment. To increase job opportunities in Palestine, the German Society for International Cooperation supported in 2015 the introduction of a dual study programme, which covered information technology, at Al-Quds University in Jerusalem. The organisation also funds a tech and entrepreneurship hub in the Iraqi city of Sulaymaniyah, which aims to build a nationwide ecosystem for entrepreneurs. The German government’s engagement with the Arab world is partly guided by its 2014-2022 special initiative on stability and development in the Middle East and North Africa, which focuses on projects relating to youth unemployment, economic development, democratisation, and the stabilisation of countries in crisis.

Such efforts increasingly intertwine with the EU’s work on protecting human rights. In December 2019, EU foreign ministers agreed to set up a sanctions regime modelled on the US Global Magnitsky Act, with EU High Representative for Foreign Affairs and Security Policy Josep Borrell describing human rights as a “clear priority for Europeans”. The EU has also used its trading power to address human rights concerns. For example, in February 2020, the European Commission announced its plans to levy sanctions on Cambodia over the government’s human rights violations. The measures, which involve the withdrawal of preferential tariffs, are likely to be implemented in 2020 (unless the European Parliament or member states raise objections).

Sweden has stressed in the UN Human Rights Council that human rights apply to the internet in areas such as data protection. There is also momentum within the European Parliament and the European Commission for legislation on mandatory due diligence on human rights, which would place greater responsibility on European companies. Indeed, a European Commission study published in January 2020 found that there was a need, and widespread support, for such legislation.

Recommendations

The EU’s support for digital transformation in the Arab world goes hand in hand with the new agenda of the European Commission. It also complements various strands of the foreign policy of the bloc and its member states, including those focused on stabilisation and conflict prevention in the Middle East and North Africa.

European countries that have long supported economic development in the Arab world, such as Germany and France, should expand their existing work on digitisation. They could do so by, for example, funding training centres that provide digital skills to citizens in the region or set up a fund for digital innovation projects. The German Society for International Cooperation should adapt its support for the dual study programme in Jerusalem to other parts of the region, including by providing courses specifically designed for refugees and internally displaced persons.

It is in the EU’s interest to develop the digital economies of Arab countries, especially given their potential to boost regional employment rates, improve socio-economic stability, and reduce the incentives for people to migrate to Europe. A more productive digital ecosystem could encourage circular migration to the Middle East and North Africa by young, tech-savvy Arabs who currently work in Europe, enabling them to contribute to the Arab world’s digital transformation. And, as noted by Alida Vracic in an ECFR policy brief on brain drain in the Western Balkans, the EU can benefit from promoting circular migration. Europe’s support for digitisation also aligns with that for democratisation and political empowerment in the Arab world (with the caveats discussed above).

In many ways, the EU and its member states can play a crucial role in digital transformation in the region, building on their existing initiatives to support economic development and empower young people. The following recommendations, which align with the new European Commission’s prioritisation of digital issues, fall into three broad categories: regulations; capacity-building and vocational training; and funding.

The EU’s regulatory power

The global battle for technological dominance is partly a battle to set international standards. At the heart of this lies the issue of how tightly governments in the Arab world control the development of cyberspace and, just as crucially, which international players will assist them in the task. In this context, China’s involvement in 5G is a particular concern, given the threat the country poses to the ideals of net neutrality and digital rights.

The EU has an important role to play in offsetting some of the negative dynamics that could affect digitisation in the Arab world in the coming years. In this, the bloc should make use of its international credibility as a leader in setting regulatory standards and best practice.

The EU should use its pioneering work on technology regulation (in areas such as data privacy) to engage with governments in the region, constructing policy frameworks and passing laws that help the digital economy thrive. The EU and its member states can provide technical assistance in drafting legislation and training public servants. Drawing on the success of countries such as Estonia – which has made 99 percent of its government services available online – they can also help Arab leaders strengthen their e-government services. However, to fulfil this role, the EU and its member states need to begin to catch up with the US and China in technology investment, innovation, and talent retention.

Targeted funding and vocational training

By increasing its focus on digital transformation, Europe can enhance its programmes designed to empower young people in the Arab world – who are set to be the main beneficiaries of the shift. And, by helping create employment opportunities in the region, Europe can reverse some of the brain drain from non-GCC countries and help create knowledge-based economies there.

The EU and its member states can play a decisive role in supporting digital capacity-building activities in the Middle East and North Africa. This can involve establishing or financially supporting workshops and training centres in which information-technology practitioners provide citizens (including the unemployed) with up-to-date skills. The EU can also organise business exchange programmes with countries in the Arab world, to facilitate the transfer of knowledge.

As part of its new digital strategy, the EU should connect knowledge hubs in Europe with those in the Middle East and North Africa. The bloc could model this on its Africa-Europe Innovation Partnership.

The EU should also consider increasing its support for the Centres of Excellence for High Performance Computing in Barcelona and Bologna, which have stated their willingness “to extend expertise and capacity” to countries in the southern Mediterranean region. More broadly, research facilities supported by EU funding could host capacity-building workshops and share best practice with researchers and practitioners in the Arab world, including government officials, academics, tech workers, and civil society groups.

European governments should also expand TAIEX assistance to help Arab countries share best practice and implement European regulations such as the GDPR. This could help these countries create coherent digital policy frameworks and strengthen their digital economies.

The EU and its member states should set up mechanisms to provide financial support to underfunded digital businesses in the region, particularly those that aim to have a social impact by supporting disadvantaged communities, or that are located in marginalised areas. This would complement the EU’s work to empower women and young men through job creation. Equally, the EU should continue to explore opportunities for co-funding mechanisms with development institutions in the Middle East and North Africa, such as the Islamic Development Bank.

The EU can also complement its work to support marginalised people, including refugees and IDPs, by financing local initiatives that teach digital skills in their communities. Donors need to make a greater effort to ensure that they are not competing against one another but rather coordinating and streamlining their work in consultation with these people.

Protection of human rights

Efforts to uphold human rights should be key to European support for digitisation efforts in the Arab world. Building on its attempts to establish a human-rights sanctions regime modelled on the Global Magnitsky Act, the EU should use its influence as a major donor in the Arab world to protect human rights standards through digital transformation. This should extend to regulation, on which the EU can use its expertise and political leverage to ensure that governments enshrine human rights and data protection in law.

To prevent egregious human rights violations, the EU could condition trade, aid, and investment on Arab governments’ attempts to protect human rights. The bloc’s planned withdrawal of Cambodia’s preferential tariffs could serve as a model in this.

European countries should also try to halt the spread of China’s internet governance model to the Arab world. They should increase their engagement with policymakers in the region, aiming to emphasise the benefits of a policy framework and a set of regulations that guarantee the free flow of information and support the internet’s role in socio-economic development. In this way, the EU could use its position as a regulatory superpower to export its values through digitisation.

Such efforts align with the EU’s broader promotion of human rights and democratisation in the Arab world. The EU-China summit planned for late 2020 presents a prime opportunity for the EU and its member states to highlight their concerns about internet freedom in China and the Arab world.

Export controls

The EU should also devise a coherent strategy to prevent European tech companies from supporting authoritarianism, and even facilitating grave breaches of human rights, in the Arab world. At a minimum, the bloc should implement legislation on mandatory human rights due diligence.

In the aftermath of reported efforts to hack the devices of various human rights defenders in the Arab world and Amazon founder Jeff Bezos, the EU should ensure that European companies involved in the export of surveillance technology fall under more stringent export controls. Backed by the European Commission, the European Parliament, and member states, the EU should update regulation covering export controls on dual-use goods and technology to reflect recent developments in cyber-surveillance.

The EU should agree to create an autonomous list of dual-use items subject to export controls, thereby taking a more active role on the issue rather than relying on international agreements. This list should use a broad definition of human rights – including those in data privacy and freedom of assembly – to justify export control decisions, going beyond grave violations of international humanitarian law. The EU should also lead discussions on these issues with member states, which are the ultimate decision-makers on export controls.

It is vital that, as they implement a new digitisation strategy, the EU and its member states increase their support for digital transformation in the Arab world. While digitisation is not a remedy for all the region’s ills, it can – with the right support – help provide a bright future to the young people who live there. For the EU, digital transformation opens new avenues to promote economic development, stabilisation, and the empowerment of young people in the Arab world. At the same, the bloc must remain vigilant against the misuse of new technology at home and abroad.

Acknowledgements

The author would particularly like to thank Hugh Lovatt for his guidance and feedback throughout the project. The author would also like to thank Julien Barnes-Dacey and Ellie Geranmayeh for their invaluable input in shaping the final paper. Dozens of people in the Middle East, North Africa, and Europe have shared their valuable insights on this topic. This paper would not have been possible without them.

About the author

Manuel Langendorf is a visiting fellow at the European Council on Foreign Relations, where he works on digitisation and the digital economy in the Middle East – with a special focus on the United Arab Emirates and Jordan – as well as Europe’s interests in the issue. His other research interests include Iraq, Israel-Palestine, and Yemen.

Langendorf has been a frequent contributor to The Arab Weekly and other media outlets focusing on the Middle East. He was the editor-in-chief of The World Weekly, an award-winning international news magazine. He has commented numerous times on Middle Eastern affairs for broadcast media. He holds an MSc in international politics from the School of Oriental and African Studies in London.

[1] Interview with Philip Bahoshy of MAGNiTT, Dubai, 7 October 2019.

[2] Interview with Riyad Abou Jaoudeh of Middle East Venture Partners (speaking in a personal capacity), 12 November 2019.

[3] Interview with Mothanna Gharaibeh, Amman, 19 November 2019.

[4] Regional sandbox initiatives have also been launched in Dubai, Abu Dhabi, and Saudi Arabia.

[5] Interview with Rose Murad of Bahrain FinTech Bay, 28 October 2019.

[6] Interview with Rose Murad, 28 October 2019.

[7] Interview with Jason Gasper of Razr Lab, 16 October 2019.

[8] Interview with Tom Fletcher, 11 December 2019.

[9] Interview with Laith al-Qasem of ISSF, 25 November 2019.

[10] Interview with Philip Bahoshy, Dubai, 7 October 2019.

[11] Interview with Hanane Boujemi of Tech Policy Tank, 11 November 2019.

[12] Interview with Andrew Puddephatt of Global Partners Digital, 30 January 2020.

[13] Interview with Samuel Woodhams of Top10VPN, 3 December 2019.

[14] Interview with Sara Hsu of the State University of New York at New Paltz, 30 October 2019.

[15] Interview with Sheikha Najla al-Qasemi of the Dubai Public Policy Center, 6 January 2020.

[16] Interview with Mothanna Gharaibeh, Amman, 19 November 2019. The GDP estimate excluded people driving for Uber, according to the minister.

[17] Interviews in Amman, November 2019.

[18] Interview with Manaf Asfour of Propeller, Amman, 20 November 2019.

[19] Interview with Mohammed Salah of Startup Grind, Amman, 19 November 2019.

[20] Interview with Manaf Asfour, Amman, 20 November 2019.

[21] Interview with an employee of an international donor.

[22] Interview with Mothanna Gharaibeh, Amman, 19 November 2019.

[23] Interview with Mothanna Gharaibeh, Amman, 19 November 2019.

[24] Interview with Gerard Galler of Directorate-General for Communications Networks, Content and Technology, 20 October 2019.

The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of their individual authors.