The West’s Chinese crossroads

Against the backdrop of the US-China rivalry, it is tempting to ignore recent strategy changes by smaller players like Canada and Hungary. But these two countries offer radically different models for other countries to consider as they navigate an increasingly fraught geopolitical terrain

Last month, Canada suddenly announced that it was freezing all ties with the Asian Infrastructure Investment Bank, a multilateral lender created by China as an alternative to the World Bank. According to Canada’s finance minister, Chrystia Freeland, the decision comes in response to allegations that the Chinese government has stacked the institution with Communist Party of China officials who “operate like an internal secret police.”

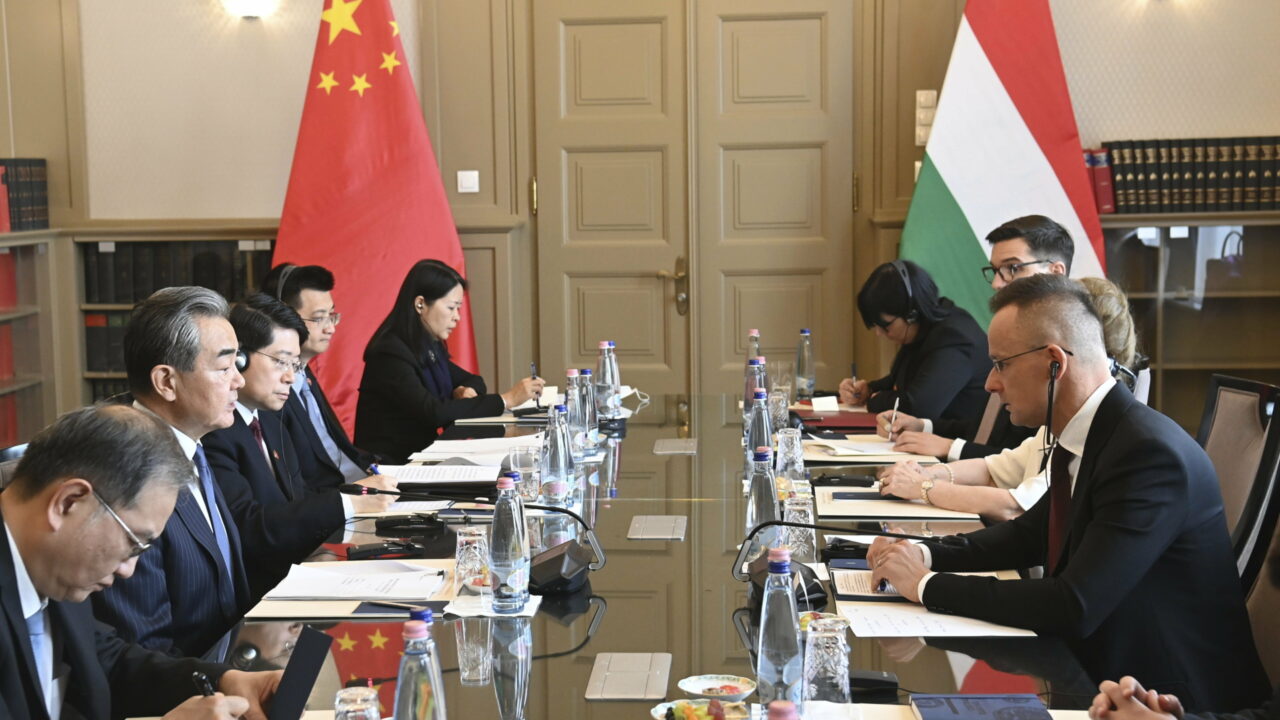

Then, just days later, Hungarian Foreign Minister Peter Szijjarto announced that the Chinese company Huayou Cobalt would site its first European factory in Hungary, in the small village of Acs, where it will produce cathode materials for electric-vehicle batteries.

Against the backdrop of the US-China rivalry, it is easy to dismiss these two headlines as trivial. But Canada and Hungary’s leanings are highly relevant to this bigger geopolitical story. While decision-making in Washington and Beijing obviously matters, these strategic bets by smaller countries offer equally important insights into the future of globalisation.

While decision-making in Washington and Beijing obviously matters, these strategic bets by smaller countries offer equally important insights into the future of globalisation

Canada and Hungary are among NATO’s less populous member states. And with each undergoing a fundamental change to its strategic outlook, the two countries are somewhat unexpectedly beginning to trade places. Five years ago, Hungary was the poster child of nationalism, and Canada a paragon of free-trading globalisation. But now, Hungarian prime minister Viktor Orban and his political director, Balazs Orban (no relation), are betting on a strategy of economic connectivity, whereas Canada is heading in the opposite direction.

Faced with all the talk of protectionism, decoupling, and China’s notion of economically self-sufficient “dual circulation,” Balazs contends that, “If the fragmented, bloc-based international order of the cold war era is restored, it will threaten Hungary’s international relations and trade status.” For a country whose economic model relies on trade with both Germany and China, and on oil and gas from Russia, decoupling is bad news. Thus, the ‘Orban doctrine’ is about finding a sweet spot between China and the United States, rather than choosing one over the other.

Canada, on the other hand, used to be a standard bearer for multilateralism and the liberal international order. But it now seems to have abandoned the idea of a universalist order in favour of one that excludes states motivated by values that depart from its own. The most articulate exponent of this strategy is Freeland, the dazzling journalist-turned-deputy prime minister and finance minister in Prime Minister Justin Trudeau’s government. While US secretary of the treasury Janet L. Yellen coined the term ‘friend-shoring’ to describe the privileging of trade relations with countries that hold similar values, Freeland has taken the concept much further, advocating not just deeper economic relations with likeminded countries, but closer social and political ties as well.

According to the ‘Freeland Doctrine,’ the West should no longer be devoting time and energy to slowing the unravelling of the geopolitical era that began after the cold war. Instead, it should start severing ties with autocracies and concentrating more on forming smaller likeminded groupings such as the G7.

This is not just empty talk. Both Hungary and Canada have already started implementing their new agendas. In addition to approving the Huayou factory, Hungary has also greenlit the Chinese company CATL’s plan to build what will be the biggest battery plant in Europe. In doing so, it is making a big bet on the future of China’s economic relations with the European Union.

Of course, Canada and Hungary have very little influence on the shape of the global order. But when it comes to reacting to the structural changes that are underway, they have given other smaller and midsize countries two radically different models to consider. The extent to which one proves more attractive than the other will have far-reaching implications.

One of the biggest question marks hangs over the rest of the EU, with its population of nearly 500 million and combined GDP of $16 trillion. Germany, especially, will have to make strategic choices that will inevitably pull the rest of the bloc along with it.

There were high hopes that Germany’s eagerly anticipated China strategy, published earlier this month, would provide some clues as to whether it is heading down the Canadian or the Hungarian path. Yet the months-long drafting process culminated in a document that tries to have it both ways, embracing Freeland’s grammar and Orban’s logic.

The German strategy begins with the clear-eyed observation that “China has changed,” and that “de-risking is urgently needed.” Yet it stops far short of advocating decoupling, and it leaves it to German companies – with their deep economic interests in China – to decide how much de-risking is appropriate. This is quite a departure from an earlier draft of the strategy, which had envisioned “stress tests” on German companies present in China, and which would have required German businesses to “specify and summarise [their] China-related developments.” This is no small matter, considering that just four German companies – Mercedes-Benz, BMW, Volkswagen, and BASF – accounted for 34 per cent of all European investment in China between 2018 and 2021.

Notwithstanding the new strategy document, German politics remains divided between the two different persuasions. Events in both China and the US will undoubtedly bear on the debate and help to determine which faction wins out. The stakes are high, because where Germany goes, the rest of Europe often follows. While its ambivalent rhetoric tells us very little, its policy decisions will tell us everything. We will soon know which path it has chosen.

This article was first published in Project Syndicate on 28 July 2023.

The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of their individual authors.