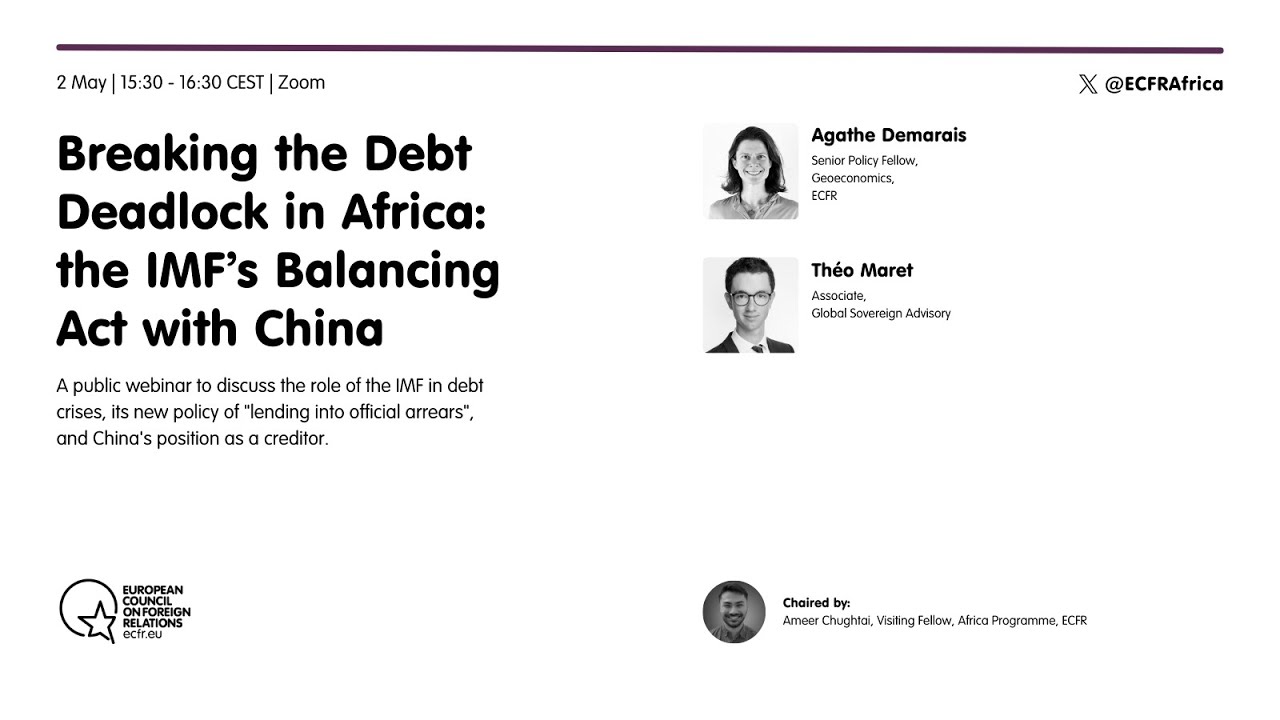

Breaking the Debt Deadlock in Africa: the IMF’s Balancing Act with China

Guests

- Agathe Demarais, Senior Policy Fellow, Geoeconomics, ECFR

- Théo Maret, Associate, Global Sovereign Advisory

Chaired by

Ameer Chughtai, Visiting Fellow, Africa Programme, ECFR

The economic shock after COVID-19 plunged many African economies into debt trouble. Yet, four years later, the current system for restructuring debts – the G20 Common Framework – has struggled to support African economies in making their debts sustainable. A key block in these talks has been China. Chinese development banks have largely refused to take losses on their loans, making reaching an agreement difficult.

At the recent Spring Meetings, the IMF brought forward a potentially radical proposal to break the deadlock: to leave China out of debt restructuring deals. By adjusting the policy of “lending into official arrears” (LIOA), the IMF could support a partial debt restructuring agreement and freeze out China. At face value, the new policy could be a way out for African economies in debt trouble. However, in the immediate aftermath of the announcement, a few questions remain unanswered: is the IMF willing to use its new tool? Will “lending into official arrears” actually move talks along? And what are the consequences of the IMF antagonising China?

This event aims to analyse the changes to the LIOA policy and their implications for debt restructuring, provide a current state of play on debt restructuring in Africa and discuss the wider political implications of the IMF proposal.