Climate superpowers: How the EU and China can compete and cooperate for a green future

Summary

- The broad notion of ‘partnership’ no longer reflects the true complexity of the EU’s interactions with China in tackling the most important global challenge.

- Instead, as climate action becomes more material to economic interests, Europe and China will both compete and cooperate with each other, against the backdrop of an overarching systemic rivalry.

- To successfully manage this new reality, the EU and its member states will have to clearly define benchmarks and red lines for credible climate action, to set the framework for cooperation.

- At the same time, they will need to invest in future competitiveness, especially in the green technology needed to compete for markets, standards, and influence in a low-carbon world.

Introduction

Over the past two years, discussion of China in Europe has changed markedly. Policymakers across the European Union have begun to describe China as simultaneously an economic competitor, a systemic rival, and a negotiating partner.

The first dimension – competition – has been in the spotlight in recent years, as China and Europe engage in an increasingly sharp struggle for market shares, resources, customers, and technological leadership. The second part of the trinity – systemic rivalry – is its most provocative one, and is a new component in the EU’s diplomatic vocabulary. But it too can be defined relatively easily: China’s authoritarian party-state, with its Leninist roots and predatory approach to capitalism, stands apart from the EU’s liberal-democratic market economy.

It is the final element in the three-part definition – the partnership dimension – whose substantive meaning has become harder to justify. This is due to China’s increasingly assertive behaviour at home and abroad. Almost as a default reaction, diplomats and policymakers reach for “climate change” when asked for examples of areas in which Europe and China remain partners. In the foreign policy community, climate diplomacy remains one of the few commonly acknowledged issues on which partnership with China is not only indispensable but also desirable and possible.

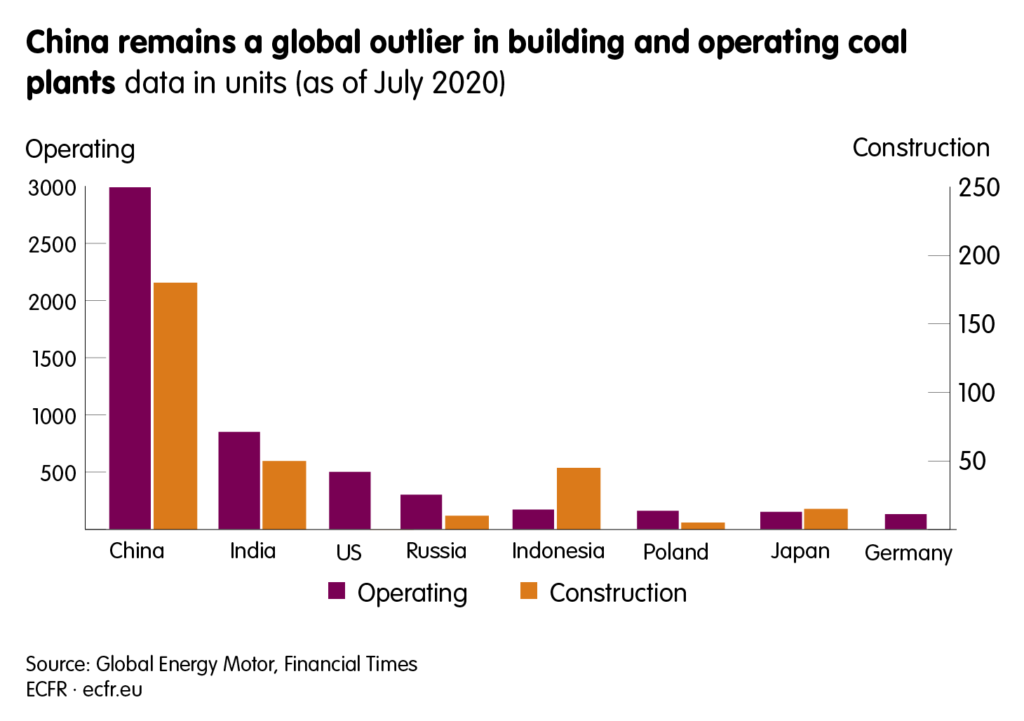

But the reality is more complicated. It is certainly true that climate action will require coordination with China, the world’s largest emitter of greenhouse gases, to protect Europe from dangerous levels of climate change. The EU cannot safeguard Europeans from the worst impacts of climate change – extreme weather events, migration crises, and supply chain shocks – without action by China to address this in a serious way. The same holds true for China, which has huge swathes of populous regions that are highly vulnerable to the impact of climate change. Globally, China accounts for 28 per cent of greenhouse gas emissions and half of coal power plants under construction. What Beijing prioritises in its covid-19 recovery plans and its upcoming five-year plan will shape global emissions for decades to come. However, as Europe’s own climate actions begin to reshape the European economy, new areas of competition with China are starting to emerge.

This paper argues that the broad notion of ‘partnership’ no longer sufficiently reflects the true complexity of the EU’s interaction with China in tackling the most important global challenge. Climate action will increasingly intersect with questions of geopolitical and geo-economic interest, particularly on trade and technology. This means that it will no longer be possible to ringfence climate policy from the broader complexity of the Europe-China relationship. This is an opportunity for a pragmatic rethink of relations between the two sides. Having acknowledged the fundamental systemic differences between it and China, Europe will increasingly have to balance the growing competitive dimension with the need to coordinate to achieve ambitious climate protection, including engaging China on the evolving rules of global competition around carbon.

The paper opens by briefly describing the changing background of EU-China relations, before examining the domestic challenges China is facing that will influence its climate policy. It identifies the competition for technologies, markets, resources, and broader geopolitical influence that Europe will need to manage in order to shape climate-relevant policy choices in third countries, as well as the areas where cooperation remains in Europe’s interest. The paper concludes with a set of concrete policy recommendations for EU action, proposing ways to manage growing competition, build alliances to deal with the broader systemic rivalry, and foster deeper cooperation when countries meet benchmarks and abide by red lines.

The changing narrative on EU-China relations

European perceptions of China

EU policymakers’ and the general public’s views of China changed markedly throughout 2020 as the coronavirus crisis unfolded. Overall, China’s standing in Europe has declined, including among ordinary citizens. Covid-19 brought several fundamental questions – about the future of Europe’s interactions with Beijing, about the character of the globalised economy, and about the vulnerability of supply chains – to the heart of member states’ domestic politics. This was likely a direct consequence of Beijing’s assertive approach to shaping the narrative on the origin of the virus, its opportunistic questioning of democracies’ ability to rein in the spread of the disease, and its promotion of its own prowess in quickly getting its economy back on track. Beijing’s imposition of national security legislation in Hong Kong in 2020, and the situation in Xinjiang, have only added to these concerns. From Europe’s point of view, this violation of fundamental human rights and international commitments does not form a convincing basis for building trust. The move further undermined Europeans’ previously held beliefs in the sincerity of Chinese support for multilateralism. Therefore, China’s engagement – not only on a bilateral level, but in multilateral forums in particular – has come under much greater scrutiny.

This development has come at a political cost for Beijing – starting at the EU-China Summit videoconference in June this year, and during the leaders’ meeting in September, which included German chancellor Angela Merkel in her role in the rotating presidency of the Council of the EU. The event was marked by a decidedly frostier atmosphere than previous meetings, by clearer demands from the EU, and by less European sympathy for Chinese preferences. However, it is not just the most recent shifts in public perceptions of China that are shaping this response. As early as 2017, European business leaders were already complaining of ‘promise fatigue’ about the prospects of China opening up its market and creating a level playing field. A similar sense of fatigue has now set in among European diplomats.

At the same time, the incoming Biden administration is injecting new energy into its transatlantic relationships; and France, Germany, and the Netherlands are at the leading edge of a growing interest in the Indo-Pacific, each having released their own strategy for the region. On the climate front, recently announced targets to achieve carbon neutrality by 2050 from South Korea and Japan are opening up new avenues for cooperation with established partners in east Asia.

China’s commitments to carbon neutrality

The Chinese leadership is acutely aware of this shift – and the climate conversation is not immune to these broader trends. The EU appeared to have won a significant victory for its climate diplomacy when, in September 2020, Xi Jinping announced at the United Nations General Assembly that China would be carbon neutral before 2060. This took place just days after European Commission president Ursula von der Leyen proposed this as a benchmark for credible Chinese climate action. The declaration created momentum for the climate conversation at a crucial juncture before the US election. It also put pressure on other countries in Asia, such as South Korea and Japan, to quickly follow suit and raise the ambition of their national climate targets – a domino effect certainly welcomed by Europeans.

Xi’s announcement was well-timed: close enough to the EU-China leaders’ meeting to give a hat-tip to European diplomacy but firmly independent on a multilateral stage, setting China in a positive light in comparison to the Trump administration.

Over the course of 2020, European diplomats had made concerted efforts to put climate on the agenda of various EU-China formats, including by creating a new high-level climate dialogue format. However, despite cautiously welcoming Xi’s announcement, Europeans remain sceptical about the sincerity of Beijing’s promise. While Xi’s message seemed tailor-made to win European hearts and minds on a topic of particular importance to voters’ interest in key EU member states, European policymakers acknowledge that it was likely also motivated by a combination of geopolitical considerations, and by a domestic industrial policy push to accelerate developments in China’s green economy sector.

And, by declaring its ambition in front of the international audience at the UN, Xi signalled on the global stage, not just vis-à-vis Europe, that China would be a force to reckon with in the domains of developing green technologies and setting environmental standards. This initially low-cost charm offensive on tackling climate change may halt the decline in EU-China relations – which is not in Beijing’s interest, especially in light of its growing rivalry with Washington. But, at the same time, the declaration also served Beijing well in drawing attention to a positive, future-orientated commitment – and away from its mishandling of the early days of the coronavirus crisis, its lack of transparency managing the health emergency in a broader context, its questionable vaccine diplomacy, and its “mask diplomacy” efforts during the height of the pandemic in Europe.

With Xi’s carbon neutrality announcement, the domestic political winds in China are likely to shift. What is happening is similar to that which occurred after his landmark 2013 Belt and Road Initiative (BRI) speech in Kazakhstan. At that time, that speech too was not accompanied by a fully-fledged strategy, and it left the Chinese bureaucracy and economy scrambling to come up with an implementation plan. It is likely that, to meet the carbon neutrality goal, China will incrementally adapt multiple strategies and policies to the decarbonisation narrative over the next few years.

Europe’s position

To date, the EU has framed its approach to climate change around shaping global norms and fostering multilateral cooperation. It has implemented some of the world’s most advanced climate policy tools, starting with the European Union Emissions Trading System and culminating in the extensive set of policies and legislative agendas underpinning the European Green Deal. With the adoption this year of the European Green Deal, climate is now firmly embedded in the EU’s new growth strategy. The EU and its member states have leveraged their climate leadership and the power of the European single market to engage with other countries on raising the ambition of their climate policies. However, with the emerging global momentum towards decarbonisation, it is no longer just about convincing others to accept the challenge but also about moving to the next stage of implementing a new global economic trajectory. European businesses and industries will increasingly compete for market shares and raw materials, and over technology standards, with other rapidly decarbonising superpowers, including China. To continue the success of its climate diplomacy, the EU needs to actively manage the competitive dimensions of climate policy across its institutions in a coordinated manner.

The European Commission, under von der Leyen’s leadership, has promised to be “geopolitical” and to adopt an approach to global affairs that is more assertive and comfortable with defending Europe’s interests, as encapsulated in the objective of European Strategic Autonomy. The European Commission and the European Parliament have said that they will remain firm on the need for a level playing field before they cement the Comprehensive Agreement on Investment with China – negotiations for which are ongoing. In recent times, the EU has more forcefully stressed its demands around sustainability and market access, which is a clear indicator of this shift. Europe has learned the lesson of its earlier naivety about economic convergence, led by the expectation that China would transform into a ‘normal’ market economy after its accession to the World Trade Organization (WTO) in 2001. The EU must be mindful to avoid repeating such mistakes when it comes to climate policy. The bloc can do so by setting clearer benchmarks for what constitutes credible Chinese action in this area.

Simultaneously, the ambitious agenda of the European Green Deal is forcing the EU to strategically embed its thinking about climate change in its industrial policy, international trading relationships, and broader foreign policy. Climate change has arrived at the heart of the EU’s policymaking. The decisions the EU takes on green growth will reveal just how geopolitically the European Commission will be willing to act. The EU’s policy choices will have an impact on how and whether European companies are able to secure their competitiveness when faced with the challenge of growing US-China rivalry, with all its negative implications for European businesses. They will also need to contend with competitors from countries that have less ambitious climate goals than the EU’s emissions reductions targets of at least 55 per cent over the next ten years. Policy choices can either put European industries at a disadvantage or boost European companies in the race for leadership on emerging clean technologies.

The changing dynamics in the relationship mean that the EU is moving towards an approach that is at once both more robust and more cautious, focusing on ‘defensive’ goals of retaining technological and industrial leadership in critical sectors. But the EU is also seeking to proactively shape the world around it according to its interests; and free, fair, and green trade is crucial to establishing a framework for an EU response to China that is more robust and embedded in new geopolitical realities. It is, therefore, important to understand what drives China’s climate policies and to outline the potential flashpoints between the EU and China as they each aim for enhanced decarbonisation.

Drivers of China’s climate policy

The Chinese leadership’s interest in addressing climate change is multifaceted. Foreign pressure and international partnership play a role in this, but domestic factors have also done much to increase the profile of climate on Beijing’s policy agenda.

International climate governance

Beijing’s approach to climate governance has evolved since the days when it acted as an primarily obstructing force in global climate governance. Its paramount planning document, the five-year plan, has contained a dedicated section on climate change since 2011. Ahead of the Paris climate talks in 2015, Beijing worked proactively with major emitters, including the United States and the EU, to align negotiating positions and pledge new emissions reduction commitments. A 2014 bilateral climate agreement between the US and China helped catalyse the ambition of the Paris Agreement.

China has actively engaged in negotiations under the United Nations Framework Convention on Climate Change (UNFCCC), the platform through which country negotiated the Paris Agreement. The UN body adopts a principle that recognises the different capacities of developing versus developed countries in addressing climate change – common but differentiated responsibilities (CBDR). China has long been very clear that it continues to regard itself as a developing country that is catching up with the Western industrialised world. Less than a decade ago, China still believed that developed countries should bear the brunt of the economic burden for addressing climate change. However, with its 2020 carbon neutrality announcement, China has set a long-term climate target on a par with that of developed countries. This signals that Beijing is placing less emphasis on the CBDR principle and now sees climate change as an opportunity in China’s economic development.

Since the beginning of the Trump administration and the US withdrawal from the Paris Agreement, China has remained committed to the international climate accord and carried on with its domestic climate policies, including through a continued push to launch a long-awaited national emissions trading scheme, reforms to sustainable finance regulations, and incentives to scale up its electric vehicle industry. By the end of 2019, China claimed that it had largely achieved the 2020 climate targets it set for itself in its last five-year plan. Based on current economic and emissions trajectories, China’s greenhouse gas emissions are expected to peak in the next five years, ahead of its 2030 targets.

Beijing is also expanding its participation in international climate governance, notably in the area of sustainable finance – it now co-chairs a working group on setting global sustainable financial standards in the EU-led International Platform on Sustainable Finance. Its public financial institutions have participated in international platforms such as the Network for Greening the Financial System to drive regulatory changes that address the climate-related systemic risk to the Chinese financial system. This is in stark contrast to the US, whose financial regulators and central bank have been absent from international forums that look at the financial risk of climate change.

Energy security

Renewable energy provides a way for China to reduce its reliance on fossil fuel imports. Energy security is the implicit but most credible driver of the country’s energy transition. China is the world’s largest oil and gas importer. More than 70 per cent of its oil is imported, an overwhelming majority of which comes through the Strait of Malacca, a geopolitical chokepoint that could be crucial in a military escalation of US-China tensions. China imports 43 per cent of its gas, about one-third of which comes through pipelines from Russia and central Asia, and two-thirds via seaborne trade with countries in the Pacific, including Australia, Malaysia, and Indonesia.

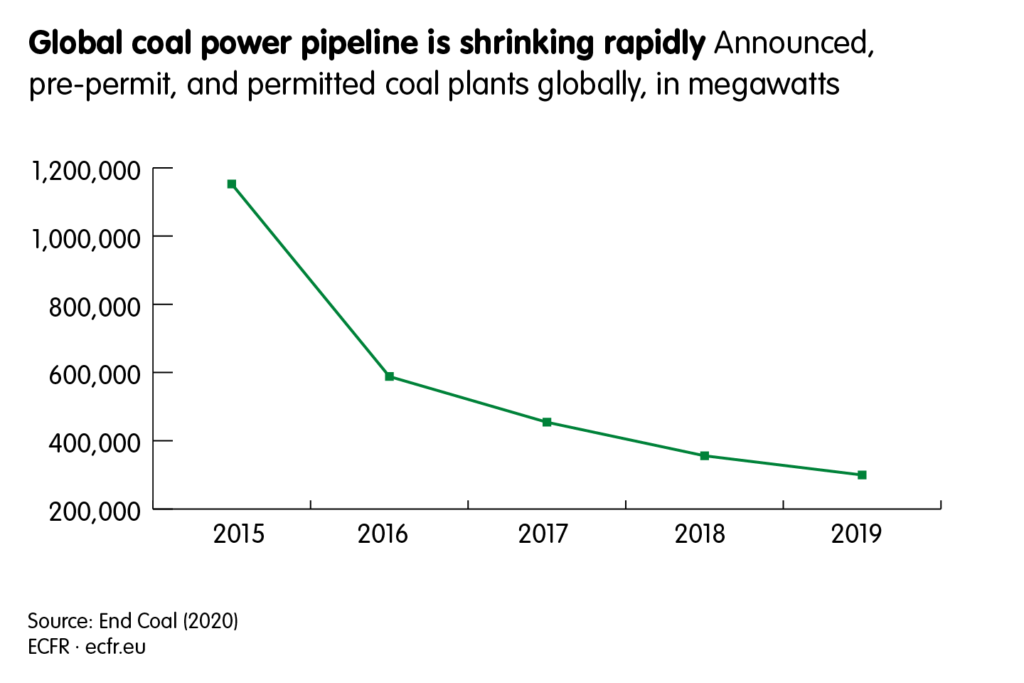

China could strengthen its energy security by doubling down on coal, an energy resource it is richly endowed with – China holds 13 per cent of global coal reserves. Fifty-eight per cent of all energy consumed in the country comes from coal. And China is still investing heavily in coal at a time when, globally, the production of new coal power plants is slowing dramatically. Half of the world’s coal plants under construction are in China. But the economics of this fossil-based power source do not work in China’s favour – it is more costly to keep running three-quarters of its existing coal power than to add new renewable energy capacity.

China is also a renewable energy superpower. It manufactures about three-quarters of the world’s solar panels and Chinese manufacturers have captured more than one-third of the global wind turbine market. The country was the largest investor in renewable energy technologies between 2010 and 2019, and is expected to account for 42 per cent of new total renewable capacity globally in 2020 – and the majority of new such capacity for the years to come.

Moreover, public opinion in China is highly sensitive to air pollution, and the cost of solar power is on the cusp of dropping below that of power generated by coal. Renewable energy is, therefore, the politically viable and economically sensible option for Chinese policymakers who are looking to build a non-polluting and reliable energy system. Leading climate modellers in China are now calling for the rapid replacement of fossil-based power with electricity from other sources. Notably, the rapid transition requires a 16-fold increase in solar energy, a nine-fold increase in wind energy, and a six-fold increase in nuclear. And reducing China’s dependence on imports is an important new part of Xi’s approach to policy. Energy security is key to this strategy. And greater self-reliance enhances China’s geopolitical room for manoeuvre.

Industrial strategy

China’s industrial strategy is predicated on the need to protect its manufacturers from low-cost competition from other emerging economies and to narrow the technology gap with developed nations. One goal of Beijing’s strategy is to establish a leadership position in key sectors. China began to pursue this when it included green energy technology in Made in China 2025, a ten-year strategy that the government adopted in 2015. Made in China aims to position the country as a leader in strategic industries and reduce China’s reliance on foreign technology in these sectors, including renewable energy and electric vehicles.

The government has since stopped explicitly referring to Made in China, as the plan led to something of an international backlash, but it has continued to pursue its policies to boost strategic independence in critical industries. The latest development to emerge from this approach in 2020 is “dual circulation”, Xi’s new growth strategy. This seeks to respond to the geopolitical shifts that have followed the pandemic and the sharpening of the US-China rivalry – what Xi calls a world experiencing “major changes unseen in a century”. Dual circulation is intended to reduce China’s dependence on external suppliers and boost domestic consumption to enhance growth from within.

Despite an additional emphasis on opening up China’s capital and consumer markets, a key priority within the Chinese leadership’s grand plan is to increase the country’s resilience in supply chains for critical technologies, to minimise the risk that it will be cut off from external suppliers. Beijing has, therefore, vowed to strengthen its leading positions in key sectors. Xi has called for the creation of “trump cards” in high-speed rail, telecommunications, and “new energy” technologies, to “enhance international value chain dependencies on China”.

Over the past decade, China deployed incentives on both the supply side (such as tax rebates, low-interest loans, and cheap land) and the demand side (such as consumer subsidies and government procurement) to jumpstart the development of the domestic renewable energy and electric vehicle sectors. Having established a world-leading position in solar panels, the country now produces 77 per cent of lithium batteries and accounts for 47 per cent of global electric vehicle stock.

Such state-led investment in the early 2010s led to serious trade tensions. In 2013 the EU temporarily imposed import duties on Chinese solar panels after German manufacturers lodged an anti-subsidy investigation. This serves as a reminder that the EU and China could be drawn into a serious trade conflict.

Climate security

China is highly vulnerable to the impacts of climate change, which is a significant threat to China’s economic and social stability. Long-term changes in weather patterns and the increased frequency of weather events driven by climate change has the potential to disrupt food production and water supply. Based on data from the China Meteorological Administration, the number of heatwave days has increased by 5.4 days since 1961. Climate change is becoming increasingly disruptive to China’s economic development. Floods in central China in summer 2020 displaced 3.7 million people and sent food prices soaring. For every 0.5°C increase in the global temperature, flood damage in China is expected to go up by more than $60 billion.

Although China has relatively high self-sufficiency in major cereal crops – with 95 per cent of its wheat, rice, and corn provided by its own supplies – it imports a significant amount of soybeans and its grain production is prone to disruption by extreme climate events. The middle and lower reaches of the Yangtze River – areas hit severely by the 2020 floods – are home to more than half of the country’s rice paddy fields. The probability of rice production in the region being impacted by heat damage is expected to increase three-fold by the end of the century under the worst global warming projections.

China’s annual water resources per capita is about one-quarter of the global mean. Water shortages from drought and glacier retreat will reduce water availability in northern and western regions. Between 1986–2005, about 249 million people in China were exposed to drought annually. This number is expected to increase to 449 million people by 2040 in the worst-case scenario. Water distribution between social groups and sectors is likely to cause water rights conflicts that both threaten stability within China and transboundary stability with the 18 nations China’s river systems flow into.

Domestic pressure

Polling data has shown that an overwhelming majority of the Chinese public is deeply concerned about climate change. Despite this, climate change is not a commonly debated topic in China’s managed public discourse. Extreme weather events, such this summer’s floods, may displace millions of people but the domestic media rarely present them through the lens of climate change. Only one in five Chinese citizens sees climate change as something that affects them personally.

That said, air quality focuses the minds of the public, the media, and the government. A series of severe air pollution episodes in northern China in the early 2010s was a catalyst in China’s pollution control efforts and, as a consequence, its climate policy. Public outrage about a major pollution episode in 2013 – the worst in 52 years – led the central government to introduce a five-year air pollution control plan. Some of the pollution control measures it implemented – such as restrictions on the use of coal, rolling out the electrification of heating, mandating the use of rail for bulk freight, and accelerating energy efficiency improvements – also helped reduce greenhouse gas emissions by 3 billion tonnes over a five-year period.

Domestic unrest caused by pollution and other environmental factors that diminish Chinese citizens’ quality of life has the potential to disrupt social stability. The Chinese Communist Party leadership is, therefore, anxious to address such issues before they get out of hand. There is still a domestic impetus for green development to maintain economic growth – albeit at a slower and more sustainable pace – given its associated promise of continuously improving living conditions. But there is also a strong impetus to ensure that increases in wealth for Chinese citizens are not immediately devoured by environmental degradation and climate change in particularly vulnerable areas of the country.

Looking ahead: A post-covid recovery

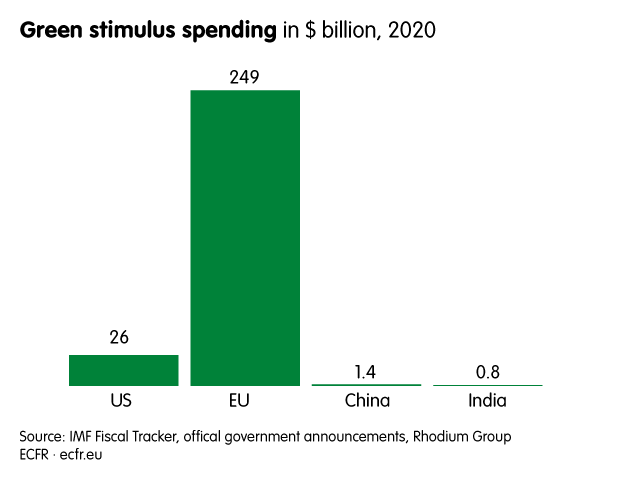

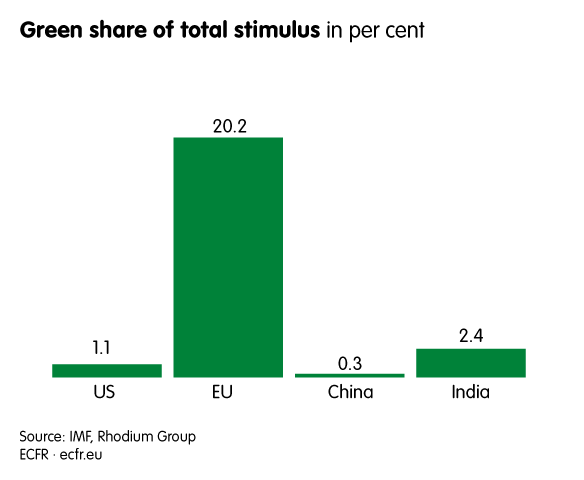

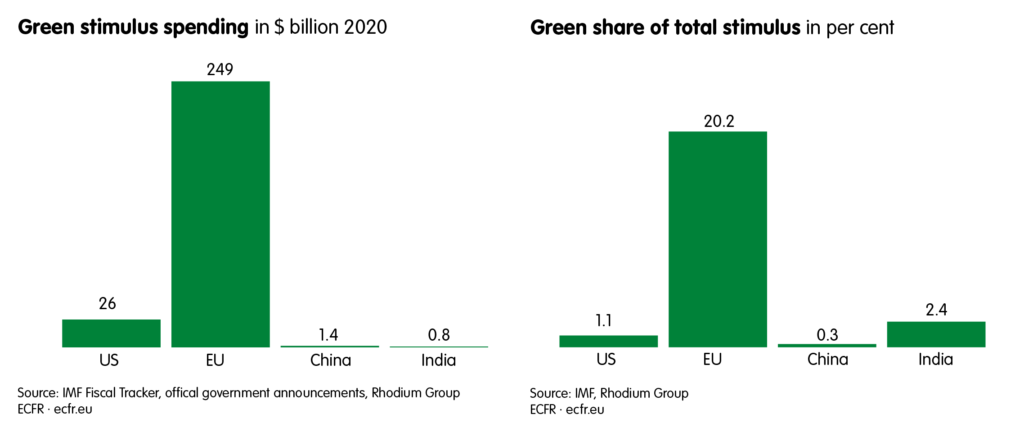

China has put in place a fiscal stimulus package worth RMB 3.6 trillion (€470 billion) to fight the economic damage caused by the covid-19 pandemic. The recovery funds will mainly come from a combination of special treasury bonds and local government special bonds. Beijing is betting that infrastructure-led demand from this stimulus, together with its strict testing and quarantine regime, will minimise the blow to its economy caused by the pandemic. China is set to become the only major economy to experience growth this year, with the International Monetary Fund predicting its GDP will increase by 1.9 per cent in 2020. However, unlike the EU’s recovery plan, China’s stimulus does not have a mechanism to prioritise green investment.

China’s “green recovery”, as advocated by Xi, focuses on “new infrastructure”: investment in technology such as smart energy grids, 5G infrastructure, electric vehicle charging stations, and data centres. Despite the rhetoric, analyses have indicated that China’s provincial authorities have so far prioritised the use of stimulus funds on fossil-fuel projects over low-carbon projects. Data also show that China has permitted more coal power plants in 2020 than it did in 2018 and 2019 combined. This development is at odds with the promise of a green recovery, but very much in line with local governments’ key goals, which are to jumpstart their economies in the wake of the pandemic and to minimise the risk of social instability.

What China prioritises in existing and forthcoming stimulus plans could make or break its climate targets, including Xi’s September carbon neutrality pledge. Infrastructure projects such as coal power plants are likely to favouring entrenched interests, reduce the flexibility of the electricity grid, and lock in carbon emissions for decades to come, all of which will make a green transition more difficult. What Beijing chooses to fund in the next round of post-coronavirus stimulus measures, likely to be embedded in the 14th five-year plan due to be announced in March 2021, will be a litmus test for China’s commitment to a climate-friendly recovery. But it will also send a clear signal to Europe about which areas Beijing will prioritise to try to capitalise on the green transformation in terms of technology leadership, market power, and standards-setting. Europe needs to monitor this closely, as it will be highly relevant for managing the competition and cooperation dynamic of interacting with China on climate change in the future.

Addressing the growing complexity of EU-China climate relations

The climate conversation does not take place separate to the broader shift in geopolitical trends and the sharpened competition between the EU and China.

As both the EU and China decarbonise their economies, they will not only face a similar set of challenges that cooperation could help overcome – but they will also be competing for leadership positions in low-carbon sectors, raw materials for green technologies, and the standards that govern them. Ignoring this competitive dimension will not only harm Europe’s future prosperity; it could also lead to undesirable dependencies that increase Europe’s exposure to the weaponisation of trade and resource access by third countries, particularly China.

Managing the competition

European decision-makers must not underestimate the highly competitive aspects of how China is changing its energy production and consumption. The competitive dimension in climate diplomacy will become more dominant, and the EU will need to actively manage this in a coordinated fashion across its institutions. Failing to do so would risk repeating the trade-related climate policy disputes of the 2010s, such as the EU-China trade spat over solar panels and the international backlash over the proposed inclusion of the aviation sector in the EU Emissions Trading System.

Technological competition

China will have to make enormous domestic investments to achieve carbon neutrality by 2060, with total capital need estimated at around $15 trillion. China will spend a significant share of this on basic research and innovation. As political scientist Scott Moore has argued, this could mean that “Chinese firms are more likely than American ones to own the intellectual property that powers the planet at the end of this century.” The same will be true for European firms if the EU does not massively increase its spending on green technology and breakthrough innovations or protect its intellectual property. As part of Europe’s green recovery, the EU has pledged to spend €1 billion within the scope of the Innovation Fund to reinforce European technology leadership globally. European companies are still world leaders in wind turbines. And Germany, for example, is striving for global leadership on hydrogen technologies. But China is now catching up and even overtaking European companies.

By 2019, six of the world’s top ten wind turbine producers were Chinese companies. European automotive manufacturers have been asleep at the wheel with regard to battery technology, not only in car-making but also in the buses market, where Chinese companies such as BYD have rapidly achieved global market dominance. The decline of the European solar industry after its failure to remain competitive due to a surge in Chinese investment in this sector a decade ago remains a salutary warning about how competition with China could end badly for EU producers – and consumers.

China has been pursuing a dual-track strategy for years – while investing heavily in fossil energy, it has also become a leader in green technology, not only in solar and wind but also in hydropower and battery storage. However, China still lacks expertise in foundational technologies, such as semiconductors, which underpin the efficient functioning of green and smart infrastructure. China is yet to lead on breakthrough innovation that can alter entire markets and create paradigm shifts. This has been a strength of the US – and, to a certain extent, European – technology industry so far. Under the conditions of globalisation that it has largely benefitted from in the past, China has obtained technology transfers from Western countries. This has been a cost-effective way for it to catch up and to advance its technology in various sectors. But the geopolitical climate is no longer geared towards maximum openness and collaboration. Instead, it is increasingly dominated by technological decoupling and export restrictions – and, in the West, research collaboration with non-democracies is coming under increasing scrutiny.

Green technology will not develop on a separate track. Many of the technologies that are of relevance to the future of the renewable energy industry around the world will be inherently critical for future prosperity. They will also often be dual-use in nature – from new materials to semiconductors – thereby drawing issues of national security directly into the debate. Europe will need to cooperate closely with like-minded partners in the Indo-Pacific region, especially Japan, and the US. Together, they will need to build sustainable, green tech alternatives to enhance their joint resilience against growing dependence on the Chinese market and Chinese suppliers. In this context, standards-setting in international bodies will become a crucial factor in ensuring the future competitiveness of Europe’s green tech industries.

Europe has already started to address this challenge to technological competitiveness by adopting defensive trade measures and attempting to level the playing field, at least in the European home market. The European Commission’s recently published white paper on foreign subsidies is a step in this direction. The EU’s Innovation Fund will help in providing some of the resources Europe needs to support research and development. Europe should strive to be a global standards-setter on green technology, to strengthen its position in the competition with China.

This will require Europe to reassess its criteria for public support for technological breakthroughs in green technologies or those that lead to breaking the ‘energy curve’ of ever-higher energy consumption for data processing. One example of the latter can be found in subsidies for the deployment of 5G technology, which are foundational to a successful green transition but which Europe has not necessarily addressed through the climate paradigm.

Competition over access to critical raw materials

China processes the majority of critical raw materials required for green technology around the world, including those for products such as magnets, batteries, high-performance ceramics, and LEDs. Beijing has implemented policies on securing access to production sites outside China, providing attractive conditions for international companies to shift production to China, and undercutting prices to eliminate competition in the rare earth elements industry (which began in the early 1990s). In this way, the Chinese state has enabled the enterprises it owns to dominate a field it heavily controls through the use of quotas and export restrictions.

In 2010 China attempted to weaponise its market position in a territorial dispute with Japan in the East China Sea, which involved the detention of a Chinese fisherman. It did so by denying Japan access to rare earths. This tactic was unsuccessful and, in fact, incentivised other players – including the US and Japan – to rethink their structural dependence on Chinese supply chains. Access to rare earths may not provide a useful tool for the Chinese leadership in its emerging geopolitical and economic disputes, as rare earths are not, in fact, rare and there are various ways for all major international market economies to counter Chinese actions. China remains highly vulnerable in certain areas, especially access to foundational technology and the international financial system. This is likely why China will continue to assertively push for its preferences, as a recent dispute with Australia demonstrates, but not cut off the global supply of rare earths.

What is certain, however, is that the potential problem of overdependence on Chinese production in this sector has become widely debated in the media and among policymakers, especially in the US and Japan, but also in Europe. This is partly because the debate about reshoring and near-shoring critical supply chains has become prominent in Europe since the coronavirus crisis began, underscoring growing concerns about dependence on China for pharmaceuticals and personal protective equipment. The European Commission recently published an updated list of critical raw materials and presented an Action Plan on Critical Raw Materials, aiming to diversify and increase the efficiency of its supply chains in this area.

The EU and its member states urgently need to adopt strategic resilience policies to ensure the uninterrupted supply of critical raw materials, given the growing importance of green technologies to their future prosperity and to achieving a green economic transformation. Europe is set to remain an importer of these goods due to limited domestic availability. A significant boost in research and investment in recycling and substitution will, therefore, become just as necessary as pushing for the rules-based management of international markets. Such efforts will make Europe’s position on global access to these goods clear in all bilateral and multilateral settings, as will simultaneously investing in the diversification of supply chains.

Levelling the playing field on low-carbon trade

The EU’s recovery programme is centred on the European Green Deal, which the European Commission describes as “Europe’s new growth strategy”. China views its green recovery through the lens of its own drive for an industrial transition. Both China and the EU will invest heavily in fast-growing green industrial sectors through recovery programmes in the aftermath of the coronavirus pandemic.

The EU’s proposal on a Carbon Border Adjustment Mechanism (CBAM), a plan to levy tariffs on products from jurisdictions that have weak carbon pricing policies, sits at the intersection between climate and trade. Although the details of the proposal are not expected to be fleshed out until 2021, Chinese officials have consistently expressed opposition to such a tax by the EU.

The European Commission sees the CBAM as a measure of last resort, to be deployed if other countries and regions do not live up to the ambition of global climate targets. To reduce the risks of the CBAM triggering disputes with its trading partners, the EU should present the measure not as a punitive move but as a catalyst for the transition of carbon-intensive sectors. The EU also needs to consult with its trade partners, including China, on the proposed tax to avoid a rerun of the aviation carbon tax drama in 2012 – in which EU had to suspend the introduction of new emissions trading rules for international flights prior to its imminent roll-out, due to fierce opposition from the US, China, and India, among others.

Competing for markets and influence in third countries

Changes to China’s foreign policy will also come into play. Greening the investments made through the BRI will be crucial to delivering not only on Chinese domestic emissions reduction targets but on global targets – which remains, of course, firmly in Europe’s own interest. With the support of Chinese development banks and state subsidies, Chinese companies are still making massive investments in coal-fired power plants in central Asia, eastern Europe, Africa, and Latin America. Seventy per cent of all coal-fired power plants outside China are financed by Chinese banks, and China’s coal power investment in BRI countries is primarily funded by China’s public banks and export credit agencies.

There are two possibilities in this. Firstly, China may continue to finance foreign fossil energy and infrastructure projects, which absorb domestic industrial overcapacity– an enormous infrastructure industry that employs millions of workers – especially after the announcement of moving towards decarbonisation. This could save jobs in Chinese state-owned enterprises and boost short-term profits. More likely, however, is an incremental shift in policy beyond China’s borders. As the global trend towards high energy efficiency and a reduction in carbon emissions continues to affect prices and industries, large-scale investments in the fossil-fuel sector in BRI countries will prove less and less viable, perhaps leading to a surge in failed projects in the long run. Economic efficiency and profitability are less important in China’s domestic energy market than in Western markets – as the former is heavily dominated by state-owned enterprises that do not necessarily follow a market logic – but could be an issue in what becomes a “BRI 2.0” version of Chinese overseas investment: a wave of post-pandemic debt restructuring and forgiveness requests, particularly those from African countries, has already posed a challenge to the Chinese leadership. This will likely lead China to rethink its long-term strategy to a degree and, potentially, to reduce its overseas investments.

But, even if China shifts gear on overseas investments and eventually brings them in line with sustainability goals and emissions targets, this will not automatically ease the path to greater cooperation between China and Europe. The issues that are already dominant in the broader conversation in EU-China relations – the long list of existing economic grievances, from unfair subsidies and market-distorting trade practices to intellectual property theft – are the symptoms of the EU’s need to deal with China’s state-capitalist economic model under regulatory conditions that were not designed to address this challenge. These problems will not disappear overnight just because Beijing makes for greener territory. The EU is, therefore, retooling its approach to competition policy and has already introduced a more comprehensive investment screening mechanism. Its defences are looking stronger than they were a few years ago, but its offence options are still weak. To proactively tackle future competition with China, Europe needs to do its homework and start building itself up while reaching out to make positive offers to third countries around the world.

Through the BRI, China has successfully built up an image of sheer unbeatable global reach and influence. But, as indicated above, cracks in the project are showing, including in the challenge of debt relief for third countries after covid-19. China also needs to rethink its global outreach strategy – this presents a moment of opportunity for Europe. One of the avenues through which Europe could boost its future competitiveness in the face of either the BRI or a ‘greened’ BRI 2.0 is to set standards and ensure it becomes a partner of choice for emerging and developing economies. The EU could strengthen its ties with developing countries of the global south by creating an ambitious global connectivity strategy. Currently, the EU is only attempting to strengthen linkages between high-quality infrastructure investments and strong digital connectivity partnerships as part of the current EU-Asia Connectivity Strategy, which has had mixed success and received only limited political buy-in from EU institutions.

This would increase constructive competition between Europe and China for access and influence in these regions. At best, it would provide countries in regions across the globe with credible alternatives, which would be environmentally sustainable infrastructure investments. In an ideal world, Europe and China would be able to cooperate and agree on common standards to improve overall development while creating a level playing field internationally for Chinese and European companies. But the current trajectory does not point in this direction. Additionally, environmental considerations are only one element of sustainable infrastructure investments. Social and ethical factors such as human rights and labour standards will be equally important, as will economic considerations such as sustainable and transparent financing in particular.

However, as recent years have demonstrated, the best-case scenario of mutually beneficial cooperation is difficult to achieve. Through massive subsidies, preferential conditions in their home market, and political deals, Chinese companies have squeezed European players out of markets in countries participating in the BRI. A greener BRI would not necessarily change this underlying dynamic, and could even make it even more pronounced as competition with Chinese companies grows in the sectors of renewable energy, hydrogen technology, battery storage technology, and carbon capture, sequestration, utilisation, and storage. Europe urgently needs to ready itself to respond in kind, creating the rules and structures that allow it to set standards in line with its own interests and values, and obliging China to cooperate rather than engage in damaging competition.

Continuing to cooperate

The drivers for systemic rivalry and emerging areas of economic competition are genuine for Europe, but it remains in the EU’s interests to cooperate and coordinate with China on specific aspects of its strategies. Europe needs to do this to tackle climate change, to protect European climate security, and to maintain the EU’s competitiveness in a low-carbon world. For the European Green Deal to be successful, the EU will need to work with its partners to build resilient supply chains for low-carbon technologies and develop standards for a sustainable economy.

Cooperation in strengthening and updating multilateral environmental governance frameworks

It is in the EU’s interest to work with its partners to strengthen the rules-based order and thereby ease tensions between the US and China. The EU will increasingly work across multilateral platforms to engage with China on climate issues. The mainstreaming of climate change in public policy discussions means that the existing framework of the UNFCCC is no longer the only multilateral forum in which states make decisions about global climate governance. Instead, they take such decisions at the annual meetings of the G7, the G20, the World Bank, and the IMF; at regular meetings of global central bankers such as the Financial Stability Board; within multilateral banks such as the Asia Development Bank, the Asia Infrastructure Investment Bank, and the Japan Bank for International Cooperation; within multilateral sectoral platforms such as the International Maritime Organisation; and in bilateral and regional conversations across the globe. These venues provide an opportunity for the EU to showcase the strength of its climate diplomacy: it can work with like-minded partners to engage with China on not only joint climate action but also the more contentious elements of global climate governance.

Cooperation on clean economy standards

Globally, countries will need to develop internationally aligned standards on green finance, digital technology, and clean energy if they are to scale up the clean economy quickly enough for the recovery and for achieving their global climate goals. For example, a global common classification on sustainable finance would help countries prioritise green energy over fossil fuel investments in their recoveries.

The EU could adapt its Taxonomy for Sustainable Activities, a catalogue to help investors to differentiate environmentally friendly activities from polluting investments, for use in other jurisdictions, including China. China spearheaded the G20 Sustainable Finance Study Group in 2016 and made significant progress in domestic financial regulation, including by recently issuing an update on its green bond standards and by including green factors in banks’ macro-prudential assessments. A closer alignment of standards on sustainable finance between the EU and China would accelerate financial flows into low-carbon sectors as the world recovered from the covid-19 pandemic. The International Platform on Sustainable Finance (IPSF), a knowledge exchange platform launched by the EU and 14 countries – China among them – would be a good venue to enhance this EU-China cooperation at the ministerial level on aligning financial regulations and standards for a greener economy. Discussions at the Working Group on Taxonomies within the IPSF, co-chaired by the EU and China, would provide a good basis for a common classification tool for a global sustainable finance market. Other players in the financial system – including central bankers, asset managers, and private banks from EU and China – could also contribute to the development of global green economy standards in platforms such as the Network for Greening the Financial System and the Taskforce on Climate-related Financial Disclosures.

With the “twin green and digital transitions” as one of the guiding principles of the European Commission’s covid-19 recovery plan, the digital issue will also play a significant role in EU-China cooperation on climate change. Standards-setting on the software that underpins green infrastructure, such as smart grids, and collaboration on research and innovation are both areas that are critical to creating an ecosystem of digitally enabled green technologies governed by a global, open, and secure system. The regional fragmentation of standards could hinder investment in research and slow the introduction of such technologies.

Cooperation on supporting developing countries

Europe and China are both strong global exporters and investors in third countries. Collaboration between China and the EU to align financial and technical support – particularly countries that already fall within the scope of the EU-Asia Connectivity Strategy and the BRI – would maximise the impact of development finance. A more coordinated EU-China approach in third countries would also facilitate conversations on energy transition and on raising national climate ambitions. Transparency and commonly agreed standards for socio-economic sustainability will need to be the basis of this cooperation in third countries.

As countries deal with the pandemic, some of the world’s poorest nations are facing growing debt distress and fiscal pressure. The covid-19 crisis is expected to slow economic growth in Africa and drive 27 million people there into extreme poverty. Unless their creditors take a coordinated approach to restructuring their official and private debt, these countries will find it increasingly difficult to raise capital for their recoveries. China’s bilateral debt accounts for 63 per cent of total debt owed by the world’s poorest countries to G20 members. The Common Framework on Debt Treatment agreed at the G20 this year provides a good basis for joint action between the EU, China, and other G20 members. The EU and European G20 members should continue to work with China to expand support and tackle the potential $130 billion to $400 billion financing shortfall over the next three years in sub-Saharan African countries.

Development banks and export credit agencies in Europe and China play a significant role in funding energy and other development projects in developing countries. Between 2000 and 2018, three Chinese institutions – the China Development Bank, the Export-Import Bank of China, and the Agricultural Development Bank of China – provided around three-quarters of the financing for Chinese coal investment overseas. More than half of the energy investment from the China-led Asia Infrastructure Investment Bank, which 18 EU member states have a stake in, is related to fossil fuels. Although Europe’s key development banks, the European Investment Bank and the European Bank for Reconstruction and Development, have a clear road map to phase out support for the coal industry, some national export credit agencies of EU member states continue to finance fossil fuel investments. Given the overlap in shareholding and target countries, there are opportunities for these financial institutions from the EU and China to share best practices, align environmental standards, and coordinate on country strategies, with the aim of shrinking the space for international fossil-fuel finance.

Recommendations for EU action

Engagement with China on climate is inevitable – simply because China has such a significant impact on European climate safety. However, the reality of the complex EU-China relationship is that the hurdles to cooperation are becoming higher. Nevertheless, cooperation between the EU and China can be in Europe’s interest – if the EU sets clear red lines and benchmarks. The Chinese leadership has clearly stated that it is committed to multilateralism and climate cooperation. Now, it needs to act accordingly – and the EU needs to hold it accountable. The EU should move to strengthen the international governance systems around climate, including by making a serious effort to coordinate on the emerging standards for a decarbonised global economy. However, the success of this approach depends on ensuring Beijing has a much clearer understanding of European interests and red lines.

As such, Europe should set clear benchmarks for what constitutes credible climate action and adherence to the principles of the current global climate governance regime. Where states meet these benchmarks, cooperation can be mutually beneficial, and the joint development of standards can leverage the enormous global market power of the EU and China. Defining clear benchmarks and red lines will also help identify where China does – or does not – meet governance and environmental integrity parameters. This can help ensure that the EU does not legitimise climate inaction under the veil of cooperation.

As the EU and China rapidly transform their economies to align with their ambitious climate goals, competition around technologies, market shares, and standards will increase. Managed properly, competition can encourage a race to the top and drive innovation in green technology. Managed poorly, the risk of trade-related disputes over low-carbon products and standards will rise and could jeopardise not only the broader geopolitical relationship between Europe and China but also the European Green Deal.

To proactively manage the trinity of competition, rivalry, and cooperation in the EU-China climate relationship, the EU and its member states should consider the following actions – in close coordination with international partners, where relevant.

Manage the competition with China

- Build institutional foundations at the EU level and mainstream climate into all high-level dialogue and cooperation formats, including those on trade and the economy.

As the clean economy becomes more central to its growth, trade, and investment, Europe will need to address climate across the entirety of its dialogue formats with China. The EU’s institutions need to collectively manage the competitive dimensions of China’s and the bloc’s climate policies – state aid in the green energy sector, the CBAM, innovation, and intellectual property. They need to tackle them in EU-China bilateral dialogues on trade, investment, and digitalisation.

Mainstreaming climate action from 2021 onwards should help ease tensions around the emerging competitive elements of the relationship on this issue. This mainstreaming will require the two sides to start to break down siloes and build literacy across the economic, trade, digital, connectivity, and environmental communities.

The process will require the EU to build European connective tissue – in the form of a project group on the external dimensions of the European green transition that could report back to the working groups of European commissioners Frans Timmermans, Josep Borrell, Margrethe Vestager, and Valdis Dombrovskis. This could form the basis for a more systematic mainstreaming of climate and clean economy agenda items into key EU-China dialogues and help inform member states’ bilateral dialogues with China.

- Keep markets open and supply chains secure by creating a level playing field in the post-pandemic recovery and the net-zero transition.

Both China and the EU are beginning to invest heavily in fast-growing green industrial sectors through recovery programmes. A steeper decarbonisation pathway for Europe is likely to require a significant rise in carbon prices – which could, in turn, increase the risk of carbon leakage, whereby member states effectively transfer their carbon impact to other countries. The EU needs to address this risk head-on to ensure that, over the coming decade, European businesses make the large capital reinvestments needed to shift towards cleaner production. The CBAM proposed by the European Commission would be a step in the right direction.

To avoid unnecessary trade friction, the EU urgently needs to engage with its trading partners to level the playing field created by differences between countries in the pace of their low-carbon transitions. The EU can leverage multilateral venues such as the Organisation for Economic Co-operation and Development and the WTO to facilitate these discussions, showcasing the CBAM as a response to international carbon leakage rather than a unilateral punitive proposal by the EU. Measures complementary to the CBAM, such as low-carbon product standards, should also form part of the discussion.

To pre-empt the risk of conflict with countries that oppose the CBAM, the EU should propose bilateral dispute settlement mechanisms. These would complement existing WTO structures, enhance the EU’s toolkit for dealing with market-distorting state support, and help level the playing field – as outlined in the European Commission’s June white paper on foreign subsidies.

- Invest in research and innovation into rare earths recycling and substitution.

The EU can decrease its dependence on China for rare earths materials by implementing the ‘circular economy’ and the European Commission’s Communication on Critical Raw Materials Resilience. The EU and its member states should invest in strategically pooling research resources among themselves and in coordinating with their partners – especially Japan, Canada, the US – and other countries, building on the EU 2020 list of critical raw materials with regard to recycling and substitution.

This could be a particular focus for the Horizon Europe research and innovation framework – which can provide financial support to the effort, as well as leverage and foster international research collaboration with key partners to enhance Europe’s position in the competition with China.

Strengthen alliances in the face of growing Europe-China rivalry

- Expand the transatlantic dialogue on climate to build a clean tech innovation space that supports business and sectoral engagement on green technology cooperation, including that with key partners in the Indo-Pacific.

Alongside fostering close cooperation on preserving and strengthening multilateral climate governance frameworks, an expanded dialogue with the US could support existing industry efforts to promote joint innovation cooperation. This could strengthen alternative market players to Chinese companies, thereby preserving international competition; help states and companies on both sides of the Atlantic avoid excessive dependency on China; and help start a race to the top on innovation. The priorities for this dialogue could include areas in which China is already leading, such as battery technology, or those in which the EU is already investing heavily in innovation, such as green hydrogen.

The enhanced transatlantic dialogue could also create a leadership group that would develop propositions for strong governance rules around the development of green technology, including on the privacy and security requirements of smart grids. Ultimately, these propositions could feed into discussions in multilateral processes, including Mission Innovation, the G20, and relevant international standards-setting bodies.

- Promote a well-financed, sustainable, and global EU Connectivity Strategy.

The European Commission should move to broaden the current EU Asia Connectivity Strategy, turning it into a more global Connectivity Strategy as a flagship initiative for a more geopolitical commission. Some member states – including Germany, the Netherlands, and Denmark – are already pushing for the EU’s connectivity efforts to live up to their full potential. So are parts of the European Commission and European External Action Service (EEAS). The entire commission should get behind this effort and expand it.

A truly global Connectivity Strategy would build on the existing EU Asia Connectivity Strategy, and widen its regional scope to include Africa, Latin America, and the Western Balkans. In these parts of the world, Chinese investment in the (digital) infrastructure and energy sectors is highly significant for these regions’ capacity to manage a green transition. Therefore, from both a geopolitical and a climate perspective, it is in the EU’s interest to provide these countries with a positive offer to compete.

Such an extended EU strategy, combining the dual commission priorities of the green and digital transitions, could provide alternatives for third countries to build modern and resilient energy systems and smart grids. By adopting a whole-of-system approach that incorporated its climate, digital, trade, finance, and diplomacy efforts, the EU could create a compelling alternative to other connectivity strategies, including the BRI.

Cooperate with China – but set clear benchmarks for credible Chinese engagement in multilateralism and climate action, and uphold European red lines on environmental integrity

- Support the Italian G20 presidency’s priority of engaging with China on unlocking third countries’ fiscal space, while laying the foundations for strengthening the architecture of international debt to help them invest in resilient and sustainable recoveries.

Developing country debt could undermine global cooperation, including that on climate action and achieving a resilient recovery (in 2021 and beyond), if these countries failed to secure the capital they needed to fund transformation. Tackling the fiscal space crisis for countries facing liquidity issues, as well as restructuring insolvent countries’ debt, will play a major role in determining the success of both the Italian G20 presidency and COP26. Failure to take multilateral action to address this looming crisis will have significant repercussions for trust in the multilateral system for years to come. As such, Europe should make support for multilateral action on this crisis a benchmark for China, and hold the country to account if it fails to meet this.

Immediate steps for European G20 members include supporting the Italian presidency (and the UK’s G7 presidency) to engage with China to ensure that illiquidity and insolvency do not prevent countries from investing in resilient and sustainable growth, and to spur growth in key global markets. Concretely, this could mean:

- Extending the Debt Suspension Service Initiative (DSSI) until the end of 2022 and expanding the scope of the initiative to cover all bilateral creditors, including state-owned enterprises. This could provide much-needed certainty for countries and markets.

- Revisiting the tools underpinning the new G20 “Common Framework for Debt Treatments beyond the DSSI”, to ensure that debt sustainability analyses do not prevent countries from recovering, while also working to boost debt transparency and, therefore, give the private sector confidence in a country’s direction of travel.

- Key European member states such as France, Germany, and Italy acting together with China, as shareholders of the IMF, to agree on a unified position to support the issuance of new special drawing rights to developing countries that face liquidity crises. They should consider issuance of at least SDR500bn ($650 billion), tied to a reallocation to ensure that the developing countries most in need receive maximum benefit from the issuance.

- Leverage existing EU-China engagement on sustainable finance to develop a harmonised global approach to defining sustainable economic activities – an approach with the “do no (significant) harm” principle at its heart.

The EU and China are already working together under the EU-convened IPSF to develop a ‘common ground’ taxonomy that enhances transparency about what is considered to be ‘green’ in member jurisdictions and about how to ramp up cross-border green investments. This provides an opportunity to build on the European taxonomy to agree on an international standard that sets the baseline for what major green finance markets consider to be sustainable. There is potential for EU-China collaboration within the IPSF to harmonise other types of financial standards, such as green bond frameworks, environmental disclosure requirements, and climate transition plans.

The EU should invest further capacity and political attention in extending the diplomatic reach of the IPSF, and building bridges with members that have formulated alternative approaches – such as Japan and Canada, which have been developing transition taxonomies. The EU should also look to enlarge the IPSF to include new members, such as the US. This would reduce the likelihood of a fragmentation in standards, thereby avoiding an increase in transaction costs for financial actors that would impede the flow of investment in green technology globally. Engagement with China and other leading actors could support the re-emergence of a sustainable finance agenda under the G20.

Clear red lines for any cooperation on sustainable finance should include: excluding coal-related investments from any definition of “sustainable finance”; and underpinning any ‘common ground’ taxonomy with the “do no (significant) harm principle” . Additionally, the EU should conduct a critical review of the role of gas in these standards, to ensure they do not support unsustainable investments or impede the development of green hydrogen technologies.

- Identify clear benchmarks for credible Chinese climate action, including a moratorium on coal investment in China, with immediate effect.

The European Commission should establish a process to clarify and regularly update the parameters by which it defines, measures, and monitors credible climate action in China and other major emitters. This could form a basis for further supporting the alignment of EU and member states’ diplomatic approaches to major emitters, which is already emerging via formats such as the Green Diplomacy Network, run by the EEAS. The EU should work closely with the UK, as president of COP26, and with the incoming Biden administration to align these benchmarks and present a coordinated front on climate expectations of China and other major emitters.

It will be possible to test whether the trajectory of China’s energy sector and its greenhouse gas emissions align with its 2060 carbon neutrality target. The EU can do this by assessing whether China has: firstly, set a cap on total carbon emissions to bring them to a peak as soon as possible; and, secondly, ceased the construction of new coal power plants domestically and set out a clear road map to phase out coal in its power generation system. China’s 14th five-year plan, due in March, and its subsequent sector plans, which are expected towards the end of 2021, will be the first port of call for EU policymakers to assess the sincerity of China’s commitments.

- Shrink the space for international fossil-fuel finance: support engagement by the European Investment Bank and the European Bank for Reconstruction and Development with Chinese public banks and export credit agencies on climate standards for development aid and export credit.

In light of the Chinese government’s commitment to carbon neutrality before 2060, the EU should seek an explicit agreement from Beijing that it will not only cease its support for coal but will also redirect its investments to sustainable energy systems and work towards broader fossil-fuel and deforestation phase-out, in collaboration with European donors. A shift away from funding coal at home and abroad in 2021 is a clear benchmark for the EU to ascertain credible Chinese climate action.

The European Commission should help key European and Chinese development and export finance institutions more systematically exchange: best practices in environmental standards; climate risk assessments; and strategies to minimise exposure to coal and other fossil-fuel investment portfolios. An initial dialogue could include the European Investment Bank, the European Bank for Reconstruction and Development, and key Chinese public and private financial institutions, particularly the Export-Import Bank of China and the China Development Bank.

This diplomatic engagement will only be credible in the medium term if the European Commission continues to support a conversation between European public banks and export credit agencies. By making European export credit agencies and public development banks disclose the sustainability of their portfolios (based on the sustainable activities defined in the EU taxonomy), the EU and its member states would significantly increase their diplomatic influence – with China and other partners.

- Solidify the EU-China high-level dialogue on climate and the environment.

This high-level dialogue is a new channel between Timmermans and Chinese vice-premier Han Zheng on climate change and the environment. Rightly, this dialogue is currently focused on near-term emissions targets, climate policies that underpin the transition to carbon neutrality, and the COP15 outcomes on biodiversity. All of these areas are critical to successful European and Chinese actions ahead of COP26.

This dialogue has the potential to include cooperation on the challenges of the green transition and the impact of climate change. However, this would require China to first meet the benchmark of making good on its commitment to a carbon neutrality transition by setting out concrete policies and near-term goals in its international 2030 climate target (known as its nationally determined contribution) and its domestic planning. Should China do so, the EU could then use the high-level dialogue to enhance discussions on achieving the net-zero transition, including by dealing with structural challenges and the societal effects of the economic transformation process. Additionally, the EU should use the dialogue to engage with China on the systemic risk of climate change that is already affecting them both, particularly the risk to food systems and global stability.

About the authors

Janka Oertel is director of the Asia programme at the European Council on Foreign Relations. She previously worked as a senior fellow in the Asia programme at the German Marshall Fund of the United States’ Berlin office, where she focused on transatlantic China policy, including on emerging technologies, Chinese foreign policy, and security in east Asia. Oertel has published widely on topics related to EU-China relations, US-China relations, security in the Asia-Pacific region, Chinese foreign policy, and 5G.

Jennifer Tollmann is a policy adviser in E3G’s climate diplomacy and geopolitics team. Based in E3G’s Berlin office, she leads E3G’s work and outreach on European climate diplomacy. Tollmann has published on topics related to the UN climate negotiations, international climate governance, European climate diplomacy, EU-China relations, and European climate risk. Her profile and previous publications are available to view here.

Byford Tsang is a senior policy adviser in E3G’s climate diplomacy and geopolitics team. Based in E3G’s London office, he leads E3G’s work on EU-China climate diplomacy. Tsang’s profile and previous publications are available to view here.

Acknowledgments

This paper was kindly supported financially by the Greens/EFA Group in the European Parliament.

The research for this paper benefited greatly from the discussions with Reinhard Bütikofer, MEP (Greens/EFA) and the inputs of E3G’s team, including Dileimy Orozco, Zach Malik, Johanna Lehne, Tsvetelina Kuzmanova, Kate Levick, Taylor Dimsdale, Lucie Mattera, Shane Tomlinson, Tom Burke, Nick Mabey, and Lisa Fischer, and the tireless efforts of ECFR’s editor Adam Harrison.

The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of their individual authors.