Turkey: Perspectives on Eurasian integration

Poised between Europe and Asia, the Russian and Chinese integration projects could both make Ankara once more a key bridge linking the two continents – but not before hostilities with Russia have been resolved

It has become a cliché to speak about Turkey as a “bridge between East and West”. The country was indeed part of the historical Silk Road, and many of the country’s settlements were founded along the route, roughly 35 kilometres apart from each other – a day’s distance by caravan during the road’s heyday. But the Silk Road collapsed six centuries ago, and the 10 million shipping containers travelling from China to Europe are, today, almost all transported via maritime routes. The shift from a land route to a maritime route represented a huge change for East–West trade, and it may be changing again.

China’s One Belt, One Road (OBOR) and Russia’s Eurasian Economic Union (EEU) are both initiatives that are designed to create common spaces for trade and investment in Asia. In that sense, each project could create a trading network in Central Asia that links East and West via Turkey, fulfilling once more the country’s former economic role as a “bridge” nation. Turkey is well poised for the task – it already has the largest fleet of articulated lorries in Europe, modern highways, active ports, one of the most important air travel hubs in Europe, and a fast-developing railway network. Ankara is now tracking these projects with an eye to widening its logistical outreach. OBOR especially is the subject of great interest in Ankara’s ministries, even if levels of public awareness about both OBOR and the EEU initiatives remain limited.

Turkish stakeholders, both public and private, see potential in OBOR and the EEU on three fronts. First, Turkey’s transportation infrastructure is being upgraded to enhance internal East–West connectivity. Becoming a key player in these trade networks would make it easier for Turkey to tap into relevant development banks and funds to finance Turkish infrastructure projects. Second, in order to accelerate its economic transformation and escape the middle-income trap, Turkey must diversify its exports away from the already satiated EU and low-tech MENA markets, and increase its presence in emerging Asia. Third, both initiatives could recast the geopolitical balance in the region, and Turkey wants to be on firm footing in its political relations with both China and Russia.

Diplomatic history

The modern history of Turkey–China relations is relatively uncontroversial. Both countries went through anti-imperialist struggles in the first part of the twentieth century. They were on opposing sides of the Korean War, after which Turkey became a NATO ally and China turned inward to focus on reforms. In 1971, Turkey adopted the One-China policy and recognised the Beijing government. The debate in parliament at the time was between those who wanted to recognise China for the economic benefits of the relationship, and those who were ideologically opposed to the idea of working with “Red China”. These two poles of opinion are still intact, but the economic incentive to cooperate is prevailing over political obstacles. This is why, despite the Ministry of Foreign Affairs coordinating the government’s OBOR activities, their approach is largely economic in focus.

Turkey’s relations with the former Soviet countries has also gradually strengthened over the past few decades. As the former Soviet Republics of Central Asia gained independence in the 1990s, the Turkish business community was eager to secure contracts and begin investing in them. Business lobbyists in Ankara at the time pitched ideas to various ministries, but were turned back due to political considerations. Their hopes for the region, however, were well-placed. Turkish firms, especially those in construction, now have a strong presence in the region. Turkey’s relations with post-Soviet Russia have been on an even keel, and in 2008 the country became Turkey’s top trading partner, due to Turkey’s increasing imports of natural gas. More recently, however, the two countries have been on opposing sides of the Syrian civil war. While Russia has supported the Damascus regime, Turkey has supported the rebels, and tensions gave way to a crisis in November 2015 when Turkey shot down a Russian jet that violated its airspace. Russia has subsequently placed strategic sanctions on selected Turkish exports, expelled Turkish companies, reinstituted visa requirements for Turkish citizens, blocked Russian tour operators from organising trips to Turkey’s Mediterranean coastline, and taken several more punitive measures. Turkey has refrained from responding in kind, and hopes to come to an understanding with Russia without deepening the crisis.

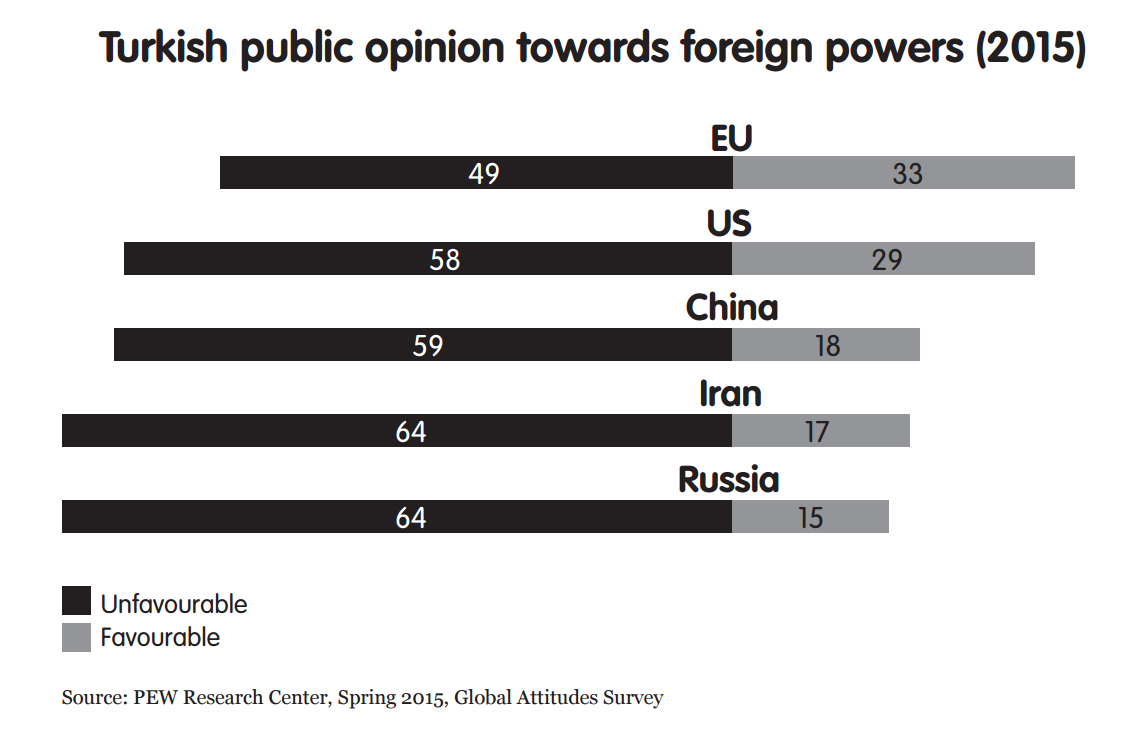

Turkish public opinion towards China and Russia is in keeping with the generally mistrustful mindset of the country’s population, which has been born out of uneasy relations with great powers ever since the defeat of the Ottoman Empire in the First World War. At the end of that war, the allied forces all but liquidated the Empire, with the Treaty of Sèvres in 1920. A group of Ottoman officers then launched a war against the occupying powers and went on to establish the Republic of Turkey we know today. This period in history remains deeply embedded in the Turkish psyche, and manifests in strong distrust of great powers.

The so-called Sèvres Syndrome is in full effect against Russia and China, even if the latter does not have a strong imprint in Turkish historical consciousness. Both countries are great powers that are not shy when it comes to exerting their will through considerable military and intelligence capabilities. Both have Turkic minorities – the Crimean Tatars and Uighur – whom considerable parts of the Turkish public see as their oppressed brethren. And while the mistrust Turks feel towards the United States and EU is somewhat mitigated by those countries’ cultural clout in Turkey, few Turks know anything about Russian and Chinese culture. China has recently kicked up its public diplomacy efforts, however, involving new branches of the Confucius Institute, Turkish-language publications, and academic exchange programmes. In time, these efforts may trickle down to broader strata of society. For now, the public perception of the Eurasian mammoths is negative in Turkey.

Why look East?

Turkish officials are eager to operate within an Asian context. The widespread feeling in Ankara is that both political and economic relations with Europe, though always vital for Turkey, have come to maturation. The bureaucracy’s perception is that the country is unlikely to join the EU any time soon, nor is there much room to improve upon relations with the US, which is more strategic and carries with it fewer regional issues with Turkey, such as visa regimes or trade.

Asia, on the other hand, is virgin territory for Turkey. Turkish decision-makers like to point out that OBOR coincides with the broader geopolitical goals that Turkey would have pursued either way. According to officials, the overwhelming majority of Turkey’s €27 billion of trade with China goes through the port of Rotterdam. Aside from the obvious economic inefficiency of this route, Turkish officials feel that it is a symbol of undue western influence over South–South relations. They see OBOR as a way of forming direct links to fellow developing countries.

Meanwhile, Turkey is developing a comprehensive Asia policy. Analysts, government officials, and the private sector strongly reject the notion that Turkey would prioritise one of the initiatives over the other or choose a side between Russia and China. They believe that Turkey can and should balance the two powers whenever necessary, and believe, in theory, that OBOR and the EEU will eventually complement each other. The recent crisis with Russia, however, has prompted them to shift their energy to focus on OBOR.

Trade

Officials see Asian markets as a critical component in the effort to meet Turkey’s export targets. A cursory glance at the country’s export numbers shows why. Turkey’s emphasis on the Middle East and North Africa (MENA) in the past decade boosted its commercial relations with that region. The share of Turkey’s exports to MENA as a proportion of the country’s total exports rose from 9.8 percent in 2000 to 24.6 percent in 2014, while the share of exports to the EU-28 declined from 57.6 percent to 43.4 percent. While these two regions currently make up about 70 percent of Turkey’s total exports, the country’s exports to emerging Asian markets lag significantly behind. Turkish officials state that if Turkey is to come anywhere close to achieving its ambitious 2023 targets of €25,000 per capita and €500 billion in exports, trade relations with Asia, home to the world’s fastest-growing middle class, will have to improve rapidly.

The single most important barrier to expanding Turkey’s trade with Asia via land routes is the lack of connectivity. In 2014, 280,000 trucks carried goods from Turkey to the Caucusus and Central Asia. Of this number, 215,000 were headed for Azerbaijan, Georgia, and Iran, whereas the remaining goods were transported to Turkmenistan, Uzbekistan, Tajikistan, Afghanistan, Kazakhstan, Kyrgyzstan, and Russia.1 The data shows zero trucks carrying goods between Turkey and China, primarily due to the lack of any Land Transport Agreement between the two countries.2 Furthermore, Turkey’s trade ties with Central Asia are heavily dependent on one mode of transportation – roads. In 2014, out of Turkey’s €400 billion of total trade, only €2 billion worth of goods were transported via rail. Trucks might be a viable way to trade with Europe, the Balkans, and the Middle East, but not with the vast landmass of Asia. “It’s like taking a taxi from Ankara to Beijing”, one expert said. The cost of trucking is prohibitively high over such a vast distance, making efficient railroad connections a necessity.

Turkey’s logistical priorities

There are currently three routes through which Turkish trucks connect to Central Asian markets: the northern route through Russia, the trans-Caspian central corridor, and the southern route through Iran. According to figures from the Turkish Ministry of Foreign Affairs, in 2014, about 80 percent of Turkish trucks took the southern route, with Russia getting slightly more than 10 percent, and the rest taking the trans-Caspian route. There were, and have since been, serious problems with all three of these routes.

The “Southern Corridor” puts Turkey at the mercy of Iran, which is yet to prove its potential as a reliable trade partner. Turkish officials also point out that trucks at the Gürbulak customs post, Turkey’s primary crossing point to Iran, experienced a 25 kilometre-long queue over the holiday period in 2015. During the research period for this piece, the queue remained fixed at around 12 kilometres on the Turkish side and six kilometres on the Iranian side. Iranian officials have also imposed taxes on Turkish trucks’ fuel costs, despite repeated agreements that these restrictions will be lifted by both sides, the latest of which took place in January 2015. Turkey’s railway line to Tehran also needs serious upgrades and will, at this point, not be able to take the kind of stress OBOR would require, according to experts. These problems could be overcome with the influx of investments into Iran after the lifting of sanctions, but Turkish officials aren’t holding out much hope that longstanding political issues will be resolved any time soon. Nobody who was interviewed for this piece on the Turkish side – in the bureaucracy, the private sector, or academia – believes that Iran is currently a reliable partner for broadening Turkey’s outreach to Asia.

Turkish officials strongly favour what they call the “Central Corridor”, which starts in Xinjiang province in China, goes through Kazakhstan and into Turkey via Azerbaijan and Georgia. They point out that this route would be relatively simple to construct, since Kazakhstan is capable of creating the “soft infrastructure”, meaning logistical and bureaucratic links that the operation would require. The Caspian states are already part of Turkey’s logistical infrastructure, and Turkey would merely have to widen the already-present routes for this new route to be operational. Turkish freight forwarders state that the Russian crisis provided the necessary impetus for Turkish politicians lobbying to streamline the Caspian crossing. Since November 2015, the number of RORO ships operating from Baku to Aktau and Turkmenbashi increased, while costs for both routes significantly decreased. During this time, round-trip costs for a truck between Baku and Aktau decreased from €3,380 to €2,100, and for Baku–Turkmenbashi from €2,150 to €1,700.3 Still, the crossing clearly requires significant investment to become viable in the medium term. One actor that is hard to predict is Russia, because the Kremlin sees the Caspian as its backyard, and some say that a shift in the trade routes would require Russia’s blessing to go ahead. Whether this is the case and, if so, whether it can happen, given the current crisis in Turkish-Russian relations, is unclear.

The “blue” Silk Road across the Caspian is also a complicated game for Turkey. Europe currently uses the port of Rotterdam as its main hub, where ships traverse the Cape of Good Hope around South Africa, which takes about 60 days. The newly expanded Suez Canal is an important alternative that will shorten that time significantly. The state-owned China Ocean Shipping Company’s (COSCO) purchase of the port of Piraeus rang alarm bells in Ankara because it would significantly divert the traffic on the Mediterranean towards Greece. The Syriza government in Athens at first blocked the privatisation deal, but it went through in April 2016.

This likely means that Greece will provide Turkey with serious competition to be the naval hub of the Mediterranean Silk Road. The Chinese were eyeing up Çandarlı Port in the northern Aegean Sea, which would become one of the top ten largest ports in the world once finished, but are reported to have hesitated due to political uncertainties and the lack of a structured, bureaucratic approach to logistical planning. However, China Merchants Holdings and COSCO recently paid over $900 million to purchase the majority of shares of Fina Liman from Fina Holding, an investment holding company that owns Kumport in Istanbul with an annual capacity of 1.7 million twenty-foot containers (TEU). Like the land connections, developments on the “blue” Silk Road are still in their early stages, and it remains to be seen to what extent Turkey will be able to realise its ambitions.

Turkey’s infrastructure projects

Infrastructure investments are a vital part of Turkey’s development strategy. The country’s Tenth Development Plan (2014–2018), the Regional Development National Strategy (2014–2023), and the 2023 Vision documents attribute great importance to enhancing the transportation network of the country for

both people and goods. Currently, there are numerous “mega” infrastructure projects at the construction or design stage, such as the third airport to Istanbul, the third Bosphorus Bridge, the bridge over the Dardanelles, and under-sea passages for trains and other cargo across the Marmara Sea.

Experts argue that the planned projects will require a great deal of foreign investment. One of the most salient examples is the trans-Bosporus Edirne–Kars fast railway line that spans over 2,000 kilometres. This will then link up to the Kars–Tbilisi–Baku line, which is under construction, constituting the backbone of the Europe–Caspian transportation network. Each kilometre of this railway line is reported to cost $35 million. Even building the north-east Anatolian stretch between Sivas and Kars would cost roughly $35 billion. Government officials stress that they would approach all sources of potential financing for this project equally and enthusiastically.

The Uighur issue

The recurrent topic when talking about OBOR in Ankara is the issue of the Uighur people. The Turkic minority in China’s Xinjiang province is ethnically close to Turkey. The Chinese government has been said to restrict cultural and religious rights of the group, and Uighur individuals have committed bloody terrorist acts in major Chinese cities. The Chinese government is highly sensitive about the issue and is concerned about Turkish activists protesting against its alleged treatment of the Uighur.

Reported repressions during the month of Ramadan in 2015 caused riots in front of the Chinese embassy in Turkey, where a mob burned Chinese flags. Nationalist groups have also assaulted Korean and other Asian tourists in Turkey because they mistook them for being Chinese. The feeling appears to be mutual in China. There is often speculation, especially in the wake of Uighur terrorist attacks, that Turkey is supporting Uighur groups in order to destabilise Beijing. Experts believe that this is why China put little emphasis on Turkey and its OBOR plans when the strategy was initially announced in 2013.

But the tide seems to have turned with President Recep Tayyip Erdoğan’s recent Beijing visit. When the Uighur issue heated up in Turkey in late 2014 and early 2015, Erdoğan intervened directly. He dispatched reporters to Xinjiang to counter reports that Uighur culture was under threat. Erdoğan then went on a visit to Beijing in July and expressed Turkey’s unequivocal support in “combating terrorism”, meaning that Turkey would cooperate with China on counterterrorist measures.

Bureaucrats seem comfortable that the political class will continue to maintain the tone that Erdoğan has set. They argue, and China experts in Turkey largely agree, that the Uighur are free to practise their cultural and religious rights. Some are sympathetic to Turks who are worried about the Uighur way of life, but argue that there is no room for sentimentality in state policies. They caution against emotional reactions in the short term and point out that Xinjiang province, as China’s gateway to the Silk Road, is sure to benefit from the investments to come. In this sense, they argue, Turkey’s kinship with the Uighur could be an asset in the long run, rather than a liability.

Political concerns regarding the EEU

Turkey is not a former Soviet country, and its accession to the EEU is, at this point, not on the agenda. Officials point out that the issue is new and that there is no department in charge of coordinating matters relating to the EEU, and refrain from commenting on it at length. It is, however, fair to assume that bilateral relations with Russia will be the determining factor for Turkey’s relations with the EEU. If relations should remain in a state of crisis, and the EEU deepens as an economic union, it might put Turkish exporters and investors in Central Asia in a difficult position. But if the EEU should deepen, it would almost certainly give Russia increased leverage over Turkey’s economic activity and thereby further restrict the country’s foreign policy choices.

Recommendations for the EU

There are a few things European policymakers can do to cooperate with Turkey’s economic policy towards Central Asia. They can encourage investment in Turkey’s efforts to be complementary to, rather than a substitute for, current trade routes. Effective communication with Turkey on this issue could conserve much energy. One way of doing this would be to prioritise the Central Corridor over the Northern and Southern Corridors. This would have the dual function of building confidence in the Southern Caucasus and decrease reliance on Russia and Iran.

In the short to medium term, EU leaders should also look into ways they can facilitate the start of scheduled freight trains between Turkey and the EU. They should emphasise container/freight over passenger traffic. Turkish institutions such as BALO (Büyük Anadolu Logistics Organization) have some recent experience on this issue that could be expanded to other areas.

On a larger scale, European countries could also share know-how with Turkey in the establishment of regional Trade Facilitation Bodies (TFBs) in Central Asia and the Southern Caucasus within the framework of the World Trade Organization (WTO). Integrating Europe’s experience in forming coherent business groups into such mechanisms would greatly facilitate the development of “soft infrastructure” (i.e. streamlining of trade rules and functioning of border crossings) in the region.

Lastly, European leaders should make sure to continue the “interconnectivity” agenda of the Chinese G20 presidency throughout Germany’s 2017 G20 presidency, with a special emphasis on the OBOR initiative. It should utilise and empower both the 2016 G20 troika of Turkey, China, and India, as well as the 2017 G20 troika of China, Germany, and India, to push for “hard infrastructure” investments and “soft infrastructure” convergence along the OBOR routes.

1 International Transporters Association (UND), 2015, authors’ calculation.

2 The framework for a Land Transport Agreement for Turkey and China was initialled in 2015. This agreement would be the first of its kind that China would sign with any country. The full agreement is expected to take effect by 2018.

3 Figures as reported by International Transporters Association (UND).

The European Council on Foreign Relations does not take collective positions. ECFR publications only represent the views of their individual authors.